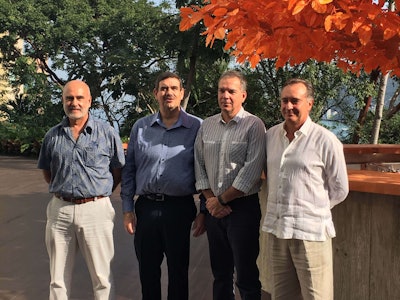

Ramón Medrano (Frio Express), Alex Theissen (Femsa Logística), Stfan Kürschner (Daimler Commercial Vehicles Mexico) and Miguel Gómez (Fletes México)

Ramón Medrano (Frio Express), Alex Theissen (Femsa Logística), Stfan Kürschner (Daimler Commercial Vehicles Mexico) and Miguel Gómez (Fletes México)If you think business conditions in the U.S. are challenging, consider the trucking industry south of the border. Daimler Commercial Vehicles Mexico hosted North American media and fleet customers to discuss the unique market conditions facing Mexican fleet operations.

Mexican GDP is mired at 2.6 to 2.8 percent growth in 2015, but Stefan Kürschner, president and CEO Daimler Commercial Vehicles Mexico, says the emerging economy should be experiencing GDP growth of 4 percent or more.

The cause for the economic constraints, says Kürschner, is two-fold. First, the popularity of the current political administration in Mexico is at an all-time low after a number of promised reform programs either haven’t happened or have been carried out with little effect. Low oil prices – a major export product for Mexico – are also negatively impacting GDP growth, says Kürschner.

Despite the anemic economic growth, Daimler reports a strong increase in marketshare year-to-date through November. Daimler’s marketshare in the Class 6-8 market has increased 7 percent to 30.6 percent, while its Class 8 marketshare has improved 7.2 percent to 28.4 percent.

Part of the company’s rapid growth in the Class 8 segment is a result of the 2015 introduction of the Detroit DD15 engine for Cascadia models for the Mexican market. “The product introduction of the DD15 really changed the perception of our market,” says Kürschner, adding that the take rate for the DD15 on Cascadias has already reached 90 percent.

Big fleets discuss challenges

Executives from three large Mexican fleets – Frío Express, Femsa Logística and Fletes México – say the three biggest challenges facing the Mexican trucking industry include the country’s lagging infrastructure, average fleet age and failed reform programs such as the Mexican government’s scrapping program intended to take older trucks off the road.

“We are very far from where we should be in regards to infrastructure,” says Frío Express’s Ramón Medrano. According to some estimates, paved road infrastructure in Mexico is six times less than the United States on a proportional scale. Femsa Logística’s Alex Theissen says another hurdle facing Mexican fleets is that the majority of the good roads in the country are tolled, adding to cost of operations.

The Mexican trucking industry’s average fleet age is 17.9 years, compared to six years in the United States. The fleet panelists agreed that older trucks lead to increased accident rates, higher maintenance costs and a worsening public image of the industry.

Fletes México’s Miguel Gómez says the failing scrapping program was intended to take six thousand trucks at least 20 years old off the road and offer incentives for newer truck purchases, but to date only 536 qualifying trucks have been removed from Mexican roadways.

Mexico is currently working on upgrading its emissions standards for the 2018-2019 timeframe, but it is unclear how strict the new standards will be. Currently, Mexico uses an equivalent of the U.S. Environmental Protection Agency’s 2004 emissions standard, and the average sulfur content produced by Mexican trucks is 300 ppm. If the government opts to go to more stringent standards such as EPA 2013, it would require ultra-low sulfur diesel, a product that doesn’t currently exist in the Mexican market.

“The Mexican truck industry is far from the requirements to meet even EPA 2007 requirements, and it keeps the industry up at night because we don’t know where the government is going to go with the new rule,” says Kürschner.

The fleet panelists expressed no interest in applying for U.S. operating authority. “We’ve had the trailer interchange program for the last 20 years and we are very happy with it,” says Gómez. “Not being allowed to do cabotage in the United States really takes all the interest out of it for me.”

“The differences in laws and regulations between the two countries is so big that it is difficult, but the import/export business will continue to grow so we need to make the border more efficient so everyone gains,” says Theissen. “Just because we’ve been doing the trailer interchange the same way for 20 years doesn’t mean it can’t be done better, faster and safer.”

Despite these challenges, the Mexican trucking industry doesn’t face the level of regulation seen by fleets in the rest of North America, resulting in some opportunities for greater productivity. For example, vehicle weight per axle is 10 percent greater than in the United States, and companies are allowed to operate at 166,000 pounds pulling double trailers in certain lanes and certain times of the day. A lack of hours-of-service regulations also allow drivers more time to drive, but the larger, safety-focused Mexican fleets see this as a negative.

“No HOS rules are difficult for large fleets because we don’t want to compete without safety,” says Theissen, whose company has dropped its accident rate per million kilometers down to 0.156 and won numerous national safety awards. “ Lots of truck drivers are driving more than the hours they should, which makes them more competitive. The playing field here isn’t level like it is in the United States.”

On average, driver pay is five times less in Mexico compared to the United States, but the fleet executives agreed that it isn’t an apples-to-apples comparison compared to the U.S. labor market. “Even when we pay four or five times less compared to U.S. fleets, the reality is being a driver in Mexico is a high-end job,” says Theissen.

Medrano agrees, adding, “Our drivers are able to send their children to college,” he says. “They make less, but they also spend less. It is a good job for our people, and they tend to stay here for years.” Frío Express’s driver turnover rate is only 20 percent in 2015.

Regarding the driver shortage, due largely to a lack of driver training schools and fleets losing drivers to U.S.-based carriers, Gómez adds truck driving is a profession that has been under-valued in the Mexican labor force. “Even if we pay well and value the employees, unfortunately it doesn’t have the best image.”