As the turbulent economy of 2020 enters the final stretch, businesses are experiencing uneven patterns of equipment investment demand depending on which market sectors they serve.

Equipment and software investment collapsed 27.7% (annualized) in the second quarter of 2020, the sharpest decline since the Great Recession. However, E&S investment is forecasted to return to positive territory during the second half of 2020 and entering 2021.

Based on the Equipment Lease Finance Foundation’s U.S. Equipment & Software Investment Momentum Monitor, most vertical sectors are showing historically weak momentum after the COVID-19 pandemic abruptly halted investment during the first half of the year.

Many transportation segments are seeing quicker recovery

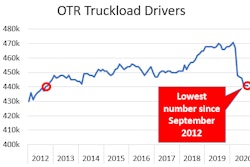

Vertical segments that are highly affected by a standstill in consumer mobility, particularly aircraft, are likely to remain weak. Meanwhile, other vertical segments have the potential for a stronger recovery, including Class-8 tractors, other industrial equipment and medical equipment.

This stronger recovery for transportation fleets is a result of many of the country’s reopening plans that placed heavy reliance and shipping activity for transporters, which subsequently has placed more miles on trucks on the road today. As a result, truck replacement and acquisition strategies will increase entering 2021, and will be an important decision for many companies.

This activity has already begun to pick up, as the latest figures show that truck orders surged to 40,100 units in October, according to preliminary data released by FTR – the first time order intake has cracked 40,000 units since October 2018.

Grocery, retail, health segments driving demand

With so much emphasis now on replacing older trucks with newer, more efficient trucks, business owners and fleet operators have important decisions in how they structure the financing of these replacement units heading into 2021.

For one, transportation fleets are placing more miles on their trucks, handling an increase of shipments on everything from grocery orders, health and sanitation products, as well as everyday goods now purchased through online channels.

Overall spending on Amazon.com during its recent two-day Prime Day event increased by 36% in the U.S. compared with its promotional day last year, according to research firm Edison Trends. Prior to the event this year, research firm eMarketer projected that Amazon’s total U.S. Prime Day sales would reach $6.17 billion.

Trucks are also poised to play a significant role in the transportation of COVID-19 treatments when they are ready in the coming months. Pfizer is just one of many companies planning to distribute these medicines to millions of Americans. The company has built a staging ground with 350 large freezers ready to serve the transportation of up to 100 million doses of vaccines, and another 1.3 billion in 20215.

Procurement strategies keeping costs down

This means that organizations are increasingly scrutinizing the impact that the cost of truck operations – fuel and maintenance and repair – have on their transportation bottom line as trucks will be central to these distribution channels.

Regardless of the price of diesel, more organizations today are making changes to the life cycle of their trucks to benefit from newer units that offer more fuel-efficiency and overall total cost of ownership (TCO). A recent analysis of truck life cycle data shows that fleet operators are now realizing a first year per-truck TCO savings of $16,856 when upgrading from a 2016 sleeper model-year truck to a 2021 model. The fuel savings alone are $5,084 per vehicle.

The improved fuel economy of newer trucks — even when fuel prices are low — is a big reason why a fleet should stay updated, in addition to the safety improvements and CO2 reductions as well.

Just how important is it to find every opportunity to keep costs down? UPS (CCJ Top 250, No. 1) reported recently that it is delivering more packages due to the increase in online shopping, but costs to deliver have also gone up. The company reported a rise in revenue of nearly 16% in the third quarter and profit rose 11.8%, but its large domestic business also reported a significant decline in profits due to more hiring, delivery costs, and $179 million in spending to speed up delivery times. These companies are constantly looking at every opportunity to reduce TCO to offset other operational costs and preserve profits.

Innovative programs infuse cash, prepare for future procurement

While some companies focused on grocery distribution saw banner years, not all transporters saw gains in 2020, and the difficult economic climate has placed significant challenges to their fleet operations and bottom line.

Many organizations needed to scale down their fleets because of the downturn in business activity, such as distributors serving restaurants that were closed. In fact, more than a quarter of executives polled in a recent industry survey (27%) said they downsized their fleets, and new industry programs were introduced to help organizations scale their fleets accordingly while infusing much-needed cash into their operations.

These innovative programs will continue to serve businesses that need to right-size their fleet operations yet wish to remain competitive with their future truck procurement strategies entering 2021 when the economy hopefully begins to rebound.

Katerina Jones is Senior Director of Marketing and Business Development at Fleet Advantage, a leading innovator in truck fleet business analytics, equipment financing and lifecycle cost management.