Might truck manufacturers lure more customers to a growing number of hydrogen options by building their own hydrogen fueling stations?

It’s a question that CCJ posed to various hydrogen experts following Nikola’s recent news announcing its fourth hydrogen station in California.

Nikola aims to open 60 stations by the end of 2026 through its HYLA brand, more than doubling the current number of hydrogen stations in the U.S., which the Department of Energy currently lists at 55 (all of which are in California).

Nikola reports that its stations will not only serve customers using the Nikola Tre fuel cell electric vehicle (FCEV) but also trucks from other manufacturers. So far, the Arizona-based startup is pleased with the results.

"The HYLA launch has been a success and our customers are pleased that we are bringing a full solution to them, including the FCEV and infrastructure, and can now see how adoption could work in the early years of the transition to zero-emissions," said Cary Mendes, Nikola's president of energy.

[Related: Hydrogen infrastructure bill reintroduced]

Srikanth Padmanabhan, president of Cummins’ engine business, the largest of the company’s five business segments, views Nikola’s hydrogen station rollout as a positive start that could help encourage hydrogen truck sales among fleets concerned with fuel availability. Cummins fuel cell powertrains and 15-liter hydrogen engines are scheduled to enter the market in 2024 and 2027, respectively.

“It's chicken or egg, right? Eventually, people will figure out who needs to set up the infrastructure and who needs to set up the equipment themselves, and I think it'll sort itself out in a while,” Padmanabhan said. “But until such time I think people are going to try this because if there is demand and there is no supply, it won't work. Or if there is too much supply and not enough demand for the use of the fuel, then that will be a problem as well. Early on, I think this is how people will try it.”

Cummins is no stranger to alternative fuels. The company’s recently launched clean energy subsidiary Accelera markets battery packs, fuel cells, ePowertrain systems and electrolyzers, which are used to produce hydrogen.

Cummins' new subsidiary Accelera markets electrolyzers that produce hydrogen onsite at 60 locations around the globe, however they do not provide the station.Cummins

Cummins' new subsidiary Accelera markets electrolyzers that produce hydrogen onsite at 60 locations around the globe, however they do not provide the station.Cummins

Padmanabhan said it’s too early to determine all the viable paths for getting hydrogen to market.

“It'll take a while before it settles down to say that it will be fuel providers and that it will be infrastructure providers, and then there'll be people that will provide the equipment that will use those fuels,” Padmanabhan said.

As the North American Council for Freight Efficiency gears up to release its report early next month on hydrogen fuel use in trucks, NACFE executive director Mike Roeth endorsed the idea of OEMs opening up their own hydrogen stations to help spur clean truck adoption.

“Vehicle OEMs helping with the very early deployment of their hydrogen trucks with fueling solutions is really important,” Roeth said. “This is very early and can be viewed as a way to support demos and field tests with these solutions. There are so many things yet to learn and decide with respect to hydrogen trucks and their fueling that we need to start doing it to help refine how this will actually occur. Down the road we will look back and see many, many ‘phases’ of hydrogen truck deployments.”

It worked for Tesla

Bill Elrick, executive director at the Hydrogen Fuel Cell Partnership, formerly the California Fuel Cell Partnership, pointed out how Tesla helped enable sales of its EVs by rolling out its own brand of chargers across the country. He thinks that fuel cell manufacturers might also benefit from that same approach, albeit it with some challenges.

“I'd say take a look at Tesla. That's how they got on the map. They knew charging was a problem so they provided that,” Elrick said. “They've also shown how it's really challenging. ‘Do we open it up to other people or not? How big do we build it? Do we use the same plug?’”

When it comes to deploying hydrogen stations, Elrick sees startups like Nikola having an advantage over well-established OEMs.

“They’re not bound by their history. A startup like Nikola can be anything they want to be, so it's probably easier for them as opposed to a [legacy truck manufacturer] or anybody who's been around for a hundred years to say, ‘I'm going to provide the fuel too.’ It’s creating a whole new widget – and challenge and business – that's quite likely needed. And at the same time, do we want to get into it?”

[Related: Cummins CEO sees engine use declining amid push for alt fuel]

Elrick said that legacy companies have had longstanding partnerships with large fuel companies that could prove advantageous when it comes to pairing up fuel cell deployments with hydrogen station rollouts.

“[Legacy OEMs] are so well connected,” Elrick said. “Why would they go compete against somebody who's been a partner over the decades?”

Hyliion, a startup that’s pursuing both Class 8 natural gas hybrids and fuel cells through a recently announced partnership with Hyzon, is not looking to deploy its own hydrogen stations.

“I think for us, it's not a smart use of the capital that we have to go try to do something like that,” said Hyliion CEO Thomas Healy. “With hydrogen, if fuel cell vehicles are your sole business then you're going to have to solve the infrastructure problem, because it's kind of a chicken or egg situation of which comes first.”

Amgad Elgowainy, senior scientist and distinguished fellow at Argonne National Laboratory who leads the electrification and infrastructure group with a focus on hydrogen and electrification applications, views OEM hydrogen production as “possibly” a productive path for hydrogen truck adoption.

“We see a lot of like industry trying to vertically integrate basically to be independent,” Elgowainy said. “It would make sense for some to do a partnership. For others, maybe depending on their plans, they’d rather be vertically integrated.”

Whatever the path, Elgowainy said hydrogen production technology stands at the ready.

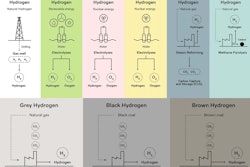

“Whether it is electrolyzer or whether it is reformation, the technology is there today. Some might be appropriate for certain scale, others may be appropriate for other scales. You have to consider the availability of your energy supply chain, cost of the energy supply chain and carbon intensity of your energy supply chain. All of this will be important for sustainability, whether economic and environmental among others.”