As warmer weather creeps in during the next few weeks and brings with it seasonally heightened economic activity, reports from the typical January and February lulls continue to roll in.

Trucking economic indicators of late have showed slowing freight and lower rates.

The outlook for trucking this year, however, remains mostly positive.

[gttable cols=””]

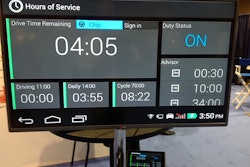

Trucking conditions show short-term weakness: FTR’s monthly Trucking Conditions Index — a measure of the environment for trucking companies — fell 34 percent in January from December. Cheap diesel continued to put upward pressure on the TCI in January (the higher the better), but weaker freight rates, slow load growth and increased capacity pushed the index downard.

But if diesel keeps itself in check throughout the year, FTR predicts a positive 2015 for the index readings.[/gttable]

[gttable cols=””]

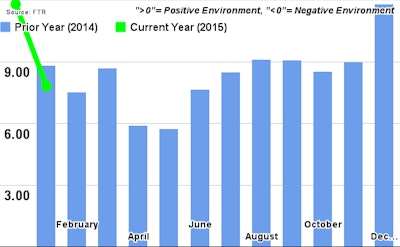

West Coast port labor disputes caused nationwide freight slump: Cass’ monthly Freight Index Report showed increases in both shipments and freight expenditures in February. Though the work stoppages and slowdowns — and the subsequent cargo backlog — at West Coast ports throughout January and February hurt freight shipments throughout the U.S., Cass says.

Cass, however, also remains positive about the rest of the year, equating the port labor disputes with the disruptions caused by 2014’s early severe winter weather episodes.

Freight shipments in February topped January by 5.5 percent and last February by just shy of 1 percent. Expenditures were up 4.3 percent from January and just above half a percent from last February, snapping three consecutive monthly decreases.[/gttable]

![shutterstock_217677985[1]](https://img.ccjdigital.com/files/base/randallreilly/all/image/2015/03/ccj.shutterstock_2176779851.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)