Elevated uncertainty is preventing businesses from making investment and planning decisions, said FTR Transportation Intelligence analysts on Tuesday at the company’s conference in Indianapolis.

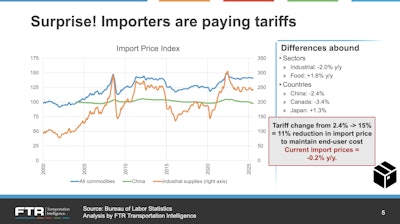

FTR Chairman of the Board Eric Starks pointed out the roller-coaster ride of tariff policy since February, with tariff rates fluctuating from under 2.5% to over 30%.

FTR’s forecast suggests a 15% tariff rate, though uncertainty remains with major trading partners such as Canada, Mexico, and China. Renegotiation of the USMCA next year could also add further complications.

Import prices have remained stable despite tariff increases. However, FTR CEO Jonathan Starks noted that a 15% tariff would require an 11% decrease in import prices to maintain the same end-user price.

FTR sees no downward movement on import prices. “The exporter is not paying that tariff,” said Jonathan Starks, adding that currently, businesses and importers are taking the brunt of that impact. This will shift soon, as FTR anticipates upward pricing pressure.

“We’re trying to understand tariffs as they impact the broader economy,” said Eric Starks, “but there’s another aspect of this, and it’s that the tariffs, in and of themselves, aren’t necessarily destructive. It’s the uncertainty that’s keeping people on the sidelines.”

This uncertainty, more than tariffs themselves, appears to be the primary driver of economic weakness. “The biggest component continues to be the fact that nobody has certainty in how they’re doing their planning and what they’re preparing for,” Jonathan Starks said.

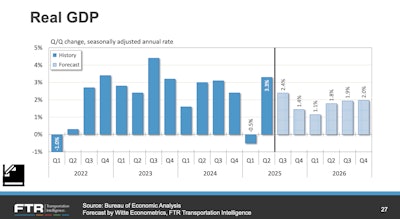

The economy is experiencing significant pressure across multiple sectors, with Jonathan Starks pointing out, “more elevated risks (for a recession).”

Investment in capital goods is declining, and the industrial base is weakening. Energy investment, particularly on crude oil and natural gas, has seen no significant acceleration, despite upward growth in output. While consumers remain relatively resilient, they’re facing increasing pressure from slower wage growth and reduced disposable income. The labor growth has softened, with negative job growth outside of COVID-19 periods.

From 3.3% in Q2, FTR’s outlook on real GDP is at 2.4% in Q3, followed by 1.4% in Q4, and slower growth in 2026 ranging from 1.1%-2.0%. “It’s a bit of a weakening, then a recovery back towards a more normal environment,” said Jonathan Starks.

In FTR’s GDP Goods Transport Sector, which adds imported goods movement and removes services that don’t lead to freight, Q1 started at 18.6%, followed by a decline of 14.2% in Q2, with an anticipated decline of 3.7% in Q3. Jonathan Starks attributed this to tariff swings and an import environment that is hard to predict.

FTR anticipates further declines of 3.7% in Q3 and 1.8% in Q4 before heading to improved estimates in 2026, starting with 0.9% in Q1.

What does mean for freight conditions and outlook?

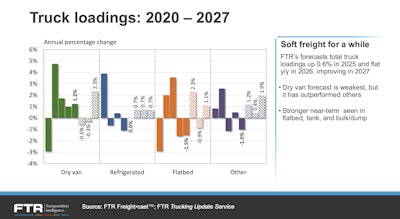

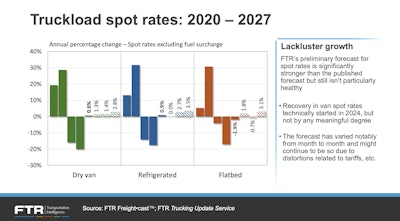

The freight market remains relatively flat, with spot rates running around 2019 levels after three years of normalization, said FTR VP of trucking Avery Vise.

Flatbed and refrigerated volumes are stable, while dry van volumes are slightly weaker year over year. A few instances, such as the CVSA International Roadcheck, the Fourth of July, and Labor Day, offered a few blips, but Vise noted that there haven’t been signals of systemic recovery in the market.

FTR anticipates total truck loadings looks to inch about 0.6% in 2025. In 2026, dry van segment is estimated to decline 0.3%, with refrigerated is projected to be 0.7%, flatbed at –0.9% and bulk/dump at 0.4%.

Truck utilization levels have been flat but stable since early 2024. While it sounds positive, Vise said it’s an indication that while the market is not collapsing, it’s not improving either. FTR expects slight softness in the near term, with a real rebound not happening until around 2027.

For carriers, Vise said this means that it’s more about squeezing productivity from existing trucks, as well as delay replacing fleets because of financial constraints until demand improves.

As for rates, Vise explained that by the end of 2024, freight rates had stopped falling and leveled off, which feels like a small recovery, but not a true growth.

FTR projects rates to inch upward only slightly, with truckload spot rates for dry van projected at 1.4% in 2026, refrigerated at 2.7%, and flatbed at -0.7%.

Similarly, truckload contract rates are expected to rise somewhat year over year, with dry van contract rates forecasted at 1.2% in 2026, refrigerated at 1.4%, and flatbed at 0.9%.

Vise explained that while rates are expected to rise slightly, it’s not enough to keep pace with inflation. What could push rates higher would be an outside shock, like a major disruption or a natural disaster.

[RELATED: Q3 2025 truckload forecast points to muted demand and potential for peak season rate pressure]

Looking into capacity, employment data from the Bureau of Labor Statistics shows weak growth overall, with some gains in local and specialized trucking, likely due to specific market conditions.

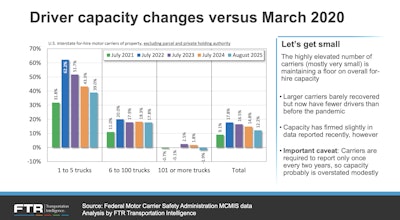

In the carrier population structure, while large carriers have reduced capacity more significantly (down 1.9% from pre-pandemic levels), small carriers are still 39% higher than in the same period. Despite challenges, small carriers aren’t exiting the market at the expected rate given ongoing economic challenges. Vise said this could be attributed to better utilization through technology, spousal income support, improved debt management, and reduced fixed costs compared to larger operations.

Private fleets have grown substantially, outpacing for-hire companies in hiring Class 7 and Class 8 drivers. Vise noted this represents a shift in freight capacity allocation, limiting the amount of freight available in the broader market.

Regulatory and operational pressures

Rising insurance rates (up 6.5% year-over-year) is another challenge, especially for smaller operations, though impacts may not be fully felt until next year.

Additionally, new driver qualification requirements and English proficiency standards are creating compliance burdens, with more than 12,000 violations recorded through late August. Compliance also presents costs pressures for carriers to meet requirements.