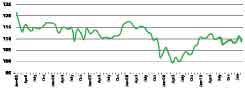

Tonnage index falls in February

Winter weather blamed for much of the decline

The American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index decreased 2.9 percent in February after increasing a revised 3.5 percent in January. The latest drop put the adjusted index at 113.3 in February; in January, the adjusted index equaled 116.6. During December 2010 and January 2011 together, the adjusted tonnage index rose 6.1 percent. The nonseasonally adjusted index – representing the change in tonnage actually hauled by carriers before seasonal adjustment – dropped 2.8 percent in February from the previous month.

ATA’s For-Hire Truck Tonnage Index dipped significantly in February, but Chief Economist Bob Costello believes winter weather played a major role.

ATA’s For-Hire Truck Tonnage Index dipped significantly in February, but Chief Economist Bob Costello believes winter weather played a major role.Year over year, February tonnage was up 4.2 percent, and for the first two months of the year, tonnage was up 5.9 percent compared with the same two months last year.

Winter storms in February probably played a role in the latest reduction, says ATA Chief Economist Bob Costello, who added that he wasn’t concerned about the decline. “Tonnage is not going to increase every month, and in general I’m very pleased with freight volumes early this year.” Costello also says that anecdotal reports from carriers are encouraging. “I’m hearing a significant amount of positive news from fleets and that the largest concern continues to be the price of diesel fuel, not freight levels.”

ATA calculates the tonnage index based on surveys from its membership. This is a preliminary figure and subject to change in the final report issued around the 10th day of the month. The baseline year is 2000.

IN BRIEF

* Trade using surface transportation between the United States and its North American Free Trade Agreement partners Canada and Mexico was 13.8 percent higher in December 2010 than in December 2009.

* TransCore’s latest North American Freight Index showed the highest spot market truckload freight volume for the month of February since the company established the index in 1986.

* Rail carloads increased 4.2 percent in February compared to the same 2010 month, while intermodal traffic increased 10.3 percent, the Association of American Railroads reported. The month marked the 12th straight month for year-over-year increases in rail carloads and the 15th straight month for year-over-year increases in intermodal traffic.

* Container traffic increased 5.6 percent at the Port of Los Angeles and 10.9 percent at the Port of Long Beach in February compared to the same 2010 period.

* Housing starts were at a seasonally adjusted annual rate of 479,000 a year in February – 22.5 percent below the revised January estimate and 20.8 percent below the February 2010 rate. Building permits authorized for housing were at an adjusted rate of 517,000 – 8.2 percent below the revised January estimate and 20.5 percent below the February 2010 rate.

* Construction spending during January declined at a seasonally adjusted annual rate of 0.7 percent from December and 5.9 percent from January 2010.

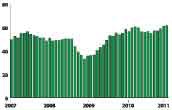

Trucking job growth highest in 20 years

The U.S. economy added 192,000 nonfarm jobs on a seasonally adjusted basis during February – 11,200 of which came from for-hire trucking companies, according to preliminary estimates released by the U.S. Department of Labor’s Bureau of Labor Statistics. If the numbers hold, the increase in trucking jobs would be the largest one-month surge since December 1990. However, BLS revised January estimates for payroll employment in truck transportation downward by 4,300.

Payroll employment in trucking surged by 11,200 jobs in February – the largest one-month increase since December 1990.

Payroll employment in trucking surged by 11,200 jobs in February – the largest one-month increase since December 1990.Payroll employment at for-hire trucking companies was 38,300 jobs – 3.1 percent – higher than in February 2010, according to the preliminary figures. Since the beginning of March 2010 when the slump in trucking jobs hit bottom, trucking companies have added 39,000 jobs, according to BLS estimates.

Total employment in trucking in February was more than 1.266 million – down 187,000, or 12.9 percent, from peak trucking employment in January 2007. The BLS numbers reflect all payroll employment in for-hire trucking, but they don’t include trucking-related jobs in other industries, such as a truck driver for a private fleet. Nor do the numbers reflect the total amount of hiring since they only include new jobs, not replacements for existing positions.

Figures for trucking do not include the express delivery companies, which fall under the category of “couriers and messenger” in BLS data. According to preliminary numbers, that was the only segment of transportation that lost jobs, likely reflecting the final terminations of temporary jobs added to handle holiday season demand. Employment by couriers and messengers was down by only 1,400 jobs, however.

Despite the strong growth in jobs throughout the economy, the unemployment rate was little changed at 8.9 percent as the number of people seeking employment rose at about the same level as the number of new jobs added.

Manufacturing index at highest level since May 2004

Economic activity in the manufacturing sector expanded in February for the 19th consecutive month, according to the Institute of Supply Management’s monthly composite index known as the PMI. The PMI registered 61.4 percent, an increase of 0.6 percentage point when compared to January’s reading and the highest PMI reading since May 2004 when the index also registered 61.4 percent. A reading above 50 percent indicates that the manufacturing economy is expanding; below 50 percent indicates that it is contracting.

New orders and production are especially strong, suggesting solid freight volumes in the near term.

New orders and production are especially strong, suggesting solid freight volumes in the near term.Especially encouraging for trucking is the fact that the new orders and production indexes – both components of PMI – are outpacing the PMI, while inventories contracted. The growth in new orders and production is driven by strength in exports in particular, says Norbert Ore, chair of ISM’s Manufacturing Business Survey Committee. n