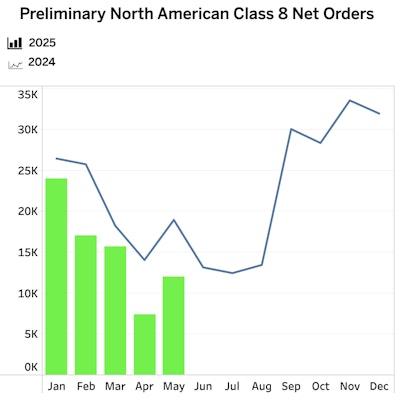

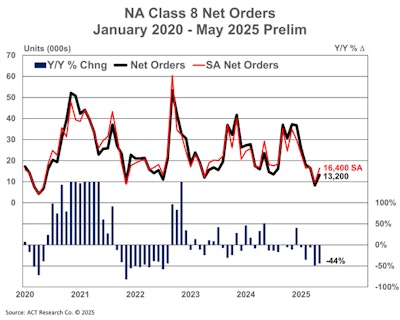

North American Class 8 net orders saw a 40% increase in May compared to April’s low figures, reaching 12,000 units, according to FTR Transportation Intelligence. However, orders were still down 47% from May 2024 and significantly below the seven-year May average of 18,319 orders.

Last month marked the lowest May order total since 2020. Over the past 12 months through May, total orders were 260,355 units.

FTR noted that the month-over-month improvement may be a result of temporary easing of tariffs, especially the reduction of tariffs on Chinese goods from 145% to 30%, pulling back some of the sharp hikes announced in early April. Despite the monthly gain, the year-over-year decline was sharp. Class 8 net orders in 2025 were down 32% year-over-year and retail truck sales in 2025 are down 11% through April.

Tariff volatility and uncertainty over the economy and the truck freight market are continuing to pressure the North American Class 8 truck and tractor market, explained Dan Moyer, senior analyst of commercial vehicles at FTR.

“Legal challenges surrounding emergency tariffs (reciprocal tariffs and those related to fentanyl) and the potential introduction of Section 232 tariffs on Classes 4-8 trucks and their components adds further uncertainty to the market environment,” Moyer said.

This, alongside anticipated changes to the EPA’s 2027 NOx emissions standards, has prompted many fleets to delay capital expenditures, Moyer added.

ACT Research reported similar sentiments, with an estimate of 13,200 units orders in May, a month-over-month improvement, though it’s still down 44% year-over-year.

“Given the uncertainty around 'Liberation Day' in April’s data that sent order activity across the board to 59-month lows, it’s little surprise preliminary order activity for May showed month-over-month improvement, with total classes 5-8 net orders expected at 26,400 units when released mid-month,” said Carter Vieth, research analyst at ACT Research.

Vieth pointed out that continued trade uncertainty will slow order activity, adding that the market has entered the weakest seasonal period for orders.

“Improvement, if any, likely won’t reveal itself until the opening of 2026 order boards in Q3 of this year,” Vieth said.

In the medium-duty segment, Vieth noted that preliminary Class 5-7 orders in May fell 32% year-over-year to 13,200 units, the second-lowest monthly total since the pandemic, only surpassed by April’s weak figures.

Final Class 8 net orders in April from ACT Research also confirmed the weak trends in its preliminary figures, totaling just 8,200 units, a sharp 48% year-over-year decline. Vieth noted that order volumes in April “dropped to levels not seen since the onset of the pandemic, when similar uncertainty reigned.”

In addition to economic factors, the first quarter of the year saw publicly traded trucking and logistics carriers’ net income margins fall to the lowest levels since Q1 2010, which Vieth said is an ominous signal for the market.