CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

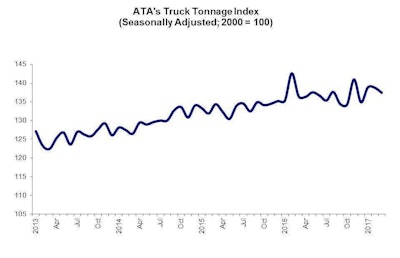

However, compared to last March, the index was up seven-tenths of a percent. Year to date through March, the index was up 2.5 percent.

“March truck tonnage was likely hurt by some late season winter storms,” said ATA Chief Economist Bob Costello. “While I’m not expecting a surge in truck tonnage anytime soon, the signs remain mostly positive for freight, including lower inventory levels, better manufacturing activity, solid housing starts and good consumer spending,” he said. “As a result, we can expect moderate growth going forward.”

Following 2016’s strong finish, 2017 has started slowly, Montague said.

The spot market was strong in the first quarter, Montague said, with the load-to-truck ratio on DAT’s loadboard nearly doubling over the same period last year. However, rates on the contract market “continue to suffer,” says Stifel’s report, particularly for the dry van segment.

“The spread between van spot rates and van contract rates sits at roughly 30 cents per mile, which is close to the higher end of the historical range,” according to Stifel’s recap of Montague’s presentation.

![Pottle’s truck[1]](https://img.ccjdigital.com/files/base/randallreilly/all/image/2013/12/ccj.Pottles-truck1.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)