A look at a few trucking economic indicators to come across the wire in recent days:

[gttable cols=””]

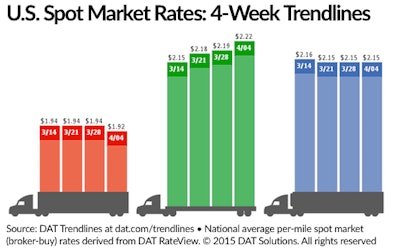

Spot market loads increase, rates mostly flat: The number of available loads on the spot market rose 3.2 percent in the week ending April 4, according to DAT Solutions’ weekly Rate Trends report. Flatbed led the way with a 9 percent jump in available loads from the week prior. The segment also saw a 5-cent increase in the linehaul (base) portion of its $2.22 per mile rate — a 3-cent increase from the week prior.

Reefer demand slipped a fraction of a percent, but its rates remained unchanged at $2.15 a mile.

Van freight availability also fell a fraction of a percent, though its rates remain mostly flat. Its $1.92 gross rate was a 2-cent drop from the week prior, but the linehaul portion of the rate has not changed in four weeks.[/gttable]

[gttable cols=””]

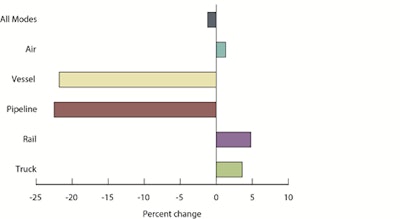

Trucking gains NAFTA freight share: Truck was one of three transportation modes that saw its share of NAFTA freight grow in January. Trade between the U.S. and its North American Free Trade Agreement partners Canada and Mexico fell 1.2 percent in January from the same month in 2014, but trucking’s share grew 1.3 percent. In the month, trucks carried 62.3 percent of the $89.3 billion in freight moved between the U.S. and Canada and Mexico.[/gttable]

[gttable cols=””]

Truck orders flatten in March: According to preliminary figures released last week by ACT Research, the number of Class 8 orders were down from the same month in 2014, signaling a potential end to the recent multi-month boom in truck orders. “Down 9 percent compared to last year, March’s orders marked the end of a 25-month streak of consecutive year-over-year gains,” said ACT’s Steve Tam. “Rather than signaling weakness in the market, March’s lower intake is more akin to turning the tap down as the pool nears the full mark.”[/gttable]