Carriers see softer freight in October

By Avery Vise

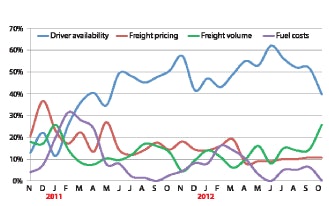

Since January 2011 in Randall-Reilly’s monthly MarketPulse survey, no more than 16 percent of senior for-hire executives have identified freight volume as their top concern in any month. That changed in October, when the number jumped to 26 percent. And nearly 31 percent of executives with carriers of more than 100 power units said freight volume was their biggest worry. Driver availability remained the greatest worry in the survey, although for the first time since May 2011, fewer than 40 percent picked it No. 1.

The most obvious cause for this sudden challenge with freight volume is Hurricane Sandy, which slammed the nation’s densest population center. The Federal Reserve estimated that the storm reduced the rate of change in industrial production by nearly 1 percentage point, turning a month that otherwise would have seen slight production growth into one with a slight decline. The agency said the greatest estimated storm-related effects included reductions in the output of utilities, chemicals, computers and electronic products, food and transportation equipment. Remember, Sandy didn’t make landfall until Oct. 29, so you can imagine what lingering impacts we could see in industrial production in November and beyond.

AVERY VISE is executive director, trucking research and analysis for Randall-Reilly and senior editor, industry analysis for Commercial

AVERY VISE is executive director, trucking research and analysis for Randall-Reilly and senior editor, industry analysis for CommercialCarrier Journal. E-mail [email protected].

In reporting retail sales for October, the U.S. Census Bureau declined to estimate Sandy’s impact, saying that its survey simply isn’t designed to isolate the impact of a factor that is focused in on geographical area. The agency pointed out that sales lost due to the storm certainly were offset – at least partially – by purchases related to storm preparation and evacuation. Regardless, sales were down slightly, and Sandy probably had an effect.

While most of the comments in the October MarketPulse survey focused – as they have for months – on the upcoming election, a few pointed out how disruptive the storm had been. “October was going to be OK until Sandy crippled us for the last three business days of the month,” said one executive. “Right up until the hurricane hit the East Coast, we were having a great month,” said another. Still another: “The hurricane slowed our business down for the whole week. Revenue went down and added a couple points to the OR for the month.”

On the other hand, one executive saw the glass as half full: “We do a lot of business in the Northeast and expect business to really pick up as we rebuild from this storm.”

CARRIERS’ TOP WORRY Source: Randall-Reilly MarketPulse survey of for-hire trucking executives

CARRIERS’ TOP WORRY Source: Randall-Reilly MarketPulse survey of for-hire trucking executivesDon’t rush to a conclusion that worries – or hopes – about freight are tied to Sandy, however. Several executives discussing struggles with freight demand didn’t mention the storm at all. “Even though the fiscal cliff is looming, we are already experiencing the freight cliff,” one executive said. “Another year without the October ‘push’ of freight,” said another. “I guess this is the new norm.” One executive even said that business was soft despite a small surge at the end of the month.

Because we launch the MarketPulse survey during the final week of the month, the results might have been distorted by the storm. Indeed, many economic indicators for October and November could be clouded by Sandy’s relatively temporary effects. With an election just completed and a potentially bitter fight ahead on taxes and federal spending, the storm makes analyzing the impact of these factors on consumers and businesses difficult. About the only sure thing is that times will be good in the near term if your freight is needed to rebuild and restock what Sandy left in its wake.