As peak season approaches, analysts paint a sobering outlook on the disconnect between certain economic indicators and freight demand.

During FTR Transportation Intelligence’s State of Freight webinar on Thursday, CEO Jonathan Starks noted that despite tariff-related disruption throughout the year, retail inventories are “relatively lean.”

Manufacturing has shown little growth, but Starks said it’s been “at a level that’s not really all that far from where we were all the way back in 2019.”

Two key sectors are driving economic growth but little freight activity: computers and electronics, and pharmaceuticals.

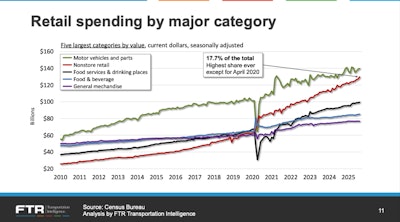

Non-store retail also continues to grow, with a 17.7% market share in April, which, again, doesn’t help freight demand.

“Even though we are seeing strong gains in certain areas of economic data, not all of that is translating into a strong environment for transportation,” Starks noted.

Consumer spending is increasingly concentrated among high-income earners.

“That’s not a broad view of robust spending activity," Starks said. "We’d like to see it much broader in order to have a more solid base to see fundamental transportation demand.”

Amid economic indicators, the impact of tariffs is still growing, Starks said, while new vessel fees will bring another set of cost pressures on carriers.

Starting Oct. 14, any arriving vessel owned or operated by a Chinese entity will face $50 per net ton fees. Any Chinese-built arriving vessel will face higher fees: $18 per net ton or $120 for each container discharged. Any arriving vessel classified as a vehicle carrier or roll-on/roll-off will face a $14 per net ton fee.

[RELATED: Economy risks cloud freight market, FTR reports]

Freight demand

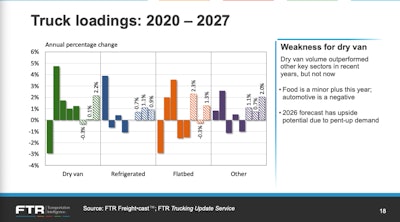

Avery Vise, FTR vice president of trucking, said spot market remains flat, with all three major segments showing little improvement. Flatbed shows stronger year-over-year loads, though Vise attributes it to “a lot of the pull-forward effect due to the aluminum and steel tariffs and just general preparation for tariffs.”

The freight forecast shows minimal growth. Vise noted that “-3% year over year for the current year is an improvement over our prior forecast.” Recovery isn’t expected until the middle of next year, though there’s “no real great, robust environment on the horizon," he said.

Rate forecasts also remain soft for the rest of the year, with dry van at 0.9%, 0.4% in refrigerated, and 2.1% in flatbed. Vise said, based on the current forecast, it’s only in 2027 that FTR sees any “significant improvement,” but even then, spot-rate growth remains “pretty slight.”

Capacity conditions showed that while large carriers have rightsized, small operators remain abundant. Persistent pressures from rising costs (especially insurance) and newer pressures to drive out foreign drivers could impact capacity soon, FTR noted.

CDL rule and immigration enforcement threaten driver supply

Regulatory enforcement could also reshape market dynamics, Vise noted. The most significant is FMCSA’s late September non-domiciled CDL rule, which projects “the exit of 194,000 CDL holders over the next two years” out of an estimated 200,000 currently operating.

Vise pointed out that a high-end impact from this scenario would suggest utilization could return to 2021 levels, which Vise said would be “really about where we were in 2021: very good for carriers, not very good for shippers.”

U.S. Immigration and Customs Enforcement activity amplifies this impact, he said.

FMCSA’s new rule requires specific immigration documentation to show one’s legal status. Vise noted that aggressive ICE activity could create an environment where many of these drivers, who are likely “subject to being deported,” will proactively exit the industry out of fear.

“It’s not so much that they’re as worried about getting stopped and being fined or put out of service,” Vise explained, but rather “the possibility that enforcement action itself might lead to their deportation.”

Pointing to recent enforcement actions like in Oklahoma, Vise noted this climate of heightened ICE activity could accelerate the projected exit of 194,000 drivers over two years, causing them to leave much faster.

The impact can’t be precisely quantified, but Vise believes it’s meaningful and that “without that ICE activity, it might not be as meaningful” in driving capacity out of the market.

English language proficiency enforcement was “not really a market mover,” Vise said, with about 20,000 drivers a year affected. FTR noted that only 28% of violators were placed out of service.

“We’re losing roughly 35,000 a year to the drug and alcohol Clearinghouse,” Vise noted. “And I think we could all agree that has not really fundamentally changed the market.”

Adding pressures is the insurance environment, though Vise noted the full impact may not hit until policy renewals come around in fall and early next year.

What will drive the trucking market recovery?

Vise suggested that supply constraints will be the primary market driver affecting the market.

Looking at the demand side, Vise said FTR finds it difficult to see a stronger surge in production or consumption.

The supply-side factor, he said, is more likely to be the real “market changer.” This includes insurance impact that will drive up costs and carrier exits, combined with immigration and foreign driver enforcement reducing the available driver pool through stricter CDL requirements English proficiency rules, and B1 visa crackdowns.

FTR’s freight forecast is unlikely to get worse than it is now, Vise said, unless there’s a recession or a major unforeseen event.