Kyler Ford, vice president of sales and operations for Maven Machines, says the ELD mandate has benefitted fleets by spurring new innovations in fleet management technology.

Kyler Ford, vice president of sales and operations for Maven Machines, says the ELD mandate has benefitted fleets by spurring new innovations in fleet management technology.In March 2014, the Federal Motor Carrier Safety Administration ushered a reluctant trucking industry into a new era when it proposed the electronic logging device (ELD) mandate.

The final ELD rule was published on Dec. 16, 2015 and set the enforcement date to start exactly two years later. FMCSA then extended the deadline to April 1, 2018. By then, motor carriers had to use technology that meets the new ELD specifications in Parts 395.20 through 395.38 of the agency’s rulebook or the grandfathered Automatic Onboard Recording Devices (AOBRDs) in Part 395.15.

After April 1, 2018, drivers and carriers not using AOBRDs or ELDs were cited by officers at roadside inspections for a failure to have a record of duty status. This violation carries a 10 hour out-of-service penalty and will be the same one given to stragglers who have not converted from AOBRDs to ELDs after Dec. 17, 2019.

This final ELD deadline has been looming over the industry the past four years. It has forced motor carriers to evaluate their current and prospective vendors to find those who can best meet their technology needs.

Many ELD and telematics suppliers have entered the market during this period, seeing the tremendous opportunity to help fleets modernize their technology. The increased competition has brought more digital innovation to the industry in the past four years than any period of similar length since the automobile replaced the horse-drawn wagon.

While the trucking industry’s initial response to the ELD mandate was that it would be an enemy to productivity and profitability, the opposite has occurred. It has sparked new innovations in fleet management technology that have made it possible for organizations to operate more efficiently and safer.

The days of being limited to a few providers of mobile and back-office technology are gone. As you evaluate vendors and technology platforms in the New Era of Digital Fleet Management, look beyond compliance and choose partners who understand your business and the needs in the trucking industry to prepare for whatever lies ahead.

ELD adoption at a glance

Motor carriers are focusing their attention on opportunities to consolidate technology in a single platform.

Motor carriers are focusing their attention on opportunities to consolidate technology in a single platform.The initial reluctance many in the industry had towards ELDs stemmed from concerns the technology would exacerbate longstanding problems. Slim operating margins, driver turnover and mileage-based pay structures have always been the norm.

Inefficiencies in the supply chain were masked by paper logs, such as the time drivers spend loading, unloading and sitting in traffic congestion. These obstacles became larger with electronic logs.

Drivers wondered, “what’s in it for me?” in the early days of AOBRD and ELD adoption. Motor carriers also worried the technology would negatively impact their capacity and revenues, especially for next-day freight lanes of 500 to 750 miles.

With electronic logs, these “tweener” lanes would tie up drivers and assets for two days. Carriers quickly realized, however, the ELD mandate was a golden opportunity to restructure freight rates and driver pay models to more fully account for the value of time.

The ELD mandate also benefitted them by spurring innovations in fleet management technology to bring hours-of-service and other new data sources into the load planning and dispatch process.

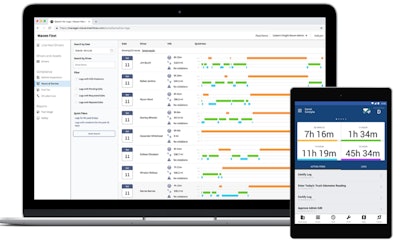

Modern fleet management systems are more economical, easier to implement and scale out than ever before. Photo courtesy of Maven Machines.

Modern fleet management systems are more economical, easier to implement and scale out than ever before. Photo courtesy of Maven Machines.A common trait among technology suppliers who excelled in this new Digital Era of Fleet Management is they do not have legacy hardware and software platforms to support. Instead, they entered the market with resources they could focus solely on innovation.

They brought talented programmers together with the brightest minds in transportation and users on the front-lines to develop modern fleet management systems. These systems get the right data to the right people at the right times with intuitive interfaces from cloud-based applications. Work has become more enjoyable for drivers and fleet administrators, and in turn, the technology is making carriers more profitable.

Technology suppliers who have excelled in this new Digital Era of Fleet Management are those who are taking motor carriers beyond ELD compliance. The latest technology is transforming the work of drivers and office employees to create efficiencies on an unprecedented scale.

Moving beyond compliance

Since 2015, the ELD mandate has been a catalyst for fleet executives and management teams to evaluate mobile and back-office technology. At a minimum, management teams assumed the vendors they chose for AOBRDs would give them a path to migrate to ELDs when the time was right.

Fleet management platforms that utilize mobile Android and IOS devices are giving carriers the flexibility to use software from their core telematics provider side-by-side with applications from other vendors.

Fleet management platforms that utilize mobile Android and IOS devices are giving carriers the flexibility to use software from their core telematics provider side-by-side with applications from other vendors.This assumption has proved tenuous. Upon closer inspection, legacy AOBRD vendors have struggled to match the cost savings and expanded functionality of newer platforms. Market competition has been adding pressure on legacy providers to quickly adapt to modern technology trends or lose customers.

During the AOBRD to ELD transition period, fleets who already had implemented a telematics solution, as well as those who started using one for the first time, generally followed one of three approaches to evaluate vendors:

Approach 1 – Reached out to respected colleagues at other carriers to find out what they use or were looking to use. The initial inquiry led to evaluating the hardware and monthly subscription costs for one or two vendors, installing the new technology in a few trucks and conducting a trial.

Approach 2 – Assembled a dedicated internal team to develop a grid of all the features and functionality they want in a next-generation telematics platform. After researching the market, they contacted vendors to determine which items they do or do not have. The evaluation typically lasted several months and involved side-by-side testing and trial runs.

Approach 3 – Evaluated vendors and products to meet their compliance needs — ELDs, fuel taxes, driver vehicle inspection reports (DVIRs), etc. This step was followed by exploring additional features and functions in each platform. The process led to discovering platform capabilities such as document imaging, camera solutions, collision mitigation and integration with transportation management software (TMS), and more.

With any of these approaches, management teams have discovered modern fleet management systems that are more economical, easier to implement and scale out than ever before. The discovery process also led teams towards vendors who are combining mobile and back-office functions in a single platform, which includes:

- Cloud-based applications that connect drivers and fleet managers through user-friendly interfaces and automated workflows.

- Instant optimization of load planning and dispatching activities. When a driver logs into a mobile app to start the workday, all relevant data needed by back-office systems such as vehicle number, location, mileage and hours-of-service status, is instantly available.

- Real-time updates as a driver arrives and departs from planned stops, as well as predictive ETAs for shipments and tracking of detention events for billing and route analysis.

- Advanced driver workflow from a single mobile app that includes barcode scanning, capture of accessorial charges, signatures, pictures of damaged freight, and other tasks.

- Image capture of signed proof-of-delivery documents and receipts. Images captured by the mobile app are instantly optimized for clarity and immediately available for billing and payroll.

Modern fleet management solutions with these features have been making drivers more efficient as well as improving job satisfaction with additional connections to back-office systems for accessing pay details and other HR-related information.

An appetite for consolidation

With the ELD mandate in the rear-view mirror, motor carriers are now focusing their attention on opportunities to consolidate technology in a single platform. After all, the value of any system is limited if management and front-line users have to pull data together from separate servers and databases to make informed decisions.

Workforce demographics is a major factor driving fleet migration to mobile Android and IOS platforms, as younger workers expect technology at work to mirror their experiences with technology in their personal lives.

Workforce demographics is a major factor driving fleet migration to mobile Android and IOS platforms, as younger workers expect technology at work to mirror their experiences with technology in their personal lives.Some fleet management systems now offer subscription models with robust applications and an open platform to consolidate costs and functions. A number of telematics platforms, for example, offer camera systems to bring video and event data together in driver coaching workflows that reduce accident risks and litigation costs.

Some mobile apps also have driver workflows with compliance, messaging, performance scorecards, image capture and more applications. With image capture, drivers are able to streamline OS&D reporting, vehicle inspections, proof-of-delivery documents, scale tickets and fuel receipts.

Fleet management platforms that utilize mobile Android and IOS devices are giving carriers the flexibility to use software from their core telematics provider side-by-side with applications from other vendors. Mobile devices act as a bridge for fleets to migrate these third-party apps to their core vendor’s platform, over time, as their vendor continues to build out functions.

Workforce demographics is another factor driving the migration to mobile Android and IOS platforms. Millennials are now the largest segment of the workforce. This generation and younger workers that follow expect technology at work to mirror their experiences with technology in their personal lives.

Looking under the hood

Besides consolidating mobile applications, motor carriers have new opportunities to consolidate back-office functions onto a single, cloud-based platform. Dispatch and route planning applications no longer have to be purchased separately. Modern telematics platforms also have real-time dashboards that give fleet managers visibility of driver performance, safety and compliance metrics.

When evaluating platforms that combine telematics with back-office dispatch and routing functions, it helps to map out the processes in your operations to better understand how each one interacts with the technology you currently use.

Looking at each of these processes will spotlight areas where you have information that is siloed or limited, causing employees to spend time doing repetitive tasks that do not add value to an organization.

In some cases, a transportation management system (TMS) could be the culprit by feeding dispatch and routing instructions to drivers. The day may not be optimally planned to maximize available resources in terms of equipment and drivers’ hours of service.

Companies that take the time to properly evaluate all of their current and future technology needs in this post-ELD environment will be prepared to capitalize on new opportunities that modern fleet management systems bring to the table.

Once you have a clear understanding of your current and future needs, look for technology vendors that share this vision and have a product roadmap that ensures they will accommodate your needs. As the trucking industry continues to move towards new levels of automation, the vendors you align with today will be more critical to leverage new connected vehicle technologies from OEMs with your mobile and back-office systems.

About the Author: Kyler Ford is vice president of sales and operations for Maven Machines, a developer of fleet management and dispatching solutions for small, medium and enterprise transportation companies around the world.