While the trucking market shows slow signs of recovery, Motive highlights that the upcoming holiday surge poses significant challenges for fleets: rising accidents, cargo theft incidents and losses due to fraud.

The freight market has “settled into a flatter baseline,” wrote Hamish Woodrow, head of strategic analytics at Motive and author of the 2025-2026 Holiday Outlook Report.

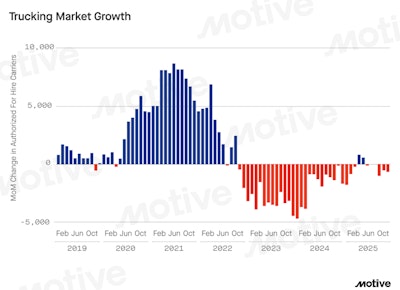

Taking insights from the Federal Motor Carrier Safety Administration, the U.S. Census Bureau, the U.S. Department of Transportation, and its network of drivers, the report noted that the market has somewhat stabilized. Only 2,125 carriers exited the market through October 2025, a slowdown compared to 15,000 exits at the same point in 2024 and nearly 30,800 in 2023. Capacity continues to contract but at a gentler pace.

The market has entered a “pause after a hard reset,” the report said. As fleets enter the holiday season, this creates a “calmer capacity picture,” though not a true rebound.

[RELATED: 2026 brings a ‘marginless recovery’ as capacity shakeout accelerates]

Surge of safety risk around Christmas

The pre-Christmas week shows a 12% increase in speeding events, according to Motive’s data from a year ago, indicating last-minute shoppers, higher shipping activity, and the rush for time-sensitive loads.

Additionally, Motive added that 66% of Christmas Day collisions occurred on wet, snowy or icy roads. While 38% of collisions happened in dark conditions, Motive noted that collisions after dark are 1.7 times higher on Christmas Day.

The report encouraged fleets to manage a pre-Christmas rush through targeted coaching and real-time feedback, planning around winter conditions and investing in after-dark policies to decrease risk.

The holiday surge

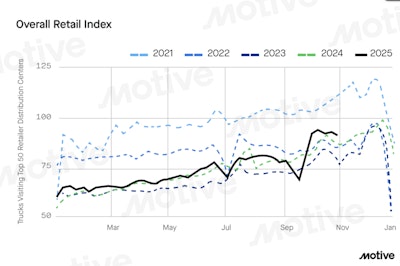

Motive’s Big Box Retail Index, which tracks exits and entries to distribution centers at the Top 50 retailers, shows 2025 freight movement is up just 3.5% year over year, closely mirroring 2024 figures.

Demand flattens during the holiday window rather than spiking, Woodrow said, just as it has in previous years. From a volume perspective, this year’s surge looks similar to a year ago.

“Where we’re seeing change is in driver risk behavior,” said Woodrow, citing the increase in speeding events in the week before Christmas.

Even as shipment patterns remain similar to prior years, Woodrow noted that the combination of tight delivery schedules, holiday pressure and winter weather is pushing risky behavior upward.

Cargo theft and fraud amplify during peak season

Peak season creates an environment for cargo theft because of the increase in loads, faster movement, and additional points of exposure, the report said.

Research from American Transportation Research Institute estimated annual trucking industry losses at $6.6 billion, or roughly $18 million a day. CargoNet data shows theft jumped 27% in 2024, with average losses exceeding $200,000 per theft incident.

Fraud compounds the damage. Motive estimated that 19% of fleet spend is lost to fraud or theft, with 44% reporting significant financial impact.

Fuel theft continues to escalate, the report said, with 96% of U.S. companies reporting attempted fraud. The holiday surge boosts vulnerability, as higher transaction volumes and faster processing lead to delays in catching fraudulent activity.

The risks that fleets face during the holidays — safety incidents, theft/fraud, and supply chain disruption — are now driven by year-round forces, Woodrow said.

“The holiday surge doesn’t create these risks; it just makes them more intense, adding extra volume and urgency on top,” he said.

Cargo theft and safety risks illustrate this clearly, along with supply chain disruption.

“Geopolitical tensions, tariffs and sourcing shifts continue to reshape freight flows,” Woodrow noted.

Trade shifts, such as imports from China, which are down 18.9% year to date compared to 2024, reflect longterm trade realignments rather than seasonal variation. Woodrow said fleets are entering the peak season with more vulnerability than they did the year before.