Following seasonal patterns, rates in the last week of January eased down a bit. Other indicators for carriers, however, remain strong: Monthly truck order volume continues to be elevated, and industry employment continues to gain.

Here are a few key indicators from the recent week:

[gttable cols=””]

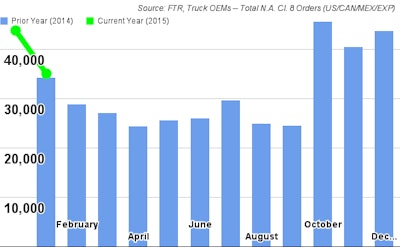

Truck orders see strongest January in 9 years: Continuing the trend in recent months — in which truck orders were above 40,000 for three consecutive months — preliminary data for January shows the strongest Class 8 order month in nearly a decade.

FTR reported last week net orders at 35,060 in the month and 377,000 in the rolling 12-month period.

ACT Research in its preliminary figures put the number at 35,400. The last six months of orders annualize to about 433,000 truck orders, says ACT’s Kenny Vieth, president and senior analyst.

FTR’s Don Ake says January’s numbers are line with forecasts for the year, which are expected to be strong.

“Even though orders were the lowest in the last four months, the market remains very robust,” he said. “Fleets are now trying to determine their requirements for the entire year and then place orders accordingly.”[/gttable]

[gttable cols=””]

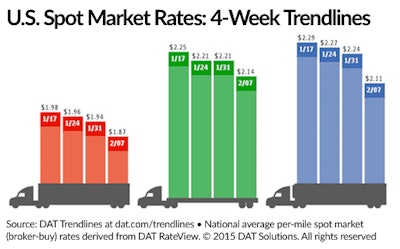

Fuel, weather continue to hold back spot market rates: Rates on the spot market continued their recent slow decline in the last week of January, according to numbers from DAT Solutions.

Decreased fuel surcharges continue to play a role, as do seasonal trends. Van rates on the spot market fell 2 cents (1 cent being the linehaul portion), while reefer rates fell 3 cents and flatbed didn’t change.

In the week, available van and reefer loads fell 8.4 percent and 7.3 percent, respectively, while available capacity rose in both segments, DAT reports.[/gttable]

Previously reported indicators

CCJ posted more in depth on each of these last week, but as a recap:

[gttable cols=””]

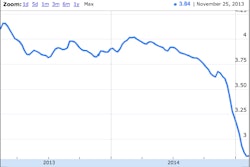

Trucking employment nears 8-year high: The for-hire trucking industry continued its long streak of employment gains in January, adding 2,400 jobs. It’s not bearing down on the most recent employment high seen in January 2007.[/gttable]

[gttable cols=””]

Spot market rates dip: All three segments — dry van, reefer and flatbed — saw multi-cent rate declines on the spot market in January, according to Internet Truckstop.

Reefer fell 20 cents. Van fell 16, and flatbed fell 9 cents. All three are just above where the were the same month last year.[/gttable]