Colin Sutherland, executive vice president of sales and marketing, at the Geotab Connect 2020 conference on Jan. 14 in San Diego.

Colin Sutherland, executive vice president of sales and marketing, at the Geotab Connect 2020 conference on Jan. 14 in San Diego.The final ELD mandate of Dec. 17, 2019 created an opportunity for new vendors to enter the telematics market, but all along a disruptive force has been taking shape.

About five years from now, the fleet telematics market will be disrupted by vehicle manufacturers installing their own devices at the factory, Geotab Chief Executive Neil Cawse predicted at the company’s Connect 2020 conference, Jan. 14, in San Diego.

OEMs already install their own devices in vehicles to collect operating data for product engineering and to provide their fleet customers with remote diagnostic services.

Going forward, Cawse expects to see fleets opt-out of installing telematics devices because the connected vehicles of OEMs will come standard with a free basic management platform. Fleets will have the option to upgrade to a more full-featured telematics platform through a subscription.

“I am convinced that this is the way it will ultimately be,” he said.

Getting telematics for free will be no different than having Gmail and other basic software tools on a smartphone. If you decide to upgrade to use Google’s business tools, you pay a subscription that comes with “a whole other level of support,” Cawse said.

Cawse expects most fleets will upgrade to full-featured fleet management platforms that will be connected to the telematics data captured by OEM devices through integrated servers in the cloud. Fleets operating two or more vehicle brands will want to manage all of their telematics data from vehicles in a single platform that is also connected with various third-party applications they use, such as ELDs and camera systems, he explained.

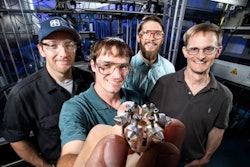

Neil Cawse, chief executive officer of Geotab, during the Geotab Connect 2020 conference in San Diego, Jan. 14.

Neil Cawse, chief executive officer of Geotab, during the Geotab Connect 2020 conference in San Diego, Jan. 14.Geotab’s fleet management platform is used by thousands of fleets today to connect with more than two million vehicles. More than 500,000 of its vehicle subscriptions are class 6-8 trucks, he said. Fleets can install Geotab’s low-cost GO device in their vehicles, or not, by instead using the integrations it has with OEM telematics platforms.

During the company’s Connect 2020 conference in San Diego on Tuesday, Cawse announced that light and medium-duty vehicles from GM and Ford are connected to Geotab’s cloud-based platform, making it unnecessary for fleets to install additional hardware in the aftermarket.

In the heavy duty market, Geotab has similar telematics integrations with Volvo and Mack Trucks. Navistar exhibited at the conference and plans to announce an integration soon. Geotab is working with all of its OEM partners to standardize how their telematics systems log data for fleets to have uniform data sets.

The Geotab platform comes with applications for fleet productivity, ELD compliance and driver safety. Its open APIs allow third-party software developers to integrate products with the platform to give fleets a single sign-on experience for all connected applications. With these integrations, Geotab has an extensive portfolio of mobile apps, software add-ins and hardware add-ons that can be activated through its Geotab Marketplace.

The company has a large network of resellers that specialize in certain markets to implement fleet management solutions for its customers in transportation, construction, government and other industries.

During the Connect 2020 conference the company announced the availability of new products in the Geotab Marketplace:

- Eleos, an all-in-one driver workflow platform, is accessible through a pre-loaded enterprise-grade tablet. It also has a driver app with certain features for drivers to use outside the cab.

- Lytx, a video-based telematics platform for fleets, combines machine vision and artificial intelligence (MV+AI) with professional review and behavior tagging. The new integration is a single interface between Lytx’s video-based telematics platform and Geotab’s fleet management capabilities. Fleet managers using the Geotab platform can browse video and data from Lytx’s DriveCam event recorders to understand exactly what is happening in their fleets at any moment.

- Trimble’s Video Intelligence platform includes a two-channel DVR and forward-facing camera with the option to add a secondary camera. The integration gives Trimble an opportunity to expand its presence in light and medium-duty vehicles.

Geotab has been privately owned since it was founded in 2000. Colin Sutherland, executive vice president of sales and marketing, said not having investment from private equity gives Geotab the “freedom to focus on research and development for our product.”

Other telematics companies tend to focus on specific markets, like trucking or construction, and Sutherland said Geotab does not consider traditional telematics companies to be its competitors. Rather, it considers them to be potential customers with Geotab positioned as a data company.

“We don’t normally benchmark against other telematics companies. We do more thinking about ‘how do we enable data to be consumed in the truck space?’” Sutherland said.