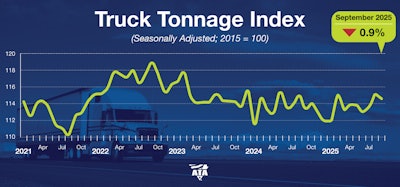

Truck freight tonnage in the U.S. fell 0.9% in September, marking the lowest level in three months. This reversed gains of 0.9% in August and 1.1% in July, according to the American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index.

The September reading brought the ATA’s advanced seasonally adjusted For-Hire Truck Tonnage Index to 114.2, down from 115.3 in August. Based on 2015 as 100, the index still showed a 0.8% increase from the same month last year, following a 0.4% year-over-year gain in August.

ATA Chief Economist Bob Costello noted the volatility in the market: “Tonnage levels remain choppy, but they are up 2.1% since hitting a low in January. Compared to the high three years earlier, however, truck tonnage is still off by 3.9%. In fact, September’s tonnage level was essentially the same as in September 2023, underscoring the tough freight market over the last few years.”

Despite the September decline, there are signs of potential improvement in market conditions. FTR’s Trucking Conditions Index (TCI) showed improvement, rising to an essentially neutral 0.3 in August from -1.03 in July.

The TCI tracks five key elements of the U.S. trucking market: freight volumes, freight rates, fleet capacity, fuel prices, and financing costs. Positive readings signal favorable conditions, negative readings reflect challenging conditions, and values near zero indicate a neutral environment.

“The gain was due primarily to less challenging freight rates. Although utilization was the most positive factor, it was not very strong,” FTR said.

FTR projects improved market conditions ahead in 2026 and 2027, despite near-term readings expected to remain in a similar range as August.

Capacity constraints are emerging as potential catalyst for market recovery. Avery Vise, FTR’s vice president of trucking, noted, “The potential for a capacity-driven recovery in trucking has risen over the past month due to severe restrictions imposed on issuing and renewing commercial driver’s licenses for foreign drivers. However, despite some anecdotal reports about various effects of a crackdown on immigrant drivers, available data has yet to show a substantial impact on market conditions.”

Vise noted in a previously that the impact of FMCSA’s non-domiciled CDL rule, which projects the exit of 194,000 CDL holders over the next two years, could result to utilization levels similar to conditions in 2021. This, Vise said, “would be very good for carriers, not very good for shippers.”

U.S. Immigration and Customs Enforcement activity, which can’t be “precisely quantified,” could also intensify this impact, he added.

“We expect pressure on foreign drivers to be a significant factor for capacity in the coming months, but many questions remain about the scope and speed of the tighter CDL and English language enforcement on the truck freight market,” Vise said.

Tim Denoyer, ACT Research’s vice president and senior analyst, noted that market conditions are shifting. The ACT Driver Availability Index indicates that the driver market is “no longer loose, but not yet tight.”

The index, derived from surveys of medium and large fleets, has needed to drop below 40 in the last two cycles before triggering rate increases.

“The new rules on non-domiciled drivers could tighten driver capacity over the next one-to-two years, but heavy truck tariff costs are starting to constraint equipment capacity,” Denoyer said.

The capacity reduction is also evident in production data. Denoyer said, “Class 8 tractor production is on track to decline about 35% from 1H to 2H this year, to a rate several thousand trucks per month below what is needed to maintain the fleet size.”

ACT Research believes that reduced capacity amid steady demand could accelerate the market cycle and create for-hire demand by reversing the "insourcing of recent years."

However, Denoyer pointed out that this transformation will "take time."