As the industry navigates macro volatility from trade policies and shifting federal regulations, FTR Transportation Intelligence noted that elevated insurance costs and stagnant freight rates may lead to tighter capacity in the near term.

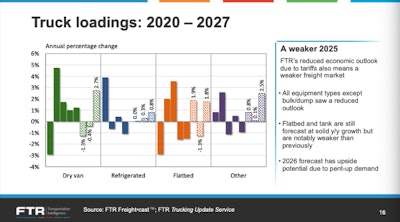

FTR projects no signs of a rebound in dry van spot rates in 2025 (1.4%), while refrigerated rates remain sluggish (-0.8%) and flatbed rates offer a slight bright spot (2.7%), according to Avery Vise, vice president of trucking at FTR.

Truck loadings are also underwhelming, Vise added, with all equipment types except bulk/dump seeing a reduced outlook. Contract rates are expected to stay soft for the foreseeable future.

“We really do not see, at least until 2027, a year-over-year change that exceeds the presumed level of inflation,” Vise said.

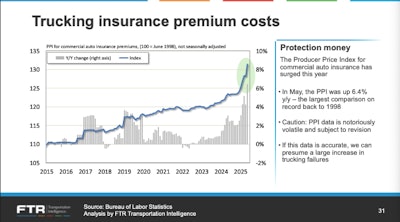

A concerning factor, Vise said, is the rise of insurance costs. Without a meaningful boost in freight, soaring costs could result in a loss of carriers, especially smaller fleets.

According to the Producer Price Index, commercial auto insurance premiums have surged this year. The PPI was up 6.4% in May on a year-over-year – the largest year-over-year comparison in the data that goes back to 1998. While it’s subject to revisions, it’s still a solid increase.

“If this data is accurate, it would seem logical that we are going to start losing a lot of small carriers unless we see some really big increase in spot rates or a big increase in trade activity,” Vise said.

Truck orders are another factor that could impact capacity, Vise said. April orders were down 47% year-over-year, hitting their lowest level since 2020.

The results aren’t surprising, Vise said, as there’s still a lot of uncertainty on state of the freight market and the impact of tariffs.

“We also don’t know exactly what the EPA regulations are going to be, or at least how they’re going to be enforced,” Vise said. “But we do presume that there won’t be the same pre-buy pressure that we were expecting under the Biden administration.”

This isn’t something that will impact capacity immediately, Vise pointed out. On average, FTR don’t expect significant effects over the next five months, though it could change in 2026 or 2027. If the market begins to recover and fleets haven’t invested in enough new equipment, there could be a tighter capacity environment.

Adding to that is the ongoing federal investigation by the Department of Commerce on the national security implications of imports of medium- and heavy-duty trucks and key parts and components. FTR noted that approximately 40% of Class 8 trucks bought in the U.S. are built in Mexico.

Vise pomited to a comment on the Federal Register that truck prices might be artificially suppressed due to unfair foreign competition. “I would ask all the carriers, do you know if you are paying too little for your trucks?” Vise stated.

The comment period ended on May 16, with more 3,300 comments filed, of which 102 have been made public so far.

The American Trucking Associations opposed the imposition of the tariffs on medium- and heavy-duty trucks, on top of the existing 12% federal excise tax, pointing out that the average price of a new Class 8 truck could rise from $170,000 to $224,000.

Some production will likely shift to the U.S. in response to tariffs, but that shift won’t come quickly or without additional costs, Vise said.

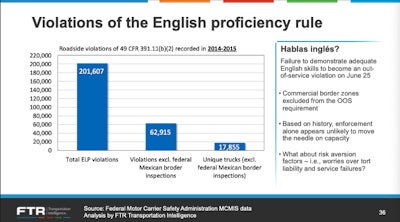

The enforcement of English proficiency requirements is another policy with potential capacity impact. Drivers lacking English skills may be placed out-of-service, excluding commercial border zones. This could have broader consequences, Vise said.

[RELATED: FMCSA will use 2-step evaluation for enforcement of English-speaking CDL requirement]

FTR’s data indicated that 17,855 unique trucks were affected by the English proficiency rule from 2014-2015, which Vise said is not a number large enough to shift the market today. Still, if enforcement becomes widespread, it could push some drivers out of the industry or create reliability and legal liability issues.

“We’re kind skeptical that this is a market mover, but it’s certainly possible,” Vise said.

Looking at diesel prices, FTR expects relative stability moving forward, with recent data favoring lower prices. Until the latest week, when prices ticked up slightly, diesel has been at its lowest level since September 2021.

The relatively stable diesel outlook suggests that high fuel costs, one of the potential pressures on smaller carriers, is not likely to materialize in the near term.

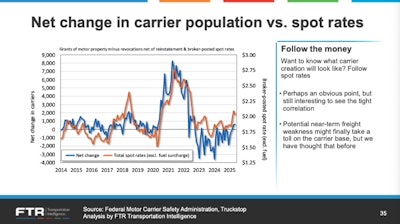

The net change in the carrier population plotted against the total spot rate excluding fuel surcharge shows a tight correlation, Vise said. Any large swing, particularly in spot rates, will directly impact the number of carriers in the market.