Want to sort the CCJ Top 250 by revenues or number of trucks, tractors, trailers or drivers? Want to see and sort carriers by type of haul or geographic region? Download the free 2020 CCJ Top 250 rankings here.

Want to sort the CCJ Top 250 by revenues or number of trucks, tractors, trailers or drivers? Want to see and sort carriers by type of haul or geographic region? Download the free 2020 CCJ Top 250 rankings here.Compared to 2018, a year that provided many for-hire carriers with once-in-a-generation market conditions, 2019 may have felt like a ho-hum year to many fleet executives. Although the North American trucking industry saw little growth in 2019, many carriers were able to eke out modest gains.

After posting a whopping 9.9% revenue gain in 2018, fleets in this year’s CCJ Top 250 still managed to turn in an increase of 3.7% last year. (Note: these figures include revenue data from carriers that self-reported or publicly provided information for consecutive years.) Take out the combined revenues and $6.7 billion gain posted by package giants UPS and FedEx, however, and the overall CCJ Top 250 revenue growth in 2019 comes in at just 1.3%.

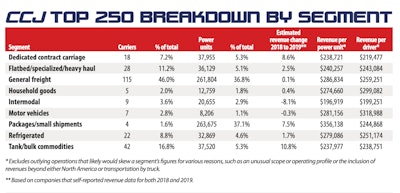

Only two of the nine industry segment groups tracked in the CCJ Top 250 posted revenue declines from 2018 to 2019: Motor vehicles (-0.3%) and Intermodal (-8.1%). The General freight industry segment – a group that makes up nearly half the carriers in the 2020 CCJ Top 250 – managed only a 0.1% revenue gain.

The Tank/bulk commodities segment led all groups with a 10.8% revenue increase thanks to increased demands for chemical, food and dry bulk goods. Other top performers include Dedicated contract carriage (+8.6%) and Packages/small shipments (+7.5%).

Click the image to enlarge

Click the image to enlargeStandouts include Heniff Transportation (CCJ Top 250, No. 67), whose revenue rose 88% after a string of recent acquisitions in the tank/bulk segment; Wilson Logistics (No. 98), which posted a 29% increase after last year’s acquisition of Market Transport; and PS Logistics (No. 36), a Birmingham, Ala.-based carrier that turned in a 21% increase after a consolidation run in the flatbed segment. Other carriers with notable revenue gains include Cardinal Logistics (No. 37, 21% increase), Hirschbach Motor Lines (No. 64, 21% increase) and Cliff Viessman (No. 156, 20% increase).

Fleets not looking to grow

While revenue numbers for the CCJ Top 250 reflect a carrier’s performance in the previous fiscal year, other data points – including straight truck, tractor, trailer and driver counts – are reported annually in June and early July. Power unit counts at the 237 fleets that appeared in both the 2019 and 2020 CCJ Top 250 rankings rose 2.1% in the last year, from 691,422 to 706,009. Excluding equipment counts from UPS and FedEx, however, the remaining 235 fleets only accounted for growth of 0.2%.

Driver counts in the last year tell a different story. Overall, carriers that appeared in both the 2019 and 2020 CCJ Top 250 rankings increased their driver totals by 1.9%. Without gains by UPS and FedEx, however, driver numbers actually fell by 1.7%, from 515,709 to 507,008.

It’s likely the majority of the decline in driver totals occurred in the second quarter of 2020 as business conditions during the COVID-19 pandemic prompted layoffs. According to a CCJ survey of fleet executives in May 2020, 28% of respondents indicated that they had been forced to decrease driver workforce as a result of the coronavirus. The U.S. Department of Labor reported total employment in the for-hire trucking industry fell 88,000 in April 2020 to its lowest total since 2014.

Bankruptcies slow, acquisitions on the rise

This year’s CCJ Top 250 ranking only lost two carriers to bankruptcy, but they had a big impact. Most notable was Celadon (formerly No. 41), the Indianapolis-based carrier with 3,300 power units that closed its doors in December 2019. While the company was able to sell its Taylor Express business unit, most of its assets were gobbled up by other carriers or disposed of in the used truck market.

More recently, Comcar Industries (formerly No. 98) – a heavyweight in the Tank/bulk commodities segment – announced it was filing for Chapter 11 bankruptcy last May and selling its five trucking business units. Notable Comcar divestitures include selling flatbed fleet CT Transportation to PS Logistics; liquid chemical hauler CTL Transportation to CCJ Top 250 newcomer Service Transport (No. 221); and dry van fleet MCT Transportation to White Willow Holdings, which incidentally purchased Celadon’s Taylor Express.

Roadrunner Transportation Systems staved off bankruptcy, but the company slid down the rankings from No. 31 to No. 47 as it sold several subsidiaries in the intermodal, flatbed and dry van markets and continued its restructuring efforts in the less-than-truckload market.

Carriers in the CCJ Top 250 have been busy on the acquisition front in the last year. The biggest transactions include Heniff Transportation’s acquisition of Superior Bulk Logistics (formerly No. 99), a move that sent the Oak Brook, Illinois-based company soaring up 37 spots in this year’s ranking. Shortly after last year’s ranking was published, Heartland Express (No. 39) jumped 10 spots when it acquired Millis Transfer (formerly No. 129) for $150 million.

NFI (No. 24) moved up four spots in this year’s ranking thanks in part to the acquisition of G&P Trucking, a subsidiary of Southeastern Freight Lines (No. 31). Canadian carrier C.A.T. (No. 105) acquired fellow Canadian firm Penner International (formerly No. 249).

Three other acquisitions in the Tank/bulk commodities segment to note are A&R Logistics’ (No. 102) acquisition of First Choice Logistics, a 125-truck bulk fleet based in Chicago, TransWood Carriers’ (No. 113) acquisition of 150-truck fleet Kane Transport based in Minnesota, and Bulkmatic’s (No. 172) purchase of Indiana-based Paris Transport.