CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

—

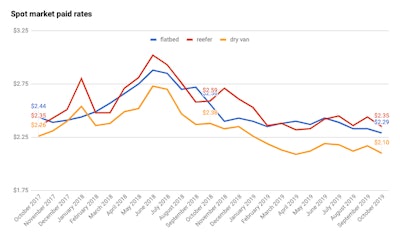

(Per-mile rates data from Truckstop.com)

(Per-mile rates data from Truckstop.com)Spot market rates in October hit a snag, with rates in all three major truckload segments falling month-to-month, according to monthly per-mile average rates data from Truckstop.com.

October in recent years has been unpredictable for spot rates, with per-mile rates climbing some years from September and declining in others.

Spot market flatbed rates slipped 4 cents a mile this October, to $2.29 a mile. Compared to October 2018, flatbed’s per-mile average was down 27 cents. The segment was also down 15 cents from the same month in 2017.

Reefer rates were down 9 cents a mile in October, to $2.35. Though reefer rates were flat compared to October 2017, they were down 24 cents a mile from October of last year.

Lastly, dry van rates slipped 7 cents from September, to $2.10 a mile. That’s down 28 cents from last October and 16 cents from October 2017.

Trucking employment rallies after a quarter of declines

Preliminary figures show that the for-hire trucking industry added 1,300 payroll jobs on a seasonally adjusted basis in October, coming after three straight months of declines, according to the Department of Labor’s monthly employment report.

The economy as a whole in October added 128,000 jobs, and the unemployment rate was 3.6%.

October’s gains for trucking come after a 4,300-job loss in September and menial losses in July and August. Industry employment rose through the spring months.

Of major freight producing sectors, the construction industry added 10,000 jobs in October, while manufacturing lost 36,000 jobs, due in large part to the strikes at General Motors.