Regulatory uncertainty, whether trade policies or EPA rules, has created cascading effects in the industry, according to dealers and manufacturers.

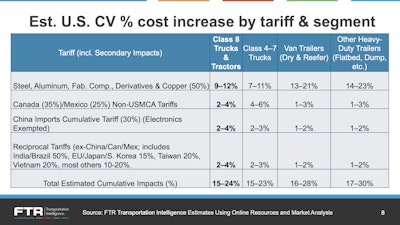

Tariffs are projected to significantly add to the cost of trucks and trailers. Dan Moyer, commercial vehicles senior analyst at FTR, estimated that the total impact will be 15-24% on Class 8 trucks, 16-18% on dry van and reefer trailers, and 17-30% on other heavy-duty trailers, including flatbeds.

Fleet buyers are reluctant to make purchases, worried about paying inflated prices, while dealers avoid stocking units subject to tariffs, fearing they’ll be forced to sell at a loss if the tariffs are lifted.

Kyle Treadway, dealer principal at Kenworth Sales Company, speaking at the 2025 FTR Transportation Conference, explained that their inventories are being pushed back to stock trucks with tariff surcharges. “We’re hesitant (to order) because if the tariffs go away, we’ll have an expensive truck.”

Mark Hall, general manager of trailers at Stoops Freightliner - Quality Trailer, echoed similar concerns: “If we order that inventory, we have to figure out how to move it when they sell out and make money at it. So that’s a decision for us as dealers that we’re not going to take on inventory if we don’t have to.”

Can supply chains outrun tariffs?

Meanwhile, Mack Trucks, which manufactures its vehicles domestically, said they’re feeling the impact. Jonathan Randall, the company’s North America president, described how Mack has added tariff surcharges to new trucks—a strategy to offset additional costs.

“We are actually disadvantaged today versus some (manufacturers) that are producing in Mexico,” Randall said.

Rather than paying tariffs on complete vehicles imported from Mexico, Mack faces tariff costs on every individual component it imports for assembly into its trucks.

This burden affects manufacturers across the industry.

“We have to basically look at all of our components and distinguish how much of each component would be (subject to) tariffs and then figure out the pricing for that. If we don’t, then the entire component would be facing tariffs,” said Krista Toenjes, general manager, North America on-highway business for Cummins.

For instance, Toenjes said that if a turbo has 80% tariffed widgets, the company is charged on 80%, not 100%. “It has a very direct impact on production costs,” she said.

Taranjit (Singh) Johar, executive director, procurement and supply chain risk at Allison Transmission, noted the challenges of predicting tariff scenarios and the importance of understanding suppliers’ geographical footprints. A few examples: China’s tariffs that were paused and extended to expire in November, potential changes to India’s 50% and Brazil’s 50% rate, and possible elimination of USMCA exemptions affecting Canada and Mexico.

“We cannot expect suppliers to absorb all of this. Nobody has 25%-50% margins, especially in manufacturing. It has to push all the way to the OEMs,” Johar noted, emphasizing that Allison Transmission proactively shares cost information with customers to avoid surprises.

Market conditions also introduced sourcing complications for manufacturers. Cummins’ Toenjes noted the challenges of dual sourcing and moving production from China to India, only to face new tariffs and additional costs.

“We’re still looking at ways that we can dual source and bring supply closer to home,” Toenjes said. However, she added that nearshoring comes with a price too: it may cost more to produce based on labor shortages and domestic capabilities.

Johar said Allison Transmission maintains a hybrid sourcing strategy, balancing local and global sourcing to manage costs.

EPA rules add more uncertainty

Meanwhile, trailer dealers said customers are delaying purchases because of uncertainty about EPA regulations being rolled back. Treadway said, “It has impacted the buying world for customers.”

Treadway noted that the longer customers postpone purchases, the greater the pent-up demand grows, potentially leading to supply chain shortages once buying activity resumes.

[RELATED: Economy risks cloud freight market, FTR reports]

Strained customer trust

Alan Briley, president of Fontaine Trailer Company, noted the challenge of passing through tariff costs without losing customers. The company mostly sources its major fabrications and components domestically, with some percentage of offshore components.

“We don’t really know what it’s going to cost, and that obviously makes it challenging in an environment where we’re trying to pass those on to our customers,” Briley said.

A central question that dealers face, Hall said, is the dilemma of passing on tariff increases to protect long-term relationships or absorbing them to maintain business in the short term.

Looking at historical context, Treadway said that previous price increases during COVID caused damage: “We had to go back to those customers four times and increased the price each time. We had these very difficult conversations. And so, it damaged a lot of long-term conversations.”

Taking a proactive approach is important, Briley said, as well as transparency, flexibility, and cross-functional collaboration in managing supply chain risks.

A positive outcome from market volatility, Toenjes pointed out, is the level of collective understanding of working together towards challenges, as dealers and OEMs alike share mutual customers.