Jason Cannon (00:00):

This week's 10-44 is brought to you by Chevron Delo 600 ADF Ultra Low Ash Diesel engine oil. It's time to kick some ash.

(00:09):

Here's to looking back at 2023, and how you can improve your 2024. You're watching CCJ's 10-44, a weekly webisode that brings you the latest trucking industry news and updates from the editors of CCJ. Don't forget to subscribe and hit the bell for notifications so you'll never miss an installment of 10-44.

(00:28):

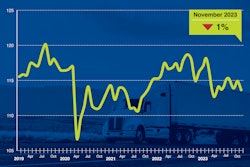

Hey everybody, welcome back, and Merry almost Christmas. I'm Jason Cannon and my co-host on the other side is Matt Cole. There's just more than a week left in the year and what a year it's been. Poor rates, poor volume, carrier exits, but not enough of them to improve rates and volume. This year has been quite the ride, but, hey, diesel fuel's down a little.

Matt Cole (00:48):

2023 wasn't all bad and it wasn't bad at all for every motor carrier. Joining us this week on the 10-44 is Walt Collier, Brand Manager for Delo Engine Oils, who has talked to thousands upon thousands of customers about their business pains this year.

Walt Collier (01:01):

Some people still have scars from driver shortages from the pandemic. So retention is a big thing. The freight demand outlook remains soft, and industry continues to add equipment capacity into the oversupplied market. With the pandemic devastating global supply chains, the industry was able to ramp up capacity in the face of unprecedented demand for commercial vehicles. That collision of irresistible force in a movable object created sticky, pent-up situations for demand that powers strong production through a weak 2023 freight environment.

(01:36):

But the big one is the regulations are affecting heavy-duty industry around emissions and alternative fuels. Not to mention infrastructure that is not available to meet those standards. Lots of fleet owners are still trying to figure out how to meet the cost of fuel being high, lat rates. And with upfront costs, how do they meet these regulatory requirements and survive? When you put this all together, it's safe to say that fleets are being very cautious.

Jason Cannon (02:05):

There was supposed to be a trucking condition improvement in early 2023. That forecast got bumped sometime to in the back half of this year. It never happened, and now it's forecast for sometime in 2024, probably in the second half. So there's not going to be this "new year, new me" condition for trucking companies.

Walt Collier (02:24):

It's been an interesting 2023 for the trucking industry, logistics industry for sure, as you mentioned, between rising and dropping fuel prices, economic volatility, freight recession, driver shortage, inflation battles, and so much more. At Chevron, we do feel like things will get better in 2024. However, fleet operators are still cautious. Going into 2023 from 2022, more than half of global companies highlighted raw material costs as their number one supply chain threat. So as we move ahead, I believe that organizations recognize that availability may fluctuate.

(03:02):

From a vice perspective, I still expect customers to expect supply chain obstacles. There is an increased demand for shipping and delivery, which also means demand for more commercial vehicles. With all of the concerns that have been going on around dropping fuel price, economic volatility, freight recession, driver shortages and inflations, we feel like things are going to get better in 2024, but it's going to take some time.

Matt Cole (03:30):

With still trucking conditions expected for at least the near term, Walt says it's critical that fleets focus on the things they can control. There's not much you can do about fuel costs and rates, but you have a major impact on a few simple areas. Walt tells us what those are after a word from 10-44 sponsor Chevron Lubricants.

Jason Cannon (03:49):

Protecting your diesel engine and its after treatment system has traditionally been a double-edged sword. The same engine oil that is so essential to protecting your engine's internal parts is also responsible for 90% of the ash that is clogging up your DPF and upping your fuel and maintenance costs. Outdated industry thinking still sees a trade-off between engine and emission system protection, and Chevron was tired of it. So, they spent a decade of R&D developing a no compromise formulation. Chevron Lubricants developed a new ultra low ash diesel engine oil that is specifically designed to combat DPF ash clogging.

(04:22):

Delo 600 ADF with OMNIMAX technology cuts sulfate ash by a whopping 60%, which reduces the rate of DPF clogging and extends DPF service life by two and a half times. And just think what you can do with all the MPGs you're going to add from cutting your number of regens. But Delo 600 ADF isn't just about after treatment. It provides complete protection, extending drain intervals by preventing oil breakdown. Before you had to choose between protecting your engine or your after treatment system, and now you don't. 600 ADF from Delo with OMNIMAX technology, it's time to kick some ash.

Walt Collier (04:56):

One of the things that we are advising our customers to do is to make sure that they have a preventative maintenance program to help keep down reactive maintenance costs. And so when you think about the Delo family of products, at Chevron, we've announced a strategic requirement of our Delo heavy-duty engine oil product line to focus on syn-blends and synthetics. This initiative will start in January of 2024, and our customers need to believe that we are a resilient supply chain to combat future disruptions and adapt to new changes quickly.

(05:31):

The new Delo product line changes in initiatives is key to help navigate these supply chain disruptions and risk. Chevron has been deliberate in making these changes to our Delo product line too, because the supply chain shortages that they've seen in recent years have been a significant pain point. Folks want to know they'll be able to find Chevron Delo products that they know and trust when and where they need them. Our customers also expect us to maintain a competitive price for our Delo heavy-duty engine oil products as well. So if you're looking to extend your oil drains, if you're looking for fuel economy retention, if you're looking for excellent oil consumption, we have a menu of Delo heavy-duty engine oils that can meet some of those needs to help you cut back on some of your costs that we can control.

Jason Cannon (06:20):

I'm not a doom and gloom type of guy. All of us have had about 12 months of good and bad experiences that we can weaponize for a great 2024. One of the things that Walt says he's excited about is Delo's product line change going from four options, which is conventional, synthetic technology, synthetic blend, and full synthetic down to two, full synthetic and syn-blend. That rollout takes place in just a couple of weeks.

Matt Cole (06:46):

As far as the industry goes, Walt says he's excited to see how the focus and trends around four key areas continue to evolve: safety, growth and predictive maintenance, investments in technician training and capabilities, and fleets' ongoing efforts to reduce their carbon footprint.

Walt Collier (07:01):

When you think about, while you're focused on safety, rewarding safe driving practices, and when we think about that, increasing fleet telematics plays a role in safety too. Companies that own trucks with heavy-duty engines are looking at electrification, compressed natural gas, electric fuel signal, and potentially hydrogen ICE once it hits the market, it becomes available. They are looking at these options because of regulations like Advanced Clean Trucks' rule, which requires truck makers to sell increasing number of clean, zero-emission trucks, regulations like President Biden's Clean Trucks Plan, which is in Phase 3 of the greenhouse gas emissions, which calls for stronger emission standards to reduce air pollutions for heavy-duty vehicles. And then there's California Air Resource Board, or CAR, which mandates shift to big rigs and other trucks to zero emissions by a certain timeframe.

(07:58):

Because these changes are over time, it will require more fleets to have mixed fleets of diesel and one of these other new platforms. You will begin to see even more new trucks in the market that's already over capacity with risk capacity looser for longer. Even with their existing trucks, they have to deal with cost, cost of fuel, maintenance, et cetera. While I can't help them with freight, I can help offer them creative solutions like one of our Delo heavy-duty engine oil product lines that helps them reduce operating costs and will help them achieve better things like after treatment protection, drain interval extension or fuel economy retention. Chevron can offer a one-solution lubricant for a mixed fleet of diesel and compressed natural gas engines, which is the industry's only ultra-low ash.

Jason Cannon (08:50):

That's it for this week's 10-44. You can read more on ccjdigital.com. While you're there, sign up for our newsletter, and stay up to date on the latest in trucking industry news and trends. If you have any questions or feedback, please let us know in the comments below. Don't forget to subscribe and hit the bell for notifications so you can catch us again next week.

(09:06):