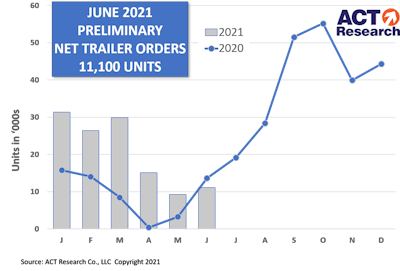

Preliminary trailer orders last month hit just 11,000 units, 16% above a weak May but down 24% year-over-year.

Trailer orders for the past 12 months total 364,000 units.

While the sequential increase in net orders was welcome, Frank Maly, Director CV Transportation Analysis and Research at ACT Research, said a full response to actual fleet demand would have generated higher order volumes.

"Some OEMs, due to their extended backlogs, continue to be unwilling to book meaningful order volumes at this time,” Maly said. “June’s negative year-over-year comparison for net orders was the first since May 2020, the tail-end of last spring’s COVID-depressed order activity. These preliminary results point to a backlog that still extends into late Q1 of next year on average, with dry van and reefer backlogs extending into Q2 of 2022 at current production rates. While total production did improve last month, the gains came from additional days in the production schedule. Preliminary analysis indicates OEMs were not able to achieve any significant increase in build rates during the month, as headwinds from material and component supplies, as well as staffing challenges, continue.”

FTR Vice President of Commercial Vehicles Don Ake noted that order activity was constrained as most OEMs are not taking additional orders for 2021 delivery. However, vocational trailer orders were steady, as there are still open build slots in those segments. The industrial sectors of the economy recovered slower than the consumer side, he said, delaying the demand for flatbeds and tank trailers.

“The market is in a holding pattern until ordering for 2022 shipments begins. Demand for trailers remains robust, as fleets attempt to move an increasing amount of freight during a shortage of Class 8 trucks," Ake said. "Fleet capacity is extremely tight."

Trailer production is also constrained by supply chain disruptions and labor shortages and orders are expected to set records once the order boards for 2022 are opened, Ake said.

"Trailer demand is expected to be sturdy throughout next year. However, the actual demand for trailers will not be ascertainable until the supply chain problems dissipate," he added. "The production situation for early 2022 could be complicated if OEMs cannot build all the orders currently on the books in 2021.”