Zonar developed Coach, an interactive tool that personalizes the risk reduction efforts of fleets.

Zonar developed Coach, an interactive tool that personalizes the risk reduction efforts of fleets.Personal auto insurers offer discounts to policyholders who install a recording device and demonstrate safe driving. Getting savings from commercial insurers is a different ballgame.

They generally are not willing to give discounts on policies even if fleets use technology that potentially could reduce accidents.

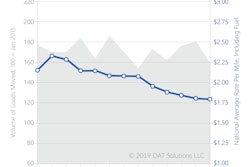

Can you blame them? During the last four years, truck insurers have paid out 12 percent more in accident claims than they brought in from policy premiums, says Tommy Ruke, founder of Motor Carrier Insurance Education Foundation (MCIEF).

Truck crash rates have been increasing, and insurance companies are struggling to reach quick settlements on claims. Litigation of truck crash incidents has also risen significantly.

“The insurance industry has a problem accepting new technology. They don’t understand what it means in dollars to them,” says Ruke.

To stay insurable and limit future cost increases, carriers seemingly have no other option than to shoulder the burden of proof that their continued efforts to reduce risk are actually working.

Using ELD data

Not all commercial insurers have shied away from offering policy discounts for using certain technology.

Progressive Insurance offers a discount to carriers that share electronic log data through its Smart Haul program. Progressive reviews a carrier’s ELD data records on an annual basis to make a determination.

The Smart Haul program from Progressive Insurance offers policy discounts of between 3 and 15 percent to carriers that share ELD data that demonstrates low risk.

The Smart Haul program from Progressive Insurance offers policy discounts of between 3 and 15 percent to carriers that share ELD data that demonstrates low risk.“We compare individual’s driving habits to those of similar commercial truck drivers and determine the savings based on their most recent driving history (last 90 days),” says Rishi Arora, product development manager for Progressive.

Smart Haul collects the same data that is already recorded by ELD devices as part of the final ELD ruling, “so there’s no requirement for the driver to get another device,” he explains.

The Smart Haul program provides a minimum 3% savings on new qualifying truck customers. Those savings can go over 15% for the best drivers, he says, depending on how safe their driving is relative to their peer group.

Most insurers at least consider technology that carriers use to underwrite their policies.

Protective Insurance, headquartered in Carmel, Ind., has researched the possibility of using ELD and telematics data from its motor carrier clients to assist with loss prevention efforts, explains Dick Mahany, the company’s vice president of product development.

Telematics systems that incorporate cameras have proven to be most effective for reducing risk, he says. The technology helps to change risky behaviors and protect fleets and insurers from fraudulent claims.

“Cameras have brought a context to the data which has been profoundly beneficial for the industry,” he says. “Data by itself without context of behavior is very difficult from a behavior management standpoint.”

Going captive

Faced with escalating premiums, carriers are taking on more risk from higher deductibles and looking for savings in alternative insurance marketplaces such as captives.

Technology helped Tri-State Motor Transport acheive a major reduction in insurance premiums this year.

Technology helped Tri-State Motor Transport acheive a major reduction in insurance premiums this year.Captive insurers, such as Cottingham & Butler, are owned by member fleet companies who are very selective of who they allow to join. Captives may require their members to follow certain policies and use specific technologies.

Tri-State Motor Transit (TSMT) operates a fleet of 485 trucks with a niche in transporting high value and hazardous materials. The company has benefitted from membership in a captive insurance group.

“We have been very fortunate. Our insurance rates have not been escalating. This year we had a major deduction in premiums,” says Donnie Lester, vice president of safety for TSMT, which is part of the Roadmaster Group, a Daseke-owned company.

Lester credits some of the fleet’s safety policies and technology for results. Speeding risks are not a concern since the company governs its trucks to 65 mph. The risks of fatigue are not much of a concern either since the company operates driver teams.

Drivers at the Joplin, Mo.-based company do not feel the pressure of running up against their limits for driving and on-duty time, he explains. They can rotate on and off-duty within the hours of service as needed with their team members.

Some of the safety technologies TSMT uses are proving to be less effective. Lester and other Tri-State executives recently decided to not order lane departure warning systems with its new truck purchases, for instance.

The technology gives drivers audible warnings if they cross lane markings without using their turn signals.

“When [the system] was beeping it would wake up the co-driver. It was causing us to be concerned with disrupting their sleep pattern,” he says. TSMT plans to continue its use of other safety technologies that include adaptive cruise, roll stability control, collision avoidance and event recorders with forward-facing cameras.

Looking beyond CSA

One of the most widely used data sources by truck insurers is motor carriers’ Compliance, Accountability, Safety (CSA) scores. However, CSA data has not proven to be a good predictive of crash risk and claims, Mahany says.

The Federal Motor Carrier Safety Administration is planning to begin an initial rollout of the new IRT-based scoring system before the end of 2019.

“[IRT] is not a measure of ‘are you a good fleet or a bad fleet.’ It is really more representative of your safety culture,” he says. Protective Insurance has already created models that show the IRT scores of carriers have a higher correlation with accident claims than CSA scores, he says.

In addition to public data sources for risk assessment, insurance companies are using various reporting services that help them establish rates and monitor for risk.

SambaSafety Transportation sells ongoing analysis and reports to insurance companies, and fleets use the same reports to get a view of driver risk.

“We do not have every piece of data, but we do have the critical data,” says Steve Bryan, vice president and general manager of SambaSafety. “Think of us as reporting on what the eyes of law enforcement see.”

The company has a reporting service that monitors the ongoing MVR activity of drivers. Carriers are required to pull MVR reports on drivers they hire and once a year, he says, but insurance companies and fleets that subscribe to reports are alerted to any changes to driver MVR records during the year.

Closed loop loss prevention

One area where insurance companies have shown interest in using technology is to get up-to-date risk assessments from their policy holders. They also like it when fleets are using a closed loop approach to manage risk.

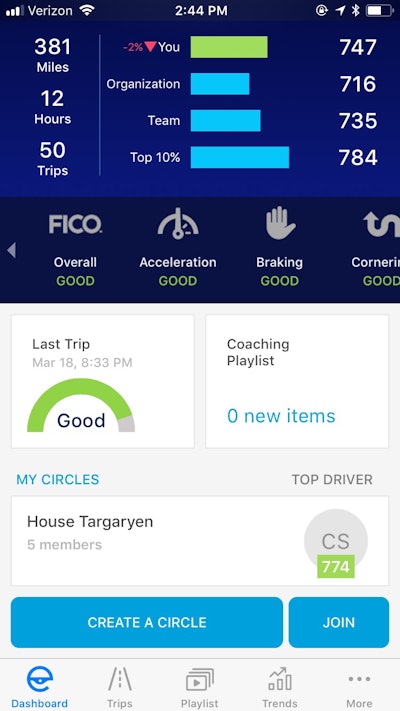

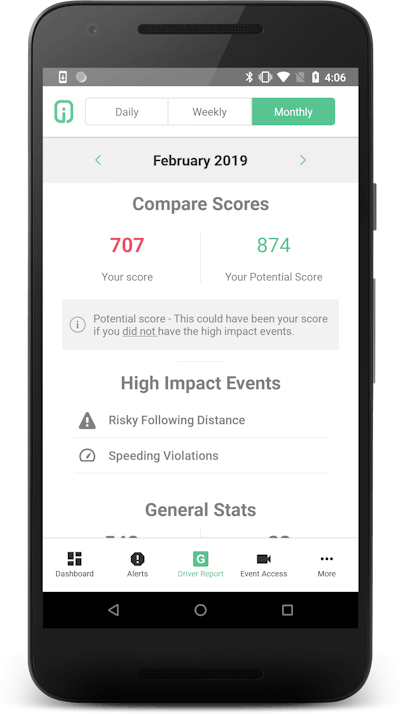

The Mentor program from eDriving gives fleets and drivers a FICO Safety Score to chart their progress for reducing risk.

The Mentor program from eDriving gives fleets and drivers a FICO Safety Score to chart their progress for reducing risk.eDriving’s risk managed insurance (RMI) program called Mentor has been around for 20 years. The program includes FICO Safety Scores, mobile technology and online driver training, among other features.

The FICO scores were created by partnering with the well-known credit scoring agency and are central to the company’s Mentor program to “get a really accurate identification of risk and go to next step to reduce risk,” says Ed Dubens, chief executive officer of eDriving.

Mentor includes a driver app that installs on smartphones to sustain behavioral improvements by engaging drivers. They can monitor their score to change risky behaviors.

The company has worked closely with insurance companies such as Zurich who strongly consider the commitment of fleets to follow the Mentor risk reduction program when underwriting policies, he says.

eDriving offers a money-back guarantee for companies that use the Mentor program. The guarantee is that companies will have a 20 percent reduction in crashes in the first year. To qualify, fleets have to follow the program but “not everyone wants to go through the pain,” Dubens says.

“Insurers are eager to encourage [their clients] to commit to these journeys,” Dubens says.

In the early fall, Mentor plans to release a new feature for drivers to use a smart phone at the scene of an accident to take pictures and answer questions for risk management. The new “first notice of loss” tool will submit directly to insurance to start the claims process. Studies show that waiting 30 to 60 days to submit a claim costs an insurer 20 to 30 percent more than by submitting a claim within 14 days, Dubens says.

Personalizing risk

Increasingly, technology is enabling insurers to work more closely with fleets to implement “personalized” loss control methods.

Mobile driver apps have become the norm for personalizing loss control by giving drivers the tools to monitor their own behaviors.

Cambridge Mobile Telematics (CMT) has a mobile app that monitors driving behaviors, and has primarily been growing among fleets not required to use electronic logs.

CMT’s platform captures and analyzes data from the inertial sensors in smartphones to track driving behaviors and cell phone use while driving. A separate device, about the size of a toll transponder, sticks to the windshield of a vehicle and communicates with the app. The device ensures the only data captured by CMT is when drivers are in a company vehicle, explains Ryan McMahon, vice president of marketing for CMT.

The mobile app is designed to increase driver engagement and give feedback for use with incentive and rewards programs. CMT also integrates with off-the-shelf cameras to use machine vision technology to capture more complex behaviors like close following distances and running stop signs.

Netradyne’s mobile app shows drivers how their performance compares to the fleet goal.

Netradyne’s mobile app shows drivers how their performance compares to the fleet goal.About one year ago, Zonar introduced Coach for its mobile fleet management platform. Coach uses a forward-facing camera that communicates with an app on Zonar’s rugged tablet display to give drivers audible feedback while in motion.

The feedback includes warnings for following too closely, running stop signs, heavy braking, poor fuel economy and aggressive turns. Fleets that use the Coach product establish the metrics they want drivers to meet, says Gary Schmidt, vice president of business solutions for Zonar.

Driver Coach is intended to be highly interactive with drivers. It lets them know when risky events are taking place so they can correct them before fleet management intervene. At the end of each trip, Coach gives drivers a report that shows risky events that happened. Drivers have the option to hit a “contest” button and explain their version, he says.

Netradyne has personalized its vision-based safety system, Driveri (“driver eye”), with a mobile driver app that drivers use on their own devices. They can view the status of their progress at the end of each trip towards meeting goals for safe driving and company incentives. Fleet managers can also share video events with drivers to review through the app.

“We have seen lot of self-management just from the fact that a driver can have all of that information,” says Adam Kahn, vice president of Netradyne’s fleet business.

Anything that reduces accidents will likely improve driving performance and reduce costs in other areas, but faced with insurance increases, that may be the number one goal for years to come.