The trucking sector’s conditions remain challenging overall, but the outlook is “somewhat more favorable for carriers,” according to FTR Transportation Intelligence.

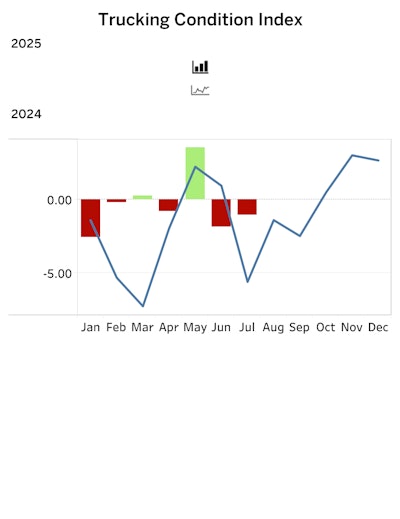

FTR’s Trucking Conditions Index inched up in July, registering -1.03 compared to June’s -1.83. FTR noted that the modest gain came despite softer freight-related fundamentals across the board. What offset the weakness was a notable slowdown in diesel price increases following June’s sharp spike.

The TCI tracks five key elements of the U.S. trucking market: freight volumes, freight rates, fleet capacity, fuel prices and financing costs. Positive readings signal favorable conditions, negative readings reflect challenging conditions, and values near zero indicate a neutral environment.

“We do not see the market any stronger for carriers soon in the areas that matter most to them – freight rates and volume – but a recent preliminary revision of trucking employment estimates suggests tighter capacity than previously indicated,” said Avery Vise, FTR’s Vice President of Trucking.

“Meanwhile, other potential capacity stresses loom, including rising truck insurance costs and pressure on foreign drivers. Although our utilization forecast is still basically flat, the prospects have risen for improved freight volume to strengthen the truck freight market noticeably,” Vise added.

Stricter enforcement of English language proficiency rules under a Trump Administration executive order for foreign drivers poses a risk to freight flows and disruptions if many drivers are sidelined from the road, according to industry experts.

Can freight recover while the trade war drags on?

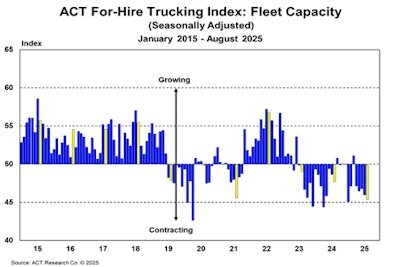

Meanwhile, ACT Research’s latest For-Hire Trucking Index reflected a weaker supply-demand environment in August, as both freight volumes and capacity declined.

The Volume Index fell 6.0 points month over month, down from 52.3 in July. The drop occurred as the pull-forward ahead of August tariff deadlines ended, which had boosted volumes in prior months. With much of that demand already front-loaded since late last year, volumes remain challenged, though the Supreme Court’s November ruling on IEEPA tariffs could provide some relief.

Consumer spending has remained strong, said Carter Vieth, a research analyst at ACT Research. However, consumers have already been shielded from higher costs because tariff impacts have not yet been passed through.

Real income growth has slowed and could decline as inflation rises, Vieth said.

FTR analysts also mentioned similar sentiments at its recent annual conference, noting that though consumers remain resilient, there’s mounting pressure from slower wage growth and reduced disposable income.

“The freight downturn, now in its fourth year, is unlikely to pick up while the trade war worsens,” Vieth said. “However, the private fleet expansion that we see as a key reason behind the long downturn is starting to reverse.”

The Capacity Index also declined slightly, slipping to 45.4 points in August from 46.0 in July. Vieth noted that for-hire truckload carriers remain under significant margin pressure, with profits near their lowest levels since 2010.

“Tariffs have added cost and uncertainty, spurring demand for pre-tariff tractors in Q2, further delaying a for-hire recovery,” Vieth said.

While bonus depreciation renewals may help at the margins, low profitability and regulatory uncertainty around tariffs and emissions remain larger headwinds to investment.

The Supply-Demand Balance weakened to 51.0 (seasonally adjusted) from 56.4 in July, which ACT said reflected reduced freight volumes offset somewhat by continued capacity contraction.

“We’re likely near the payback period following the demand surge ahead of tariffs,” Vieth said.

Additionally, Vieth noted that with goods inflation expected to accelerate as companies begin passing tariff costs to consumers, demand will remain under pressure. Capacity reductions may provide some cushion, he added, but strong freight demand and tight supply are needed for a new freight cycle to take hold.