AFN Logistics is building automated processes to get its people out of repetitive tasks and into a more “solution-oriented conversation” with customers.

AFN Logistics is building automated processes to get its people out of repetitive tasks and into a more “solution-oriented conversation” with customers.Technology is fueling a growth in non-asset transportation and logistics. Companies are finding ways to solve more complex problems for shippers and increasing the efficiency and speed of freight transactions with carriers.

AFN Logistics specializes in transporting retail goods to fulfill supply chains, many of which are now connected to e-commerce and final-mile deliveries. In this fast-growing sector, the “demands on shippers are as high as they’ve ever been,” says Rob Levy, CFO and CIO of the Niles, Ill.-based third-party logistics provider.

In response to rising transportation costs, tighter delivery windows and capacity constraints, “we are really driving a greater level of technology to make our operations more efficient and drive value to the customer,” he says.

Building automated processes with software is a top priority to get its people out of repetitive tasks and into a more “solution-oriented conversation” with customers and using data to make the best-possible decisions, he says.

Many other capabilities are making it possible for non-asset transportation providers like AFN Logistics to scale their businesses and increase margins. This article highlights six technologies fueling the growth in this sector.

1. Freight visibility

A number of technologies can locate shipments by using cell-tower signals, GPS from drivers’ phones and from telematics systems to eliminate manual “check calls” to drivers to update the status of loads.

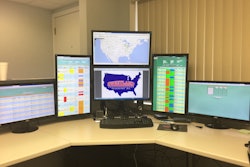

Joe Carlier, senior vice president of global sales at Penske Logistics, says the ClearChain technology suite allows users to know what is happening at the touch of a button.

Joe Carlier, senior vice president of global sales at Penske Logistics, says the ClearChain technology suite allows users to know what is happening at the touch of a button.AFN Logistics developed an internal automation tool, the AFNgine, for its operational needs such as capacity procurement. The engine uses track-and-trace information from FourKites to manage shipments and provide visibility to customers.

Whether or not a transportation company has its own fleet, they can expand their value to shippers by providing seamless visibility to all shipments, for example, no matter whose assets are powering the loads.

Penske Logistics uses commercially available technologies but has taken additional steps to give its customers visibility by connecting all parts of their supply chains by developing a ClearChain technology suite.

The suite puts its customers’ data into an organized and easily accessible repository that helps to drive efficiency, cut costs and manage service disruptions, the company says.

The suite provides status updates using GPS tracking to see carriers’ locations at any point in time. If a carrier doesn’t have an onboard tracking system, Penske can connect with the driver’s cellphone. It can also monitor real-time traffic and weather information along routes and near customers’ locations to provide accurate ETAs.

“The ClearChain technology suite — coupled with the people and processes behind it — allows users to know what is happening at the touch of a button or click of a mouse or tap of a finger or swipe of a card,” says Joe Carlier, senior vice president of global sales at Penske Logistics. “That knowledge creates better service and results.”

2. Instant pricing

One of the most effective ways that freight brokers and 3pls are earning more business is by providing shippers with instant pricing and booking tools for spot market freight movements.

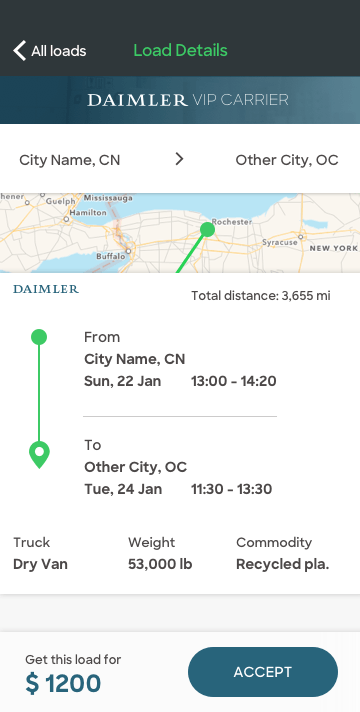

Such a strategy was used by LoadSmart, a high-tech freight broker that specializes in full truckload shipping. The company developed a digital platform and proprietary machine-learning technology that instantly predicts carrier rates to offer shippers instant pricing and “book it now” options for up to four days in advance.

LoadSmart has a machine learning algorithm that predicts what future capacity will cost in lanes.

LoadSmart has a machine learning algorithm that predicts what future capacity will cost in lanes.The company’s machine learning algorithm predicts what capacity will cost in lanes, says Felipe Capella, co-founder of LoadSmart, and the company offers instant “book it now” options for about 60 percent of customer orders.

The pricing algorithm uses data inputs from public sources, such as weather databases, and from private sources such as factoring companies that provide carrier rate data.

By using the LoadSmart platform, Daimler Trucks North America (DTNA) has been able to reduce the time it takes to complete spot market shipments for its manufacturing and aftermarket truck parts business from five hours a day to 18 minutes a day, on average.

LoadSmart is on track to manage 100 percent of DTNA’s spot market freight transactions by April 2018, Capella says.

Some carriers that buy Daimler trucks also haul freight for Daimler. To give these VIP trucking customers a first preference for loads, LoadSmart has customized some features of its online platform to identify assets of VIP carriers that are positioned to move loads.

Carriers that do business with LoadSmart provide availability of their capacity in various ways such as by email. LoadSmart captures shipment tracking data using its mobile app and integration with telematics systems. Upon delivery, it pays carriers within two days.

3. Predictive freight matching

Some companies have developed freight matching services that use historical and real-time locations and other data to predict where and when capacity will be available.

Last fall, Trucker Tools announced a predictive freight matching platform called Smart Capacity. After watching a demo in January 2018, Triple T Transport, a mid-size 3pl, decided to give the product a try.

The technology utilizes the Trucker Tools driver smartphone app which nearly 500,000 drivers use for trip planning. The app increases the probability that owner operators and small-carrier drivers will stay connected with Triple T and use the integrated Smart Capacity feature to find loads.

Triple T now has visibility of forward-looking freight matching recommendations on a map in the user dashboard of the Smart Capacity’s web portal.

“We wanted a platform where our preferred carriers give us the first shot at matching loads. Smart Capacity does that for us, as it allows us to effectively work further into the future, increasing the probability of booking with our preferred carriers before they start looking for loads from others,” says Darin Puppel, president of Triple T.

Konexial’s My20 app updates a dynamic load matching platform to send relevant load matching opportunities directly to a driver’s smartphone.

Konexial’s My20 app updates a dynamic load matching platform to send relevant load matching opportunities directly to a driver’s smartphone.As the trucking industry completes its conversion to ELDs, more companies will be creating freight matching platforms that utilize the locations and hours-of-service data to give carriers load offers.

Konexial developed an ELD that it offers to carriers for a low-cost monthly subscription. The ELD, called My20, includes a smartphone app and wireless device that connects to the diagnostics port of a vehicle.

The app updates a dynamic load matching platform called GoLoad that uses location, hours and economic factors — the rate the carrier/driver is looking for — to send relevant load matching opportunities directly to the smartphone app.

4. Freight marketplaces

While some freight brokers have developed their own technologies to automate the process of matching loads with available trucks, the vast majority continue to use freight marketplaces to find capacity.

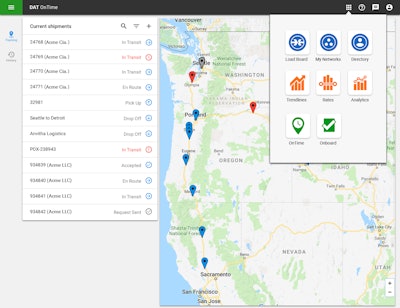

Forty years ago, DAT created the original load board to connect brokers and 3pls with carriers to conduct spot market freight transactions. Over time, DAT has evolved from being a static load board to a dynamic freight marketplace with technology that covers the full spectrum of a freight transaction.

During the past nine months, DAT has been particularly focused on creating “seamless” freight matching and connectivity services for carriers, explains Neerav Shah, vice president of products for DAT.

Once a carrier is booked on a load, brokers can message the driver’s smartphone and automatically track loads using a DAT app or by using integration with ELD systems in trucks, he says.

DAT is creating a new suite of cloud-based apps that drivers and carriers will use for specific functions.

DAT is creating a new suite of cloud-based apps that drivers and carriers will use for specific functions.DAT is currently investing heavily in new user experiences for carriers, particularly with regards to mobile applications that carriers use to automate communications with brokers to find loads and get paid faster.

“We understand that people want to put technology in their hands,” he says.

DAT is creating a suite of cloud-based apps that drivers and carriers can use for specific functions such as searching for loads, rates, document capture and more. The apps will have functions that share data like various Google apps on a smartphone.

“All these things are coming together,” he says.

5. Freight payments

With the mobile connectivity options used by freight brokers and carriers to capture arrival and departure events, as well as proof-of-delivery documents, some brokers and 3PLs are giving carriers a seamless invoicing and payment experience.

FR8Star, a freight broker that specializes in oversize, overweight and open deck load, is among a growing number of brokers using Comchek Mobile, the first peer-to-peer digital payment system in the transportation industry.

By using the technology, freight brokers do not have to collect and store bank account information for ACH deposits. Instead, brokers only need a carrier’s Comchek Mobile ID number to send funds for payment, he says.

Every month, about 5,000 owner operators and small-carrier drivers are downloading the Comchek Mobile app from Google Play or the Apple App Store, with about 30,000 current users, says Terrence McCrossan, senior vice president for Comdata North American Trucking.

6. TMS flexibility

Freight transactions can be much more complex than matching loads with available trucks. To achieve the best possible outcomes for price and service, freight brokers and 3PLs can use advanced software systems that consider all types of transport modes and routing options.

Freight brokers are using a peer-to-peer payments system for the trucking industry, Comchek Mobile

Freight brokers are using a peer-to-peer payments system for the trucking industry, Comchek MobileThe 3Gtms software system, used primarily by freight brokers and 3pls, has a feature known as continuous pool optimization, for example, that “allows us to address a surprising number of very interesting and challenging things that people are doing,” says Mitch Weseley, the company’s chief executive.

“The whole premise of the TMS world, going back to the beginning in the 1980s, was to let people be creative and dynamic,” he says. “Static decision making is very cost inefficient.”

The continuous pool optimization feature in 3Gtms identifies the best pool point, such as a warehouse or cross dock, in a company’s freight network to route a daily mix of inbound freight on truckload or less-than-truckloads to plan loads for delivery.

3Gtms has other advanced optimization features that transportation companies — both asset and non-asset — use to offer their customers and prospects dynamic solutions, he says.

“Brokerage software is not just about connecting A and B,” he says. “The direction of the industry is to create more options and dynamics to take advantage of where things are in a particular point in time.”

With new technology, freight brokers and 3pls are able to solve complex transportation problems at an unprecedented scale and speed.