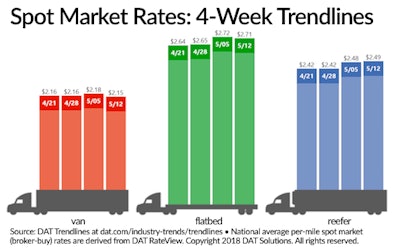

In 2018, the DAT network has consistently showed an imbalance of loads to trucks. This snapshot shows trends for the week of May 6-12

In 2018, the DAT network has consistently showed an imbalance of loads to trucks. This snapshot shows trends for the week of May 6-12Throughout 2018, the ratio of loads to trucks in the DAT network of load boards has set new records. For the week ending May 12, the ratio was highest in the flatbed market with 102 loads posted for every truck, on average. Reefer was 8.5 and van was 6.4 loads per truck.

Carriers have a full pipeline of loads coming from the spot market and contract customers. In this environment, one way to maximize the yield on loads is by using software to effectively match capacity with orders.

Load planning is a core feature in many commercial fleet management systems. Modern design tools and databases are able to assimilate more information into a single screen to improve the planning and decision process to generate higher profits.

Custom configuration

About 3.5 years ago, Decker Truck Line began using the LoadMaster system from McLeod Software. Load planning at the Fort Dodge, Iowa-based company is handled by customer service reps (CSRs). The carrier has CSRs organized into flatbed, reefer and dry van divisions as well as geographical coverage areas.

Decker Truck Line has configured LoadMaster to present each CSR live information for their respective equipment types and coverage areas. A reefer CSR in the Chicago area, for example, only sees the inbound and outbound reefer loads and trucks for that region, says Jennifer Brim, director of training and development.

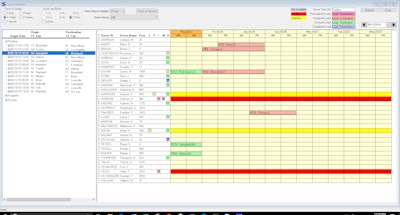

CSRs at Decker Truck Line use individually configured McLeod LoadMaster planning screens for reefer, flatbed and van shipments.

CSRs at Decker Truck Line use individually configured McLeod LoadMaster planning screens for reefer, flatbed and van shipments.The main planning screen in LoadMaster has a grid layout. On one half of the screen are orders in rows with details listed out in a string of columns. The other half shows available trucks with equipment and driver details.

The columns for orders and trucks can be repositioned or hidden, as needed, to prioritize information in the planning process. A CSR may want to first look at “deadhead miles” and “driver availability for pickup” when matching trucks with orders, for example.

“Every person is much more efficient at their jobs because of the amount of information that is there and the way a person can customize their screen,” she says.

CSRs at Decker Truck Line also factor driver schedules into the planning process. The screen has columns that show remaining hours in drivers’ duty cycle and the remaining days before they are scheduled to return home, Brim explains.

Visual dispatch

In addition to grid-style planning tools, fleets are using interactive mapping tools to quickly make sense of complex information.

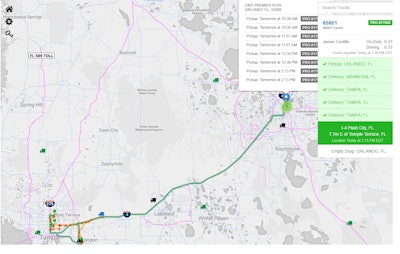

From the main planning screen of LoadMaster, users can access an interactive map that displays all essential order and truck information using color-coded push pins and hover boxes. At a glance, CSRs can see if loads are running late and view the balance of loads to trucks in their planning region, says Barry Brookins, director of service delivery, enterprise consulting services, for McLeod Software.

The Internet-based dispatch system from BOLT has a visual planning screen that brings information together from multiple sources.

The Internet-based dispatch system from BOLT has a visual planning screen that brings information together from multiple sources.BOLT, an Internet-based fleet management and dispatch software system, has a planning screen that utilizes a map display. Color-coded pins show the locations of trucks, pickups and delivery points on planned routes.

On the same map, users can view unassigned orders and capacity they have available and drivers’ hours of service. Having this information in one screen helps users identify where they can add more pallets and stops to routes to maximize revenue, says Jerry Robertson, chief technology officer of BOLT.

For each truck on the screen, “you want to present as many possibilities or opportunities as you can,” he explains. “We have taken an incredible amount of data and put it together in a way that you can look at that and make a decision.”

Planning driver hours

Drivers’ hours-of-service data has become integral to load planning, especially in the wake of the ELD mandate.

As a private fleet, Pipco Transportation hauls refrigerated loads for parent company F&S Produce in Rosenhayn, N.J., and uses the Prophesy Dispatch system from HighJump.

The Load Planner screen shows users available loads and drivers with all of the supporting details. The screen has user-definable alerts that appear to notify of exceptions such as load assignments that do not meet a fleet’s minimum revenue per mile or exceed the limit for deadhead mileage, among other possibilities.

HighJump brings in locations and hours data (the past 8 days and current day) into its Load Planner screen.

HighJump brings in locations and hours data (the past 8 days and current day) into its Load Planner screen.Prophesy Dispatch brings in locations and hours data (the past 8 days and current day) into the screen. The software calculates if drivers have enough hours available for any given load assignment, says Kevin Pasternack, vice president of sales for transportation for HighJump.

Each time a user selects a load, the driver list is updated to show those who should or should not be doing the load based on hours, deadhead miles to the pickup point and other factors. Once a load is assigned in the system, the ETAs of deliveries automatically update, he explains.

Pipco Transportation recently began to incorporate live hours of service into its load planning process by using an integration with its telematics and ELD system from Verizon Connect.

With the integrated ELD information, Pete Giovetsis, director of operations for Pipco Transportation, says the 40-truck fleet is able to plan loads a week in advance and make changes each day, as needed, to maximize use of trailer capacity and available driver hours. The Prophesy Dispatch software keeps track of the number of pallets in each trailer.

Prophesy Dispatch is designed for small to mid-size truckload carriers with over-the-road and multi-stop operations. HighJump offers a cross dock module as well.

Planning ahead

Besides using ELD data within their own software systems, some carriers—particularly smaller operators—are now sharing ELD data with third parties to dynamically match spot market freight.

Ken Evans, CEO of Konexial, says its My20 app updates a dynamic GoLoad freight matching platform to send relevant opportunities directly to a driver’s smartphone.

Ken Evans, CEO of Konexial, says its My20 app updates a dynamic GoLoad freight matching platform to send relevant opportunities directly to a driver’s smartphone.The GoLoad freight matching platform from Konexial uses location, hours and economic factors — the rate the carrier/driver is looking for — to present relevant load opportunities directly to carriers.

Load opportunities are presented to owner-operators through a mobile app and to fleets through a web-based communication and dispatch system called My20 Tower. Within My20 Tower, carriers can select the trucks they want to make available for load offers and set their asking price — the rate per mile — to move freight.

GoLoad provides real time feedback to carriers on their rates based on asset location and hours available. Shippers can name their asking price for loads and get immediate feedback.

Konexial is not a freight broker. The loads in its platform come directly from shipper and freight broker customers who accept terms upfront for freight payment, fuel surcharge and transaction fees.

By using the technology, shippers gain access to hidden capacity in the industry by using live data from carriers, says Ken Evans, chief executive of Konexial.

Carriers have to be pre-qualified to participate in GoLoad and the system tracks their performance over time using a feedback system.

GoLoad gets the location of assets and hours-of-service data from ELDs. Konexial offers the My20 ELD that integrates with GoLoad and the platform can also get live data from third-party ELD applications, Evans says.

Planning final mile

Final mile is one of the fastest-growing sectors in transportation. UPS and FedEx have the majority of volume in the B2C market, and a number of transportation companies have entered their wake to handle larger-than-parcel shipments.

Some companies with final-mile services have come over from the truckload sector. Schneider, J.B. Hunt, Werner and Penske are among those that now offer end-to-end supply chain solutions.

Kevin Haugh, Omnitracs chief product and strategy officer, discussing the applications in the new Omnitracs One platform.

Kevin Haugh, Omnitracs chief product and strategy officer, discussing the applications in the new Omnitracs One platform.Many less-than-truckload carriers have also moved into the final mile sector by changing their equipment, technology and operations to handle more volume of smaller shipment sizes and make residential deliveries.

Omnitracs has focused its recent development on converging technologies in the first, middle and final mile of transportation and distribution. The company has developed applications for carriers with all types of operations, and recently developed a unified stack of technology applications called Omnitracs One.

The new, integrated stack of software-as-a-service applications bring together features and functionalities from the Omnitracs portfolio of routing, dispatch, compliance, navigation, safety and more products in a single-source user experience.

The single-source user experience covers everything from fleet operations management to mobile driver interfaces, data analytics, data discovery and reporting, says Kevin Haugh, chief product and strategy officer.

For the data analytics and discovery component, Omnitracs created new user experiences that give a comprehensive view of fleet operations with key indicators for vehicle and driver status. Drill-down features give the ability to find and take action on real-time information, he said, and to predict problems ahead of time.

Choosing metrics

For-hire trucking companies that enter the final-mile sector will have to adapt to a more service-focused process for planning loads, explains Brian Larwig, vice president of final mile solutions for TMW Systems. While profitability is the ultimate goal, companies will be focused more on key performance metrics for meeting consumer expectations and representing their customer’s brand.

TMW’s Brian Larwig says fleets that provide final-mile deliveries use metrics that focus heavily on meeting consumer expectations and representing their customer’s brand.

TMW’s Brian Larwig says fleets that provide final-mile deliveries use metrics that focus heavily on meeting consumer expectations and representing their customer’s brand.The expectations for the final mile of transportation have changed significantly in the last few years, Larwig says. Consumers expect to have visibility of their order status and the ability to change their order — such as the delivery location — along the way using the shipper’s website.

These expectations are “moving to bigger and bigger loads, from ordering a coffee mug to a truckload full of washers and dryers,” he says.

Routing software makes it possible to efficiently book orders and plan deliveries, but Larwig says companies will be more concerned with meeting consumer expectations for on-time performance, order accuracy, damage-free deliveries, invoice accuracy and safety.

“Profit is not your biggest slice of the pie chart,” he says. “The way it arrives at the receiver is a representation of the shipper’s brand to them.”

As a Trimble Company, Larwig says TMW has strategically invested in products to create an “end-to-end solution” for transportation companies with first, middle and final mile operations. Besides load planning and routing applications, the company has business intelligence tools that bring all of a company’s data together in one source for monitoring performance and assisting with decision making.

Beyond planning routes, Larwig says final-mile software applications can calculate real-time ETAs and present the customer with a proof-of-delivery and invoice at the time of delivery.

In 2016, A. Duie Pyle, the largest Northeast regional LTL carrier, launched a new Express Solutions fleet that operates within its existing Pyle Priority Service (PPS) for customers that want same-day and time-definite next-day service.

Express Solutions is focused on smaller shipment sizes for e-commerce deliveries. For load planning, the West Chester, Penn.-based company is using a software system from TMW.

“We were looking for a sequencer, not optimizer, that would work with our in-house technology to enhance the routing process,” said Randy Swart, chief operating officer. “Our objective is to efficiently route our shipments and provide customers with reliable ETAs.”

Whether you operate in the first, middle or final mile of transportation — or a combination thereof — technology can bring live information together from various sources to a single planning screen to get most out of available capacity.