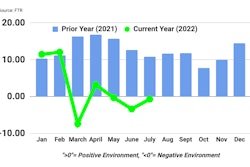

Class 8 net orders in September reached 56,500 units, according to preliminary data from FTR, not only bucking a trend of seasonal weakness that generally runs from May through September but also setting a record for highest-ever order intake in a single month.

"The strength in orders reflects OEMs having fully opened their order boards for 2023 a bit earlier than normal," said Eric Crawford, ACT Research Vice President and Senior Analyst. "September Class 8 orders were sensational no matter how you slice the data."

September order activity was up 169% month-over-month and up 102% year-over-year, according to FTR. Class 8 orders now total 254,000 units for the last 12 months.

With order boards officially open for 2023 build spots, monthly order levels through the rest of the fourth quarter will likely be dependent on how far into 2023 manufacturers are comfortable accepting orders amidst an unforgiving supply chain environment that is now expected to persist well into 2023, noted FTR Commercial Vehicle Analyst Charles Roth, who added that OEMs continue to battle supply chain bottlenecks and labor shortages.

To date, truck manufacturers have taken a managed approach to order intake, accepting future orders in quantities that closely mirror their monthly build rates. "This is in large part an effort to improve on time delivery performance while also reducing the impact a potential component shortage may have on production plans," Crawford said. "Many dealers have indicated that as a result of component availability they have had orders pushed out into the future or delayed as a result of red tag units having to be finished off-line."

Fleet confidence remains solid entering 2023, as many large national fleets are getting their truck orders in as early as possible for next year's deliveries simply based on replacement demand, Crawford said.

"Due to the limited availability of new equipment fleets have not been able to phase out aged equipment over the past two years," Crawford added. "As a result, we anticipate replacement demand to stay elevated throughout 2023.”

Peter Voorhoeve, President of Volvo Trucks North America, said the outlook for 2023 with regard to truck sales is strong, even amid broader concerns with the U.S. economy, because the average age of a Class 8 truck has crept closer to 4.5 years after having been under four years from late 2015 to late-2018.

"We don’t see a big slow down," he said. "2023 will be at least at the level of 2022, and I think it will be stronger."