The latest indicators for trucking are headed in the right direction – unless, of course, you’re a shipper.

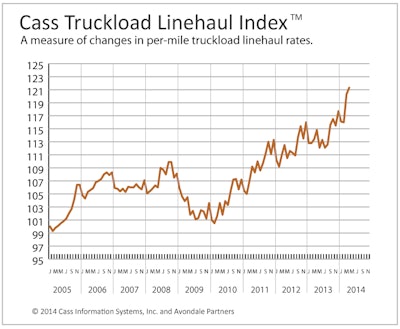

Truckload linehaul rates rose 5.7 percent year over year in April – and since February they’ve increased 4.6 percent, according to the latest update of the Cass Truckload Linehaul Index. (Figure 1, above)

For the second month in a row, the Cass/Avondale Partners truckload linehaul cost index reached a new high.

Demand continues to improve while capacity tightens “due to the increase in demand as well as freight carriers exiting the industry,” the report notes.

Avondale Partners continues to predict increases of 4 to 6 percent in contracted linehaul rates in 2014.

Similarly, all-in intermodal costs (linehaul, fuel and accessorials) also reached a new high for the index, increasing 1.4 percent year over year in April and 1 percent from March. (Figure 2)

Intermodal rates are expected to remain relatively flat in the near term, “but rising intermodal volumes, combined with increasing truckload rates, should ultimately lead to further increases in intermodal costs,” the Cass report says.

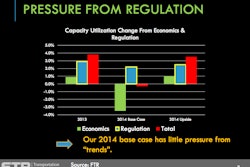

Also, FTR’s Shippers Conditions Index for March was basically unchanged from February at a reading of -8.7. (Figure 3)

The negative level of the SCI reflects extremely tight capacity available to haul goods. FTR currently expects the tight environment for shippers to moderate slightly in the coming months unless freight growth picks up as a result of a strengthening economy.

With any additional improvement in freight tonnage, capacity could hit a critical stage forcing shippers to incur added purchased transportation costs, FTR notes.

“Shippers learned that it doesn’t take much for a market that is operating with slim excess capacity to jump into the driver’s seat for rate increases. The strong spot market rate increases seen during January, February, and March highlighted how quickly the environment can change on them,” says Jonathan Starks, FTR’s director of transportation analysis. “Just one year ago, several industry sources were showing that general rate increases were actually below year-ago levels; shippers were getting rate reductions!”

A fairly static economy allowed that to take place, but the introduction of new hours-of-service rules for drivers in July 2013 changed that, Starks adds.

“Add in the potential for further economic acceleration in 2014 and we find it very unlikely that shippers will be able to get the rate reductions that they achieved last year,” Starks says.

Mid-year, FTR expects to see truckload general rate increases of 4 to 5 percent, with national rate figures hitting 6 percent or higher compared to last year.

The Shippers Conditions Index is a compilation of factors affecting the shippers transport environment. Any reading below zero indicates a less-than-ideal environment for shippers. Readings below 10 signal that conditions for shippers are approaching critical levels, based on available capacity and expected rates.

FTR’s interactive graph is here.