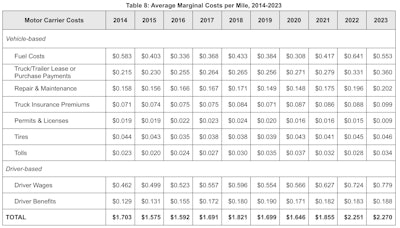

Trucking expenses climbed to a new high in 2023 for the third year in a row, according to research released Tuesday by the American Transportation Research Institute (ATRI), dragged upward by a soft freight market that challenged operational efficiency.

After first cresting the $2 per mile mark in 2022, the overall marginal costs of operating a truck hit a new record $2.270 per mile in 2023. Cost per mile has climbed 62.4 cents since 2020.

Deadhead mileage rose to an average of 16.3% for all non-tank operations, and driver turnover rose by 5% in the truckload sector. Overall, 2023 expenses rose moderately across most categories, ATRI found, with average costs across most line-items increasing at less than half the rates experienced during 2021 and 2022.

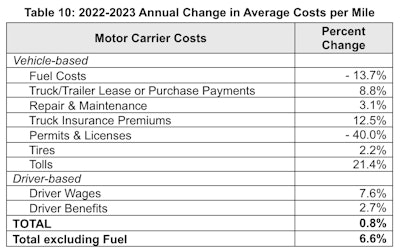

Truck and trailer payments grew by 8.8% to $0.360 per mile, driver wages grew by 7.6% to $0.779 per mile, and repair and maintenance costs grew by 3.1% to $0.202 per mile. Truck insurance premiums grew by 12.5% to $0.099 per mile after two years of negligible change, and that's a trend that is likely to extend itself. In the first two months of 2024, respondents to ATRI's report noted a 6.8% increase in insurance premiums per mile on average compared with 2023, although the report suggests recent tort reforms and a falling number of truck involved crashes could lead to some relief later this year or next.

The average truck age among respondents to ATRI's report dropped from 4.7 years in 2022 to 3.8 years in 2023, a historically low average age following aggressive equipment buying in late 2022 and 2023 on the heels of record-high average ages during the parts shortages of 2020 and 2021.

While the 2023 increase was only 0.8% over the previous year, when surcharge-protected fuel costs are excluded, marginal costs rose 6.6% to $1.716 per mile. Following the decrease in average truck age, the average truck trade cycle decreased in years from 8.2 in 2022 to 7.5 in 2023, ATRI noted.

Rising costs collided with low freight rates, straining profitability across the industry. Average operating margins were 6% or lower in all fleet sizes and sectors other than LTL, ATRI found. The truckload and specialized sectors experienced drops in per-mile or per-truck revenue, and most saw “other costs” – expenses outside of the core marginal line-items – increase as a share of total revenue.

Marginal costs on a per-hour basis were $91.27, up 0.5% from $90.78 in 2022. This per-hour cost increased at a lower rate than the per-mile cost figure because the average truck speed in 2023 fell slightly from 2022, ATRI said.

Fuel in 2023 was among trucking cost centers to see the biggest decrease from 2022, dropping 8.8 cents per mile. In the first two months of 2024, carriers reported a decrease of 3.1% in fuel costs per mile on average compared with 2023 and, according to ATRI, if present conditions hold, average fuel costs for 2024 could drop to $0.50 per mile, or down about a nickel per mile from 2023.