(EDITOR’s NOTE: This is the final installment of a series on CSA, based on several presentations, discussion and follow-up from the recent American Trucking Associations Management Conference and Exhibition. Part 1 focuses on whether CSA is, essentially, a new safety rating. In Part 2, FMCSA explains changes to the carrier safety information website. In Part 3, representatives of ATA and FMCSA debate the program’s effectiveness. Part 4 features a discussion of the state-to-state differences in enforcement as reflected in CSA data.)

With a pending challenge in federal court, as well as ongoing reviews by the DOT Inspector General and the Government Accountability Office, a prominent critic of Compliance, Safety, Accountability is hopeful that a change in favor of smaller carriers is coming. The Federal Motor Carrier Safety Administration says it welcomes the scrutiny – and the safety program has passed muster before.

FMCSA graphic

FMCSA graphic“The trucking industry is made up of tens of thousands of small business people, and they’re under assault in terms of trying to deal with a system that is unfairly classifying those carriers as having a safety issue,” says Tom Sanderson, Transplace CEO and front man for the Alliance for Safe, Efficient and Competitive Truck Transportation. “There is a segment of large carriers that would like to use SMS as a competitive weapon. That’s not about safety. Those carriers know full well the scores have no relationship with accident frequency. It’s simply a way to put small carriers out of business and jack up prices.”

Transplace, a billion-dollar 3PL and technology company, was founded by a group of large carriers, and Sanderson himself has worked at a couple of the largest. So he admits to being somewhat sympathetic.

“Trucking’s a tough business. There haven’t been many years since deregulation where the truckload segment has been able to get the pricing they’d like to offset the rising costs,” Sanderson says. “Carriers would like to see a tight capacity environment that would allow them a little more pricing power. But this is not the way to do that. In almost all cases, most of these big companies started out as small carriers. They’ve been there. They should know better.”

ASECTT has filed suit in federal court to block the public presentation of carrier safety data. Oral arguments were presented in September, and Sanderson tells CCJ he expects a ruling in the next couple of months.

Because of federal appellate court rules, the ASECTT challenge is limited to a very narrow issue, Sanderson explains. So problems with data accuracy or state-by-state variability could not be addressed. Instead, the argument is whether FMCSA, in publishing the SMS data and then advising shippers and brokers to use that data in carrier selection, constitutes a rule – one implemented without the required federal rulemaking process.

“FMCSA contends that’s not a rule, it’s just some ‘guidelines,’” Sanderson says. “But those guidelines are costing carriers business, because some shippers and brokers won’t use a carrier that has two or three alerts, or even one alert.”

The administrative reviews by the IG and GAO, on the other hand, should expose the weakness in the way CSA actually works, Sanderson suggests. (In light of four deadly crashes that it has investigated within the past year, the National Transportation Safety Board also has recently recommended an audit of FMCSA’s oversight capabilities.)

“I’m quite optimistic about that process, because they will look in a broad sense, at the completeness of the data,” Sanderson says.

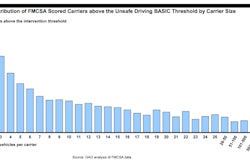

He specifically refers to the system’s not having enough data to score the majority of carriers on the highways. And, of those that are measured, the system puts almost half over the threshold in at least one safety category.

“To suggest that half of the carriers have some kind of safety flaw, given the dramatic improvement in accident frequency and fatalities, is ludicrous,” he says. Likewise any state-by-state analysis will show “it’s not how you operate, it’s where you operate” that determines a carrier’s standing under CSA.

Additionally, Sanderson points to previous studies that demonstrate there is no correlation between accident frequency and SMS scores.

“There is a precedent [for imposing changes]. FMCSA had to remove some SafeStat information from the website because it simply wasn’t reliable. I’m hopeful that will be the outcome,” Sanderson says. “The inspector General and the GAO will say that if FMCSA will just use it as it was originally intended, for the FMCSA to prioritize it’s own enforcement resources, that is a perfectly good use of the system. They can’t go look at 500,000 carriers.”

Sanderson notes that a lot of carriers do like having access to their own data.

“They take that feedback and improve the safety of their operations. So that’s good, too,” he says. “The gigantic flaw is that FMCSA publishes these scores for the general public, and then gives guidance that says the public is supposed to use these scores, but the scores themselves don’t indicate anything about an individual carrier’s accident frequency rate. They are harming a lot of small carriers who aren’t getting the freight they should be getting, and they’re increasing the vicarious liability risk to the shippers and brokers.”

FMCSA’s Bill Quade, who has led the development and implementation of CSA, explains that the department’s inspector general has reviewed CSA before, and GOA has examined the program twice already.

“The good news is that our overseers are really becoming familiar with our program,” Quade says, speaking about CSA at the recent American Trucking Association Management Conference and Exhibition. “This hasn’t been done in a vacuum. We’ve had a lot of visibility into the program. They are looking at whether or not SMS really does do a good job of evaluating risk, and to what extent interventions are improving motor carrier safety.”

Both reviews are scheduled to be released in coming weeks.

He also touched on the question of crash accountability, the subject of another GAO study.

“There’s 110,000 crashes in this country every year. Police accident reports don’t have the consistent information to let us draw reasonable conclusions that we can rely on,” Quade says. “You would think that carriers that are in at-fault crashes are much, much more likely to be in future crashes, but we’re going to need spend to somewhere between $3 and $10 million [to track fault]. If we’re going to spend that much money every single year, what are we going to get? A 5 percent improvement? It might not be worth the bang for the buck. If we get 50 percent improvement, or 500 percent, those are different stories, so we’re looking at that.”