CCJ’s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

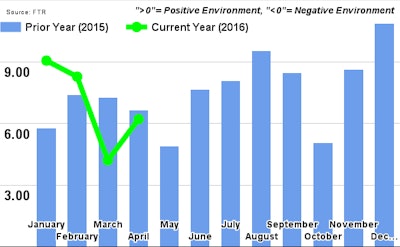

FTR’s Jonathan Starks, the company’s Chief Operating Officer, said the spot market reflects such conditions, with rates continuing to fall. Contract rates are also starting to see a downward trajectory, he says. “There is enough uncertainty swirling around the trucking markets right now to force a manager or business owner to keep the antacids handy,” Starks said.

“Luckily, not all of the news is bad. The driver shortage is no longer the immediate concern it once was, and the economy continues to trudge along. I am watching inventory right now because of its quick impact on freight demand. Inventory levels are at highs that we haven’t seen outside of a recession since the turn of the 21st century. Does that mean we are heading into a recession? Perhaps, but not definitively. The other conclusion is that higher inventory is the new norm, and it’s just going to take some time for supply chains to optimize their inventories.”

Costello’s harped on high inventory levels for some time, saying it’s throttling freight growth and, effectively, stymying rates.

Costello said the high inventory levels seen now come in response to the 2014’s brush with a capacity crisis, when spot market rates soared to record highs. Mid-2014 spurred shippers to seek higher inventories as a means to ward off future trucking capacity concerns that could cause rates to spike again.

“Trucking feels worse than the macroeconomy because inventories are so high,” Costello said.

Consumer spending will be the “bright spot” of the U.S. economy in the near future, Costello predicted, which could help pull trucking over the high-inventory hump.