We have all heard about the challenges of electrifying the trucking industry. Some of the top problems are range anxiety, high upfront costs, on-time installation of charging equipment, resale value, etc. One problem that doesn’t get a lot of visibility is the cost of electricity — at least in some regions of the country.

There are numerous total cost of ownership (TCO) studies that evaluate the costs to purchase, operate, and maintain a battery electric vehicle (BEV). Most of these studies compare the costs of a BEV to a diesel-powered vehicle and look for “diesel parity.” Diesel parity is the point in time where the cost of running a BEV is equal to or less than that of the diesel. Once this happens, BEVs will be more attractive, and adoption will be driven by economics vs regulation.

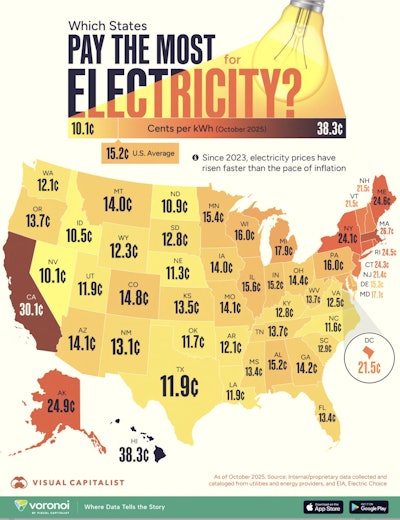

Most TCO models assume an electricity price in the range of 0.11 to 0.15 $/kWh. The problem, however, is that there are many regions in the country where electricity prices are significantly higher than this range.

This is the big elephant in the room that does not get much visibility. After 40+ years of leading product development, I can see a glidepath to significantly reduce the upfront costs of the truck and the charging system. Innovation and focused efforts will drive the costs of the vehicle down. As the technology matures, components will be integrated which will reduce material content thus reducing costs. Lower cost materials will be used. Manufacturing processes will be optimized. Production volume will increase significantly, resulting in lower costs. All of these will drive costs down. This is a good topic for a future blog.

However, the cost of electricity is concerning, and somewhat of a mystery. Before elaborating, I need to offer a caution: Electricity pricing is very complex. There are different rates for residential, commercial, industrial, etc. There are also different rates throughout the day, maximum power demand, etc. Rates might differ because of environmental and climate policies. In Figure 1 you will note electricity prices in California and many of the Memorandum of Understanding (MOU) signatory states in the northeast that adopted the Advanced Clean Truck (ACT) rule. These states show prices as high as 0.3 $/kWh. While there is no one electricity price, average prices of 0.3$/kWh have been confirmed as I have talked to various fleets. These fleets are seeing high average electricity prices and have already put a lot of work into developing smart-charging and optimization strategies.

How do electricity prices relate to the cost of diesel fuel?

What is so magical about prices in the 0.11 to 0.15 $/kWh range?

Trucks that participated in NACFE’s most recent Fleet Fuel Study consumed fuel at ~ 8 miles per gallon (MPG). Assuming $4/gallon for diesel fuel, the cost of energy would translate to about 0.22 $/kWh. Many of the modern trucks are running at 10 MPG, and this would translate to about 0.18 $/kWh.

To put this in perspective, if the costs of acquiring a BEV and the charger were equal to the cost of a diesel-powered vehicle, the fleet would achieve diesel parity if they could purchase electricity in the 0.18 to 0.22 $/kWh range. Unfortunately, the cost of the BEV and charger are significantly higher than that of the diesel-powered vehicle, so electricity prices need to be in the range of $0.11 to 0.15 $/kWh to overcome the upfront costs.

Another thing to note is the variation in electricity prices vs diesel prices. Note the neighboring states to California with electricity prices in the 0.11 to 0.14 $/kWh range. The price of electricity is ~2.5 times higher in California than Nevada or Arizona. In the northeastern states, you see electricity twice as expensive as in the midwestern states. Compare this to diesel prices, with a range $3.70 to $4.25 per gallon throughout the U.S. Diesel prices vary throughout the country by only 20% vs electricity prices which vary by 170%.

How does this compare to China?

The Chinese trucking industry is rapidly adopting BEVs. This is discussed in detail in a previous blog, and since it was written, there are reports that adoption is currently running at 25%. BEV adoption makes sense for a lot of routes and fleets in China because the upfront costs are significantly lower than that in the U.S., chargers are much more abundant, and electricity prices are low.

If we look at some of the most heavily traveled areas in China, such as Beijing, Shanghai, Shenzhen, the average electricity prices are in the range of 0.7 to 0.85 RMB/kWh. This translates to approximately 0.11 $/kWh. Note how this correlates quite well with the costs of electricity stated in a lot of TCO models. It is the target.

So, what can we do?

There are several things we can do to address the issue.

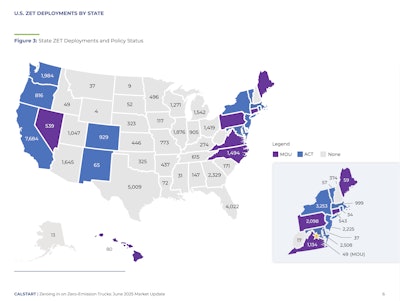

- The rainbow. If the cost of electricity in California (and northeastern states) is the elephant in the room, then the rainbow in our journey is in the states with low-cost electricity. As noted in Figure 1, there are many states in the U.S. where electricity costs are less than 0.15 $/kWh. Figure 2 shows BEV adoption, as of June 2025. Studying this a bit, I was surprised to see that the second and third highest adopting states are not those who followed ACT. They are Texas and Florida. Could this possibly be because of the low cost of electricity? This opens the door to a positive business case for electrification in these states.

- Think of the end goal. The end goal is not to electrify. It is to find solutions that are low cost, low emissions, and low greenhouse gases. As illustrated in NACFE’s recent Run on Less – Messy Middle, there are numerous solutions which offer alternatives to diesel. Many of these alternatives offer ultra-low NOx, PM, and reduced greenhouse gases.

- Drive electricity costs down. While it is unclear to me what all the issues that drive high electricity prices in California are, I surmise it has to do with regulation, lack of capacity, emphasis on climate policy, and several other things. I don’t claim to understand all of this, but my intuition says that costs can be reduced. After 40+ years in the trucking industry, I am a believer that every problem can be solved if there is a willingness and transparency to address the issue. I’ve personally run businesses where we have reduced the product cost by 50% to 70%. It boils down to hard work, deploying methodical approaches, innovation, and transparency. As California tries to encourage BEV adoption, I suggest taking this kind of approach along with some of the other things they are trying to implement

BEV adoption certainly is a challenge for many fleets in the U.S. These challenges are real, but we need to keep our eyes on the rest of the world especially China. By innovating, having an open set of books, and a willingness to reduce costs, anything can be achieved. BEVs can be a great solution if we can lower these costs. Let’s put our efforts into this.