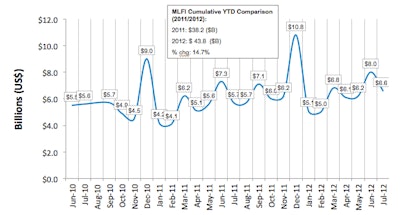

The Equipment Leasing and Finance Associations’ Monthly Leasing and Finance Index, which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for July was $6.6 billion, up 15.8 percent from volume of $5.7 billion in the same period in 2011. Volume was down 17.5 percent from the previous month. Year-to-date cumulative new business volume increased 14.7 percent.

Receivables over 30 days were 2.2 percent, down from 2.4 percent in June, and down slightly when compared to the same period in 2011. Charge-offs decreased to 0.4 percent in July, down from 0.6 percent the previous month, and down by 43 percent compared to the same period last year.

Credit approvals decreased to 77.5 percent in July from 78.7 percent in June. Sixty-five percent of participating organizations reported submitting more transactions for approval during July, unchanged from the previous month.

Finally, total headcount for equipment finance companies decreased slightly from the previous month, and declined 2.8 percent year over year. Supplemental data show that trucking and construction led the underperforming sectors, followed by small and medium-sized enterprises.

“Despite well-publicized fiscal challenges presented by the eurozone debt crisis, a recent uptick in global oil prices and a stubbornly sluggish U.S. economy, business financing of capital equipment continues to show some strength,” said William Sutton, ELFA president and chief executive officer. “Portfolio quality is steadily improving, and the number of favorable business credit decisions remains relatively stable, at least throughout the summer’s early months.”