CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

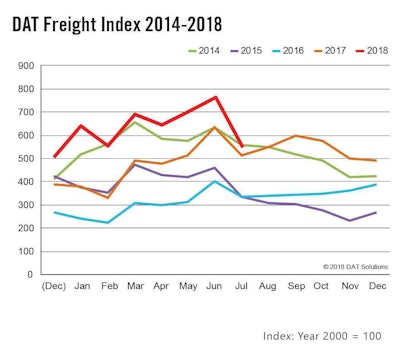

Such a dip is in line with seasonal trends, with July typically being one of the slower months for freight movement. Though rates fell in July from June, they dips weren’t as pronounced as expected, says DAT pricing analyst Mark Montague. What’s more, he says, rates should remain well elevated compared to 2017. “Going forward, rate trends are likely to follow a normal seasonal pattern but at a level that’s 25 to 30 percent higher than in 2017.”

DAT reports per-mile van rates in the mont hat $2.29 a mile on average, a 2-cent dip from June. Flatbed rates fell 5 percent, to $2.77 a month, and reefer rates dropped 9 cents, to $2.61 a mile. Compared to July 2017, the average per-mile van rate on the spot market was up 51 cents. Reefer rates were up 54 cents a mile on average, and flatbed rates were 60 cents higher.