Having wrapped up the year, FTR VP of Trucking Avery Vise, during FTR’s 2025 Transportation Outlook webinar, said that the growth FTR projected for 2024 was slightly lower than 2023, but remains fairly close to growth experienced before the pandemic.

Find out what 2025 looks like for the trucking industry

Join us for this webinar Join us on February 13, 2025, at 2 p.m. Eastern, as two leading trucking economic experts discuss all the trucking industry influences in play (micro, macro and political), and give an outlook of what is likely in store in the quarters ahead in 2025. This webinar is brought to you by Valvoline.

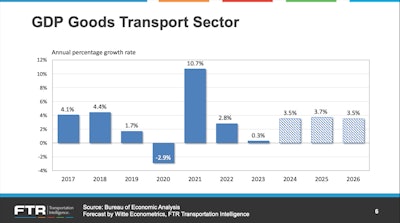

FTR’s GDP Goods Transport Sector chart, which filters gross domestic product data to reflect freight growth, showed that 2023 had barely any growth, but Vise said that 2024 had solid growth (3.5%), as does FTR’s projections for 2025 (3.7%) and 2026 (3.5%).

Inflation has slowed significantly from previous highs, though it remains persistent and hasn’t dropped as much as expected. Though it increased on a year-over-year basis in the last couple of months, it is still higher than the Federal Reserve’s target of 2%, which is considered a healthy level for economic stability.

Consumer spending remains strong, driven by durable goods. A pattern worth pointing out, Vise said, is that consumer electronics remains the biggest driver of growth and doesn’t impact freight footprint.

“It’s one of the reasons why continued strength in consumer spending has not bolstered truck freight volumes as much as we have assumed,” Vise said.

Industrial production ended 2024 largely unchanged from the previous year, with manufacturing remaining sluggish. Though there’s some expected small growth, Joseph Towers, FTR's senior analyst of rail, said the firm anticipates it will not contribute to a substantial increase in freight demand.

[Related: Is a meaningful freight recovery inbound this year?]

Freight demand and capacity

Looking at FTR’s total truck loadings outlook, data shows it has been flat for the last couple of years. That will seep into 2025, though FTR projects slight improvement in Q2.

“Based on the path we’re seeing, we’re expecting to see overall truck freight volume up, around a percentage point year-over-year," Vise said.

This varies by equipment type, with FTR projecting strong growth in refrigerated (2.9% year-over-year) and flatbed (2.4% year-over-year) markets, and dry-van (1.3% year-over-year) having average growth.

As for the carrier population, the number of new operating authorities has been declining since the record-high levels following the pandemic, Vise said. However, data also indicated that the new entrants are running above pre-pandemic average.

Though the fundamentals aren’t ideal, there’s still new entrants in the trucking market.

“I think there’s just a psychological expectation from a lot of people that there’s got to be a turnaround in freight sometime, so why not get in now so you’re already in the market?” Vise said.

A factor that Vise noted is that used truck prices are “pretty low,” offering a low barrier to enter the market.

“If you want to take advantage of an improving market, it actually makes sense to get in now, even though the fundamentals don’t necessarily look all that strong,” he added.

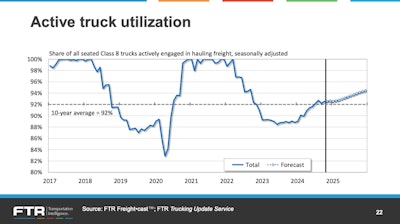

Vise pointed to FTR’s findings for the Class 8 truck population and truck utilization for more context on capacity in the market. FTR estimated that there hasn’t been much of a change in the Class 8 truck population since the beginning of 2023 and has stayed fairly flat during 2024.

“So we really expect the change in the market to come from changes in the freight environment, not really changes from capacity,” Vise said.

Active truck utilization

Data in truck utilization offers good and bad news. On the positive side for carriers, Vise said, is that utilization has clearly improved over the last year. The downside is that, based on FTR’s calculations, improvement has stalled.

“We do expect utilization to start improving from a carrier perspective around the beginning of the second quarter and see a steady gain there. It will lead to a stronger rate environment, but not a big run up, certainly not as what we saw in the end of 2020 or during 2021,” Vise said.

FTR projects a steady improvement on the truckload spot market – a 5.5% to 6% increase throughout 2025. “Nothing to get overly excited about,” Vise said, “but certainly a welcome from the carriers' perspective.”

As for the contract side, Vise said it appears that truckload contract rates have bottomed out, adding FTR anticipates contract rates to increase with at least a 5% year-over-year increase by the end of the year.

Tariff implications

President-elect Trump’s proposed tariffs on imported goods pose an uncertain element to the market.

Not surprisingly, a broad-based tariff regime is going to affect imports, Vise said, followed by exports, as other countries implement retaliatory tariffs.

With companies gearing up for tariffs from the end of last year, there’s anticipation of imports too, with Vise noting they expect to feel the impact around the beginning of Q2.

Towers added that FTR anticipates a bit of an impact of inflation as “these costs have to go somewhere. They either must be eaten up in margin or they have to be passed along to consumers, and we assumed a little bit of that.”