The Ceridian-UCLA Pulse of Commerce Index issued Wednesday, Oct. 12 fell 1.0 percent in September on a seasonally and workday adjusted basis, following a 1.4 percent decline in August and a 0.2 percent decline in July.

“With hopes that September data would be positive, last month we wrote ‘Based on the July and August data, the PCI will likely decline in the third quarter, and this suggests GDP growth of zero to 1.0 percent,” says Ed Leamer, chief economist for the index and director of the UCLA Anderson Forecast. “With the continued weakness in September, the PCI-based forecast for third-quarter GDP growth is zero.”

Over the past three months, compared to the prior three months, the PCI declined at an annualized rate of 4.3 percent. The rate of decline in the third quarter has been exceeded only in the deep recession of 2008-09 and tied only once outside of recessions in March 2000.

On a year-over-year basis, the PCI was down 0.2 percent in September. This month, the year-over-year change was below last year for the first time since May 2011, or the second time since January 2010; over the past four months, the year-over-year change has been declining rapidly.

“Businesses appear to be unwilling to restock for a potentially vibrant holiday season at the same time as normal, and they are planning to ramp up inventories late this year, if and when the sales start to materialize,” Leamer says.

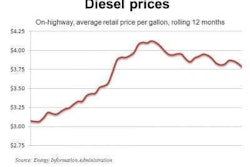

The Ceridian-UCLA Pulse of Commerce Index is based on real-time diesel fuel consumption data for over-the-road trucking and serves as an indicator of the state and possible future direction of the U.S. economy. By tracking the volume and location of fuel being purchased, the index monitors the over-the-road movement of raw materials, goods-in-process and finished goods to U.S. factories, retailers and consumers.