Editor’s note: This is the second of three articles looking at Commercial Carrier Journal‘s 2018 Economic Outlook Survey, which includes responses from 431 fleet representatives about their top concerns and outlook for 2018.

Corporate tax cuts encourage fleet spending

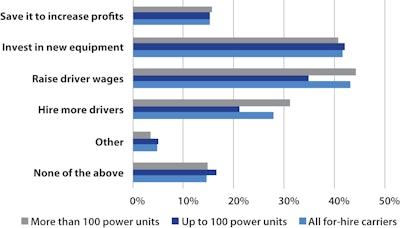

The majority of for-hire trucking companies plan to allocate corporate tax savings toward driver wage increases and new equipment purchases.

From a business perspective, the Trump administration earned high marks from trucking company executives. Among CCJ Economic Outlook Survey respondents, 55.7 percent said the administration’s overall policy had a positive or extremely positive impact on their company’s business decisions in 2017, and 58.2 percent believe that policy will benefit them in 2018. Only 11.3 percent said Trump policy negatively impacted their businesses last year, while 32.9 percent said it had no impact.

In addition to the regulatory rollback, the new tax reform legislation enacted at the end of last year certainly is a reason Trump’s pro-business policy received high marks from respondents. According to the survey responses, much of the new capital will be directly reinvested in the business.

“The reduction in ineffective but costly regulations has had and will continue to have a tremendous positive impact,” said a CCJ survey respondent from a private fleet with more than 100 power units. “Reduced taxes allow us to pay higher wages, purchase equipment, improve telecom infrastructure and invest in expansion.”

Roughly 42 percent of both for-hire carrier and private fleet respondents plan to use tax savings to invest in new equipment purchases. Only 23.7 percent of private fleet respondents plan to apply tax savings to raise driver pay, compared to 43.3 percent of for-hire carrier respondents. On a truck-count basis, 44.4 percent of respondents with more than 100 power units plan to use tax savings to raise driver pay compared to 34.9 percent of respondents with 10 to 100 power units.