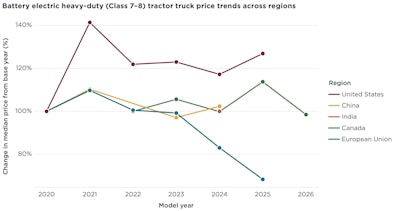

A new study by the International Council on Clean Transportation (ICCT) shows the cost of Class 8 heavy trucks in the U.S. jumped by 27% ($87,100) between 2020 and 2025, while the cost of a similar truck in Europe fell by 23%.

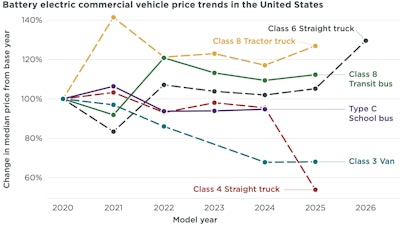

A lack of scale (and demand) in the space has kept prices for electric big rigs high, while the median price for smaller commercial trucks (Class 2B/3) fell 42% to $87,000 between 2020 and 2025, with more than 44,000 Class 2B vans deployed. During this time, the median price for the equivalent combustion engine trucks climbed by 12% ($18,000), according to the 33-page report, which is supplemented by data from The Truck Blue Book published by Price Digests, a sister company to CCJ under its parent company, Fusable.

The median price of a model year 2024 battery-electric heavy-duty tractor truck in the United States, according to ICCT, is $379,800—roughly 2.5 times the price of a combustion engine tractor. In China, the median price of the same class and type of vehicle is $119,600.

Median prices since model year 2020 have fallen in 2 out of the past 5 years, but the data shows electric trucks in the U.S. are still priced about $90,000 more than comparable trucks in Europe, despite falling battery costs, which have dropped by 20% over the period, and incentives designed to make clean trucks more affordable. A subsequent comparison of Class 8 truck prices published by the California Air Resources Board (CARB) found that the incremental zero-emission vehicle price in the United States is about $57,000 more than in the European Union.

[Related: Why zero-emission trucks often cost 30-50% more to insure than diesel models]

Median prices grew in all markets from model years 2020 to 2021, according to ICCT's report. Divergence between the EU and the United States began to emerge in model years 2023–2024, when the median price in the EU decreased precipitously through model year 2025, while the median price in the United States slightly increased. The median price in Canada—a market like the U.S. in terms of OEM makeup and product offerings—did not rise as much as it did in the United States in the same period. The contrast between Class 8 tractor truck price changes in the EU and the United States, the report said, reinforces the findings of CARB’s 2024 pricing memo that battery-electric Class 8 tractor truck prices were moving in opposite directions in the United States and Europe.

"Legacy truck manufacturers may see short-term profit protection by overcharging for short-range medium- and heavy-duty electric trucks," said Rustam Kocher, formerly of Daimler Truck North America's E-Mobility Group, "but when the market opens up—and it will—they will not be in a competitive position."

OEMs in a 'tough spot'

In response to the report's authors, Yihao Xie and Ray Minjares, truck manufacturers cited changes in raw material costs and higher demand for vehicle warranties, along with differences in U.S. and European supply chains, as causes for differences in pricing patterns between the two markets. Differences in the timing of the introduction of next-generation products in the United States and Europe further explain the comparative differences across markets, according to the report, since faster deployment of the latest generation of technology in Europe may deliver performance and cost advantages over the U.S. market.

Clean Freight Coalition Executive Director Jim Mullen, too, scoffed at the idea that OEMs would suppress sales of zero-emission heavy trucks with exorbitant charges, adding that it's simply the laws of supply and demand in effect.

"If you're the OEMs, there are a few things that are going on. You just had Congress pass the CRAs to rescind ACT, and you had the President sign it. You had the DOJ send you a letter telling you that the Clean Truck Partnership is unlawful, and you were being sued by the Nebraska Attorney General for antitrust violations," Mullen said.

Daimler Truck North America, Paccar, International Motors, and Volvo Trucks North America last month filed for an injunction challenging the Clean Truck Partnership (CTP) the companies signed in 2023 with California's Air Resources Board (CARB), arguing that when President Donald Trump in June walked back Biden-era Environmental Protection Agency waivers relating to California Truck Emission Standards (CARB's Omnibus rule) and California Truck NOx Emission Standards (CARB's Advanced Clean Trucks regulations), it also rendered the CTP moot.

The filing of that lawsuit ended a pair of antitrust suits filed last year against manufacturers of heavy-duty trucks and engines: one by the Federal Trade Commission (FTC) and one by the state of Nebraska.

"You have all those headwinds coming at you as an OEM, and then—maybe most importantly—you're not selling trucks. They want to sell these zero-emission, battery-electric trucks, but nobody's buying them," he added. "The fleets aren't happy with the OEMs, not because they're not selling battery-electric, but because they're not able to buy diesel. So the OEMs are really in a tough spot."