Truck orders for July came in below 10,000 units, according to preliminary data compiled by FTR – a level not seen since 2010.

Despite most truck order boards being open for 2020 build slots, the 9,800 units ordered last month show carriers are in no hurry to grab production capacity.

“Fleets continue to take a wait and see approach to 2020 equipment,” said Jonathan Starks, FTR chief intelligence officer. “Potentially higher equipment costs, uncertain demand, and enough available capacity in the market are keeping order activity at bay.”

July orders were 24% below an already low June and dropped 82% year-over-year. Class 8 orders for the past 12 months total 288,000 units.

In its Commercial Vehicle Dealer Digest, ACT Research noted that the heavy truck and trailer industries are each heading toward a “market correction” in 2020.

“Data that support our forecast of an impending market correction continue to mount, with the biggest driver of the change for both Class 8 and trailers being the continued building of new equipment inventories in 2019 that will require right-sizing in 2020,” said Kenny Vieth, ACT’s President and Senior Analyst. “Since March 2018, ACT’s forecasts have targeted 2019’s third quarter as the point at which the supply of Class 8 tractors and demand for freight services would likely tip so far as to break the current period of peak vehicle production, as demand reverts to the mean. Current data and anecdotes make a strong case that the call for a Q3 inflection remains intact.”

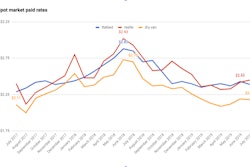

Freight volumes and rates, fleet growth, and other metrics, Veith said, point to the “impending demise of the current upcycle in heavy CV demand.”

“Economic data of note [in July] came from weak manufacturing industrial production. As well, durable goods orders have stagnated, as have the ISM and Markit Purchasing Managers’ indices, while building permits have been down year-over-year for the past six months,” he added. “Over time, the shape of the IP series, if at different percentages, broadly mirrors the shape of the Class 8 cycle.”