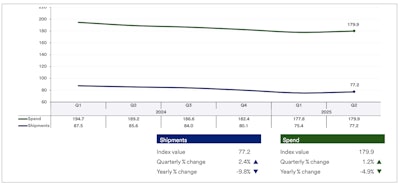

After freight volume and spending declined in the first quarter, the national truck freight market saw sequential growth in the second quarter, according to a U.S. Bank Freight Payment Index report.

The report revealed quarterly shipment and spend volume increases.

The report revealed quarterly shipment and spend volume increases.

National shipment volumes rose 2.4% and spending increased 1.2% from the previous quarter, marked as the first quarter-to-quarter gain in three years. On a year-over-year look, compared with Q2 2024, national shipments were down 9.8%, while spending dropped 4.9%. However, the year-over-year decline in shipments was the smallest since the third quarter of 2023.

Bobby Holland, U.S. Bank director of freight business analytics, noted it as a “welcome shift after years of contraction.”

Still, Holland said that the tariff-related volatility brings a state of uncertainty for shippers and carriers.

Economic activity was mixed in the second quarter, according to the report. Manufacturing activity varied across the five major regions and showed only a slight national uptick from Q1. Consumer spending also edged up modestly, while housing indicators were inconsistent but trended downward overall. Port traffic—both at U.S. land borders and seaports—was similarly volatile.

Despite economic unevenness, the report pointed out that freight shipments increased, "however, it's likely that shipments and spend were up because capacity tightened in the quarter.”

Fleet reductions played a role. Some carriers exited the market entirely, while others downsized to better match supply with current demand levels, the report noted.

As a result, adjustments took place. Carriers that remained in the market likely saw some improvement in freight levels, the report said. “This was less because freight surged, but more because there was less capacity to meet that demand.”

With unevenness in key freight drivers like manufacturing, housing, and port activity, the quarter-over-quarter gains are encouraging, said Bob Costello, senior vice president and chief economist at the American Trucking Associations.

“There are signs the industry is beginning to rebalance, even if the road ahead remains bumpy,” Costello said.

Spot rates, contract pricing, and fuel costs all declined modestly from Q1 levels, reversing the price increases seen earlier in the year.

[RELATED: Northeast bucks freight downturn as other regions struggle with weather and demand]

Has the market turned a corner or is it due to tariff uncertainty?

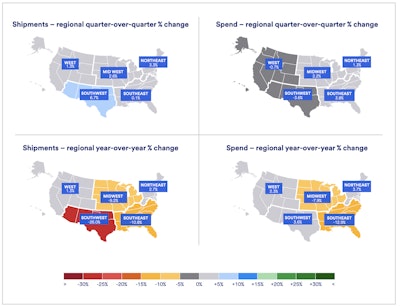

All five regions saw sequential shipment gains, though compared with the same period in 2024, results were more mixed. Despite regional shipment increases for the first time in four years, the report noted, “it may be too soon to say if the market has turned a corner or if the increases are the result of tariff volatility and uncertainty.”

The largest increase in spending was 3.8% in the Southeast, while the largest drop (-3.6%) was in the Southwest.

The largest increase in spending was 3.8% in the Southeast, while the largest drop (-3.6%) was in the Southwest.

The West region saw freight volumes rise for the second consecutive quarter, despite fluctuations in coastal seaport volume activity. Similar to the first quarter, volumes were driven by large increases in imports as shippers pulled forward cargo imports to mitigate the cost of new tariffs. Shipments increased 1.3% both quarter-over-quarter and year-over-year, while spending dipped 0.7% from the previous quarter but was up 2.3% from a year earlier.

The Southwest saw the largest sequential shipment gain of any region at 6.7%, though volumes remained sharply lower compared to the prior year, down 26.0%. Spending fell 3.6% from Q1 but was 3.6% higher year over year. Though cross-border trade declines brought freight volumes down, “decent” manufacturing activity in the region helped rebound from poor activity in Q1.

In the Midwest, freight activity posted its strongest quarterly improvement in three years, with shipments rising 2.6% and spending up 2.2% from the previous quarter. However, year-over-year metrics remained negative, with shipments down 9.2% and spending down 7.9%, reflecting the impact of flat-to-declining consumer spending despite steady home construction in the region.

Economic conditions in the region had a mixed impact early in the quarter. Manufacturing showed gains in certain sectors, while others saw declines. Consumer spending was generally flat or slightly lower, while home construction saw solid growth in April and May, based on U.S. Census Bureau data.

The Northeast led all regions in year-over-year growth, with shipments up 2.7% and spending up 3.7%. sequentially, shipments rose 3.3% and spending increased 1.3%, driven by stronger housing starts and auto sales.

In the Southeast, shipments inched up just 0.1% from the previous quarter—the second increase since Q3 2021—while spending climbed 3.8%. However, the region saw year-over-year declines in both shipments (-10.8%) and spending (-12.9%) amid continued softness in manufacturing and consumer demand.