For the third time this year, nationwide housing starts surpassed the million-mark, according to newly released figures from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. Total housing production in September rose 6.3 percent to a seasonally adjusted annual rate of 1.017 million units.

“These numbers show starts returning to levels we saw earlier this summer, where they hovered around one million units,” says NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “We are hopeful this pattern of modest growth will continue as we close out the year.”

Single-family housing starts were up 1.1 percent to a seasonally adjusted annual rate of 646,000 units in August, while multifamily production climbed 16.7 percent to 371,000 units.

Combined housing starts increased in all regions of the country. The Northeast, Midwest, South and West posted respective gains of 5.3 percent, 3.5 percent, 4.2 percent and 13.9 percent.

Click to enlarge

Click to enlarge“September’s uptick reveals that last month’s dip in production was more of an anomaly than a market reversal,” adds NAHB Chief Economist David Crowe. “I expect we will see a continued recovery as job creation grows and consumers gain more confidence in the housing market.”

Issuance of building permits registered a 1.5 percent gain to a seasonally adjusted annual rate of 1.018 million units in September. Multifamily permits rose 4.8 percent to 394,000 units while single-family permits decreased 0.5 percent to 624,000 units.

Regionally, the Northeast, Midwest and West registered overall permit increases of 12.3 percent, 8.2 percent and 5.9 percent, respectively. The South posted a 4.7 percent loss.

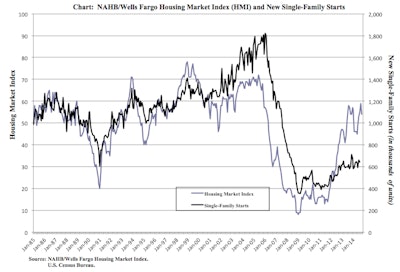

Still, after four consecutive monthly gains, builder confidence in the market for newly built single-family homes fell five points to a level of 54 on the latest NAHB/Wells Fargo Housing Market Index.

“After the HMI posted a nine-year high in September, it’s not surprising to see the number drop in October,” says Crowe. “However, historically low mortgage interest rates, steady job gains, and significant pent up demand all point to continued growth of the housing market.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales, sales expectations for the next six months and the traffic of prospective buyers. Scores from each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components declined in October. The index gauging current sales conditions decreased six points to 57, while the index measuring expectations for future sales slipped three points to 64 and the index gauging traffic of prospective buyers dropped six points to 41.

Looking at the three-month moving averages for regional HMI scores, the Northeast and Midwest remained flat at 41 and 59, respectively. The South rose two points to 58 and the West registered a one-point loss to 57.