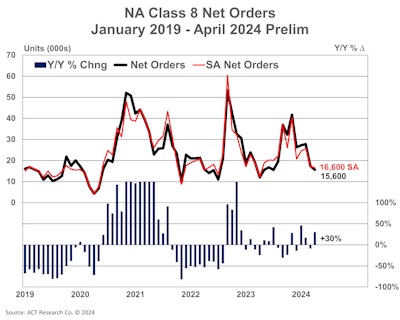

Class 8 truck orders for April came in as anticipated, dodging a major reduction, yet continuing to be impacted by excess capacity.

ACT indicated that preliminary North American Class 8 net orders were 15,600 units, down 1,800 units from March. However, in comparison to a year ago, it was 30% higher.

ACT Research

ACT Research

“Even in good years, Q2 typically delivers below-trend orders, while Q4 orders can trigger optimism at the bottom of the cycle,” said Ken Vieth, ACT president and senior analyst.

[Related: Order activity for trailers drop in March, says analysts]

Vieth also pointed out the sustained period of low freight volumes and rates, as indicated by recent data from DAT, amid lingering overcapacity in the market. As such, carrier profitability by publicly traded for-hire carriers’ performance in the first quarter of the year has been poor.

“Entering the historically worst time of the year for orders, at the bottom of on-highway tractor buyers’ profitability cycle, is producing results in-line with expectations,” said Vieth.

FTR Transportation Intelligence’s data showed similar. Preliminary net orders for April came in at 14,000 units, down 28% from March but up 12.5% year-over-year. Class orders for the past 12 months total 267,700 units.

It’s quite expected, FTR indicated, as similar to February and March order activity, April orders were aligned with recent demand trend and seasonal expectations.

The market’s performance in the first quarter eased concerns of a sudden and significant drop in demand, with orders slightly above replacement-level. While orders had been maintaining an average level of around 25,000 units over the previous three months, they’ve since dwindled to around 20,000 units, following a typical seasonal trend, FTR said.

OEMs are still filling build slots at a “healthy rate,” FTR said. Despite a majority of OEMs experiencing a decline in orders, a few saw small increases.

“Despite the month-over-month decline, the fact that orders were up significantly from the April 2023 level indicates that the market is still solid,” said Dan Moyer, senior analyst of commercial vehicles at FTR.

Though there has been ongoing stagnation in the freight markets, Moyer said fleets are still eager to invest in new equipment.

“Order levels were below the historical average but remain in line with seasonal trends, and we still expect a replacement level of output by the end of 2024,” said Moyer.

Used trends also down

ACT Research

ACT Research

Meanwhile, used Class 8 average retail sale price dipped 2.9% month-over-month to $6,100 in March.

Compared to the previous year, used retail prices were 20% lower, said Steve Tam, vice president at ACT Research.

“In our most recent update, pricing pressure abated moderately from Q4 2023 to Q1 2024,” said Tam, suggesting that the need to lower prices decreased somewhat during this period.

Tam said that prices are forecasted to remain relatively steady for the majority of 2024, with the potential of year-over-year growth to continue late third quarter or early fourth quarter. Month-to-month growth will most likely take place at the end of the year.

In March, used Class 8 retail truck sales declined sequentially, contrary to historical seasonal trends, said Tam. “However, the total market same dealer sales volume rose 17% from February to March. Compared to March 2023, the retail market advanced 3.9%,” he explained.

While there are fluctuations in sales volumes and pricing pressures, Tam noted that the outlook for 2024 anticipates for 2024 call for “moderate growth” relative to 2023.