FedEx Corp. on Thursday, Dec. 16, reported revenue for the second quarter ended Nov. 30 of $9.63 billion, up 12 percent from $8.6 billion the previous year. Operating income was $469 million, down 18 percent from $571 million, and net income was $283 million, down 18 percent from $345 million.

“Solid demand for our transportation solutions, outstanding customer service from FedEx team members and a healthier global economy helped drive second-quarter revenue higher,” said Frederick Smith, chairman, president and chief executive officer of the Memphis, Tenn.-based company. “Our yield improvement strategy is working, holiday peak season volumes are exceeding our expectations, and our economic forecast for calendar 2011 has improved.”

FedEx said that while shipments and yields grew in all transportation segments, earnings were reduced by costs related to the combination of FedEx Freight and FedEx National LTL operations, including severance costs associated with personnel reductions and noncash asset impairment charges. Earnings also were reduced by a reserve for a legal matter at FedEx Express. The reinstatement of certain employee compensation programs, and higher pension and aircraft maintenance expenses, also impacted earnings.

The FedEx Freight segment reported revenue of $1.22 billion, up 14 percent from $1.07 billion; and an operating loss of $91 million compared with an operating loss of $12 million. Less-than-truckload average daily shipments increased 8 percent, while LTL yield increased 7 percent year-over-year and 5 percent from the first quarter, primarily due to yield management programs that include targeted improvement from lower-performing accounts.

The operating loss in the quarter resulted largely from $86 million of costs associated with the combination of the FedEx Freight and FedEx National LTL operations. Additional costs associated with this program totaling $54 to $84 million are expected in the third quarter. The total expected cost of this program has been reduced to $140 to $170 million.

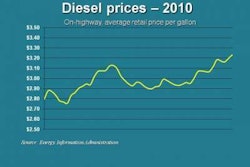

“Our operating performance in the quarter was impacted by strong compensation and benefits headwinds as we reinstated programs curtailed during the recession,” said Alan Graf Jr., FedEx Corp. executive vice president and chief financial officer. “During the quarter, we also realized more normalized growth in FedEx International Priority shipments and higher fuel prices than our earnings guidance had assumed. Yield improvement and cost management remain our focus. We expect margins to improve in the second half of fiscal 2011 and in fiscal 2012, as we continue to benefit from solid global demand for our differentiated services and as certain cost headwinds subside next fiscal year.”