Startups and major OEMs are under no illusions that fleets and other truck owners are up against a costly transition to zero emission trucks and see generous incentives like those found in California as being critical for a historic shift that’s being mandated by increasingly stringent emissions laws.

California made global headlines in April when it became the first government in the world to mandate the end the sales of conventional internal combustion trucks by 2036. Fleets wishing to continue to do business at the nation’s busiest ports and elsewhere in the Golden State will have until 2045 to make the switch to zero-emission trucks which currently includes all-electric and fuel-cell. Other states could follow suit.

Changes have been taking place at the federal level too. Last November, President Job Biden signed an international agreement placing the U.S. alongside other countries requiring OEMs to sell nothing but medium- and heavy-duty zero-emission vehicles (ZEVs) by 2040.

The Global Memorandum of Understanding on Zero-Emission Medium-and Heavy-Duty Vehicles predicts that sales of new medium duty ZEVs will comprise 30% of sales by 2030.

In April, the Biden administration cranked that percentage up even higher after proposing the toughest U.S. emissions regulations yet which the administration believes could move model year 2032 medium-duty EV sales up to 46% of the segment share and light-duty EV sales to 67%.

[Related: Schneider opens huge charging depot]

The Inflation Reduction Act will provide incentives to help ease fleets into ZEVs which cost twice that or more of conventional internal combustion. Plus there’s the cost of infrastructure, driver and technician training and new shop equipment. All of it adds up to some nail biting for fleets and OEMs alike.

To help ease the transition to ZEVs, the truck manufacturers we talked to believe that California’s Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) or something like it needs to be adopted by other states.

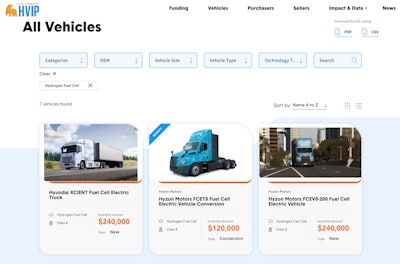

HVIP currently provides funding for 152 Class 3 to 8 vehicles most of which are all-electric (138) followed by fuel cell (7) and vehicles with an electric PTO (7) like bucket trucks. HVIP no longer offers funding for hybrid or natural gas vehicles.

A screenshot of California's Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) page shows three of seven hydrogen fuel cell vehicles eligible for funding.californiahvip.org

A screenshot of California's Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) page shows three of seven hydrogen fuel cell vehicles eligible for funding.californiahvip.org

Incentives ‘incredibly important’

California's HVIP incentives range from $20,000 for a Class 4 ePTO bucket truck all the way to $240,000 for a Class 8 fuel cell truck. Qualifying makes and models are listed including a Mack LRe electric refuse truck and Mack MD electric which are available with $120,000 and $85,000 incentives respectively.

During the reopening of the Mack Experience Center in Allentown, Pennsylvania earlier this month, Commercial Carrier Journal asked Mack Trucks North America President Jonathan Randall if it was critical to expand the HVIP model to other states.

“It's incredibly important that local governments participate in helping the adoption to get the seed in there,” Randall said. “You've got customers that have sustainability targets and they're going to do it regardless because they're partners. They understand that in order to drive the technology, there needs to be adoption, there needs to be seeding, there needs to be volume picked up.

“But if you want to get to that next level, the local municipalities, local governments need to participate in that,” Randall continued. “I'm probably going to get in trouble for this, but today there's really not a financial payback to run electric at the price of the chassis today. But there will be as we continue the volume, as we continue the adoption. So getting customers to take it and helping them with subsidies and or grants really helps drive adoption.”

[Related: Ride and drive impressions of zero emission trucks]

Daimler Trucks North America has a similar take on HVIP. Its subsidiaries, Freightliner and Freightliner Custom Chassis, have a total of four electric trucks eligible for HVIP funding.

“For positive TCO to be realized—now and for the foreseeable future—incentives, like the California HVIP program, are vitally important,” said DTNA spokesperson Anja Weinert. "TCO parity is a prerequisite and an essential driver for our customers to decide in favor of CO2-neutral vehicles. We believe that TCO parity might be feasible and achievable as the transformation of the industry is progressing. However, the exact timing of TCO parity for battery-electric or hydrogen vehicles is expected to vary significantly from one region to another and even one market to another due to factors which are out of control of OEMs like governmental support or the price of (green) hydrogen and (green) electricity.”

Colorado is one of the few states that has implemented a Class 8 ZEV incentive program. Colorado’s Clean Fleet Vehicle Technology Grant Program can cover up to 60% of the cost of a Class 8 electric or fuel cell truck. Application deadline is June 30. Bonnie Trowbridge, executive director of Drive Clean Colorado, said current incentives don't always sway fleets to sign on the line.

"Every fleet will tell you that the cost of ZEVs is a barrier for them and that funding amounts need to be higher," Trowbridge said. "The cost of the vehicles is only the tip of the iceberg for fleets in terms of transitioning to ZEVs. Many fleets are faced with changing their duty cycle and routes, training drivers and technicians, and let’s not forget the complexity and cost of infrastructure."

Too little, too late? The web page for New York City's Clean Truck Program reports that funding is temporarily on hold and that they're no longer accepting applications.nycctp.com

Too little, too late? The web page for New York City's Clean Truck Program reports that funding is temporarily on hold and that they're no longer accepting applications.nycctp.com

Going beyond HVIP

Jim Castelaz, co-founder and chief technical officer of Motiv Power Systems, has long seen how incentives can help fleets with ZEV acquisition.

The California based manufacturer has been in the commercial EV business for 14 years. Their lineup includes work trucks, box trucks, steps vans, trolleys and school buses. Eight Motiv EVs are posted on HVIP’s funding list.

“Having been in the electric truck industry since 2009, I've seen how critical HVIP has been to moving the industry forward,” Castelaz said. “Without the success it drove in deploying electric trucks, adoption of the ACT (Advanced Clean Trucks) and ACF (Advanced Clean Fleets) regulations may not have happened.”

ACT lays out the fine print for California’s ZEV sales requirement for manufacturers while ACF works to accelerate medium and heavy-duty ZEV adoption among fleets as soon as possible. Castelaz hopes to see HVIP, ACT and ACF expand beyond California.

“I think other states should consider not just HVIP-like programs to drive early adoption, but then coupling them with regulations like ACT and ACF,” he said. “Coupling them together creates a market with clear signals that allows OEMs like Motiv to make investments in scaling our production and bring our costs down, which in turns makes smaller-dollar-per-vehicle incentive programs (like the IRA tax credit) more viable.”

Colorado adopted its own ACT program based on California's.

"California has done a good job in creating and testing models for incentives that work for them," Trowbridge said. "Other states are benefitting from the learnings from California and creating programs that work specific to needs in their state."

Keeping up with funding options

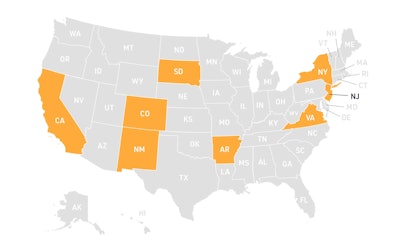

Nikola, which has two trucks listed for HVIP funding, offers a webpage with information on heavy-duty ZEV incentives across the U.S. but there’s not many states to choose from. In addition to California, fleets can take a look at funding programs in Arkansas, Colorado, New Mexico, New Jersey, New York and Virginia.

New York and New Jersey have stepped up with generous incentives that surpass California. A qualifying Class 8 electric truck is eligible for $185,000 in New York and $175,000 in New Jersey. California HVIP tops out at $120,000 for Class 8 electric. However, neither New York nor New Jersey appear to be offering fuel cell vouchers just yet.

“For Nikola specifically, the incentives have proved beneficial in reducing the cost of ownership of a Nikola zero-emission truck to be competitive on a total cost of ownership basis with traditional diesel vehicles,” said Nikola spokesperson Dan Passe.

“Funding programs that reduce the upfront cost of vehicles, such as voucher incentive programs and tax credits, are essential in ZEV adoption goals,” Passe continued. “Reimbursement funding programs, such as many grant programs currently available, help with TCO, but are not as effective in helping fleets overcome purchase price barriers of ZEV adoption. Due to the upfront cashflow offered in these programs such as HVIP, they are a vital funding mechanism and should be considered in all states seeking to accelerate immediate adoption of ZEVs.”

Fleets can also look to IRA funding which Castelaz said may prove more beneficial than HVIP.

"HVIP seems to have been shaped by CARB in recent years to focus on getting electric trucks into small fleets and getting the first few electric trucks into larger fleets," Castelaz said. "For widespread adoption, I think broader programs like the IRA tax credit may have even more impact going forward."