Forecasting is tricky business, and you as you might imagine, the federal government’s record for accuracy is particularly suspect. Consider, for example, that the Bureau of Labor Statistics in 2002 predicted that there would be nearly 2.1 million heavy truck drivers in 2010. In fact, there were 1.6 million — a miss of nearly half a million drivers. Of course, we did have that unpleasantness often referred to as the Great Recession, so perhaps we should cut them some slack.

Few government forecasts are as notoriously inaccurate, however, as the monthly energy outlook from the Energy Information Administration, the most recent of which was released on May 8. What’s striking about the May forecast — and this is hardly a rare phenomenon — is that despite recent volatility in diesel prices, the outlook for the rest of the year is almost a flat line, ranging from a low of $4.07 a gallon to $4.11 a gallon. Most trucking companies would be thrilled to see that kind of stability in diesel prices.

The whole concept of forecasting the price of diesel, gasoline or crude oil is fundamentally flawed because the petroleum markets are so sensitive to unpredictable events. Witness Hurricanes Katrina and Rita in 2005, the still-not-fully-explained surge in 2008 and the political unrest in the Middle East and North Africa last year.

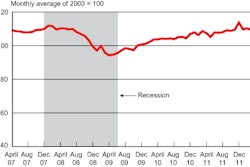

Both the low January 2008 outlook and the high July 2008 forecast failed to predict the wild swings in diesel prices during 2008 and 2009.

Both the low January 2008 outlook and the high July 2008 forecast failed to predict the wild swings in diesel prices during 2008 and 2009.We’re not talking about small variations. EIA’s January 2011 short-term outlook predicted that the average price just two months later in March 2011 would be $3.37 a gallon. In fact, the average price for March 2011 was $3.90 — a difference of 53 cents a gallon. After diesel spiked, EIA raised its forecast. Then the price moderated, and EIA lowered its forecast. The October 2011 outlook forecast a diesel price of $3.73 a gallon in April 2012. In fact, the average diesel price in April was $4.10 — 35 cents higher.

One of the most dramatic examples is 2008-2009. In January 2008, EIA forecast diesel prices for July 2008 at $3.28 a gallon. The actual number? $4.70 a gallon. That’s a $1.42 difference.

EIA then adjusted its outlook, of course. So the agency’s July 2008 outlook predicted consistently high prices through 2008 and into 2009, moderating only in the fall of 2009. The July 2008 forecast for December 2009? $4.21. The actual December 2009 average? $2.74 — $1.47 lower.

You can’t fault the EIA or the U.S. Department of Energy for failing to anticipate devastating hurricanes in the heart of refinery country, alleged speculation in petroleum markets or open rebellion in some of the most important petroleum-producing nations on Earth. That’s not the point. Rather, the point is that stuff happens. And even when stuff doesn’t actually happen, markets move because people are frightened that stuff might happen as appears to be the case earlier this year regarding tensions with Iran over nuclear weapons technology.

It’s not that EIA is especially bad at forecasting. Rather, there there’s really just not much point in forecasting diesel prices at all. Surely there’s a better use of those resources.