As part of a broader effort to cut costs and better align with weak freight demand, carriers shrunk their fleets by 2.2% on average in 2024, according to the American Transportation Research Institute’s Analysis of the Operational Costs of Trucking report.

That trend showed up again in Q2 earnings reports, where a few publicly traded carriers disclosed reductions in fleets to manage utilization and protect margins in a soft market.

Heartland Express (CCJ Top 250, No. 25) is maintaining its strategy of cutting back on “underperforming lanes of freight” and scaling down its fleet to better match freight demand. CEO Mike Gerdin said these reductions are paired with a focus on improving driver utilization and lowering operating costs.

Marten Transport (No. 37) also trimmed its fleet, with total tractors declining from 3,126 in Q2 2024 to 2,928 in Q2 2025, while total trailers fell from 5,539 to 5,164 over the same period. In an SEC quarterly filing, the company reported that the drop in operating revenue was “primarily due to a decrease in our average fleet size,” while noting it was partly offset by an increased revenue per tractor.

Meanwhile, Covenant (No. 36), decreased its tractors in the expedited segment (5.5%), although the company increased its fleet in truckload and dedicated operations, respectively at 4.9% and 11.7%. However, utilization was low on the three segments, with the company reporting higher operating expenses driven by maintenance, insurance and labor costs.

In a call with analysts, Covenant CEO David Parker said there are some key catalysts are at play that capacity is leaving the market: Class 8 orders are down 7% year-over-year, driven by tariff volatility and continued sluggishness in the economy and freight market, according to FTR.

“You can see it in the Class 8 truck orders. Nobody is buying a bunch of trucks, and it’s just a matter of time,” Parker said. “I think it’s the October kind of time frame that we will start seeing capacity really starting to (tighten) because we’re starting to sense it as we speak right now.”

Fleet reductions may help rebalance supply and demand and provide some relief to freight rates, even when volumes remain weak, as noted by the latest U.S. Bank Freight Payment Index report.

According to the report, some carriers left the market altogether, while others cut back their fleets to align more closely with current demand. These adjustments effectively reduced available capacity, which allowed the carriers that stayed in business to see modest improvements in freight levels.

“This was less because freight surged, but more because there was less capacity to meet that demand,” the report noted.

Tariff-driven trailer cost increases

Another factor worth considering is the expansion of the steel and aluminum derivative tariffs. Two categories added are dry van trailers (HTS 8716.39.0040) and other trailers for transporting goods (HTS 8716.39.0090). In 2024, the U.S. imported more than $1 billion of each, mostly from Mexico, said Jason Miller, associate professor of supply chain management at Michigan State University and interim chair of the Department of Supply Chain Management.

Until recently, these trailers weren’t being tariffed, as they qualified under the U.S.-Mexico-Canada Agreement. But the new steel and aluminum derivative tariffs override USMCA, which means those trailers will now face significant duties, Miller pointed out.

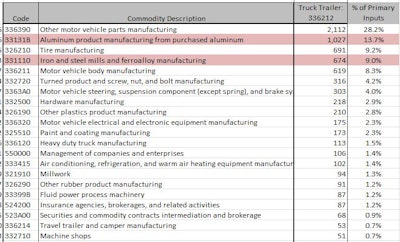

Based on cost breakdowns from the U.S. Bureau of Economic Analysis, Miller estimated that direct steel and aluminum use makes up about 23% of a trailer’s value, implying a minimum 11.5% tariff.

Breakdown of cost structure for truck trailer manufacturing Jason Miller/U.S. Bureau of Economic Analysis

Breakdown of cost structure for truck trailer manufacturing Jason Miller/U.S. Bureau of Economic Analysis

However, adding trailer components that are also made of steel and aluminum, Miller said the share is likely closer to 35%, implying tariffs in the 15% to 20% range.

Combined with domestic trailer prices that are still 44% higher than pre-COVID and aluminum costs are up 10.6% since January, Miller said, “We have a rather nasty combination for carriers considering expanding their trailer pools."

Tariff-driven trailer cost increases are and will prompt some fleets to delay replacements or reduce capacity further, said Dan Moyer, senior analyst for commercial vehicles at FTR.

“The trade-off is higher maintenance and reliability risks from aging equipment,” he said.

Miller noted that some costs will hit buyers directly, with fleets more likely to extend trailer life rather than pay inflated prices.

Leasing may become more appealing, Moyer added, as it offered flexibility and converse cash while avoiding large upfront investments at elevated prices.