The Equipment Leasing and Finance Association announced that its Monthly Leasing and Finance Index, which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for February was $5.0 billion, up 22 percent from volume of $4.1 billion in the same period in 2011. Volume was down 2 percent from the previous month. Year-to-date cumulative new business volume is up 22 percent.

Credit quality metrics were mixed. Receivables more than 30 days increased to 2.5 percent in February, up from a two-year low of 1.9 percent in January, due to higher-than-normal delinquencies reported by one of the 25 companies responding to the survey. Charge-offs were unchanged from the previous month at 0.5 percent. Credit approvals rose to 79 percent in February, up from 77 percent in January.

Total headcount for equipment finance companies in February remained unchanged from the previous month and was down 3.0 percent year-over-year. Supplemental data show that the trucking and construction industries continued to lead the underperforming sectors.

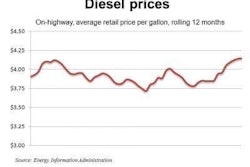

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index for March is 61.7, up from the February index of 59.6, indicating industry participants are optimistic despite concerns that external factors, including gas prices and the upcoming elections, may have on the market.

“The data show that companies continue to invest in equipment, replacing obsolete and worn assets in some sectors while beginning to expand in others,” said William Sutton, ELFA president and chief executive officer. “The roller-coaster trend pattern of our credit-quality metrics, aging of receivables, charge-offs and credit approvals are caused by the unique aspects of different sectors and their cash-flow cycles. However, we see them continuing to move in a positive direction overall.”