R.E.. Garrison decided to implement a satellite TV service from EpicVue to retain more drivers.

R.E.. Garrison decided to implement a satellite TV service from EpicVue to retain more drivers.As would be expected, driver recruiting and retention strategies are often built on three pillars: home time, respect and pay. A number of products and services are geared up to help fleets deliver more value to their drivers in these facets of their workspace.

Earlier this year, management at R.E. Garrison Trucking, a 700-truck refrigerated carrier based in Vinemont, Ala., discussed the possibility of equipping its trucks with satellite TV service as a way to boost recruiting efforts, says Shawn Nelson, the company’s director of driver relations.

R.E. Garrison already pays drivers a higher per-mile rate than competitors. Management was therefore not convinced that a premium DIRECTV package from EpicVue would make enough difference to justify the cost, he says.

That frame of thinking changed when one of its driver teams — the most difficult type of driver to recruit — unexpectedly quit to work for a company in Georgia that pays $0.03 less per mile.

The team drivers told Nelson they wanted to come back but their new company had satellite TV.

“We started looking at (EpicVue) as a retention tool,” Nelson says.

To equip its entire 700-truck fleet, the monthly cost for the EpicVue subscription would be approximately the same as what it costs R.E. Garrison to hire a few drivers to replace those that might otherwise leave, says Nelson, who estimates its hiring costs are $6,500 per driver.

“The cost for EpicVue is very nominal when you start adding it up,” Nelson says. “If we save two or three drivers a year the system pays for itself.”

R.E. Garrison will be installing the service in all new trucks going forward.

“We are trying to get it in every one of them,” he says. “We want to make it as comfortable as possible for drivers.”

R.E. Garrison uses a new in-motion satellite service from EpicVue that allows the non-driving team partners to watch live TV in the sleeper bunk and to record shows for later viewing, while the vehicle is moving.

Survey platform

Driver surveys are another tool fleets use to improve retention. Taking a survey may not be inherently satisfying, but the opportunity to provide feedback can be a rewarding experience for drivers if they know management sincerely wants to improve, experts say.

Stay Metrics administers 7-day orientation and 45-day onboarding surveys for its motor carrier clients. The surveys gather responses to questions in areas that predict early driver turnover such as mismatched job expectations.

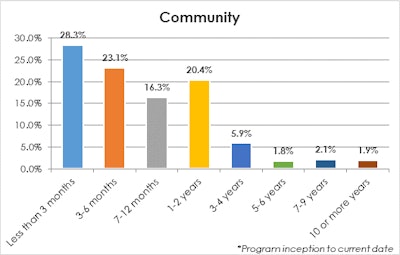

According to data that Stay Metrics gathers for its clients, nearly 30 percent of new driver hires quit within the first three months.

According to data that Stay Metrics gathers for its clients, nearly 30 percent of new driver hires quit within the first three months.Providing feedback helps drivers feel engaged, and those who do not respond to surveys signal a lack of engagement and are much more likely to quit. Tim Hindes, chief executive officer of Stay Metrics, says drivers who do not take their fleets’ 7-and 45-day surveys are 48 percent more likely to leave.

Stay Metrics can quickly identify drivers that do not take surveys and send an alert to fleet managers. Hindes recommends calling these drivers right away to prevent early turnover.

Stay Metrics administers a retention platform for its clients that includes online driver rewards, recognition and training. The company also provides ongoing reporting and analysis to identify the root causes of turnover.

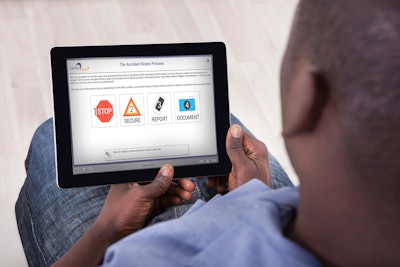

CarriersEdge recently added a survey tool to its online driver training platform. The company has been using the same survey tool to administer the Best Fleets to Drive For program for the Truckload Carriers Association.

Fleets that use the CarriersEdge training platform can create surveys for drivers to complete after taking a safety training module. Surveys could also be delivered through the CarriersEdge mobile app for drivers or sent to their personal or work email accounts, says Jane Jazrawy, chief executive officer of CarriersEdge.

Pay trends

As part of administering the Best Fleets to Drive For program, CarriersEdge identifies strategies and trends among the top performers for driver retention and satisfaction. Making pay more predictable has been one area of focus for fleets, she says.

CarriersEdge has added a survey tool to its online driver training platform

CarriersEdge has added a survey tool to its online driver training platformJazrawy sees more use of guaranteed driver pay programs to prevent uncontrollable circumstances like traffic congestion and equipment breakdowns from causing variance in driver pay. Of the Top 20 fleets recognized in 2017, 44 percent had weekly minimum pay guarantees, she says.

Top carriers also give drivers access to pay information on a daily or weekly basis. Additionally, some provide detailed performance scorecards and human resource data.

Drivers that work for carriers with transparent pay and human resource information frequently use the word “honesty” in the surveys to describe their work experience, she says. Given the intensity of the driver recruiting and retention battle, that may be best feedback a carrier can hope to attain.