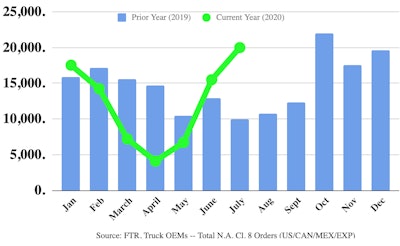

FTR Chief Intelligence Officer Jonathan Starks noted demand for new trucks last month was better than expected, but uncertainty swirling out around increasing coronavirus case counts and Congressional action on unemployment benefits could dampen the market into the fall.

“As we hit the height of summer demand, the freight markets showed strength and resilience and that led to additional orders for trucks,” he said, adding that despite the increasing orders, FTR still expects the Class 8 market to maintain a slow and steady recovery.

“The freight markets sustained a traumatic decline of volumes at the start of the pandemic and consumer demand, on an absolute basis, will remain weaker as we deal with high levels of unemployment and a Congress that has been unable to foster a bi-partisan solution to stimulate demand,” Starks said. “The OEMs received a needed boost from July orders, activity that will help keep the industry moving in an upward direction.”

The Class 5-7 market saw orders slip to 16,700, according to ACT Research, down 6% month-over-month and 3% below July last year.