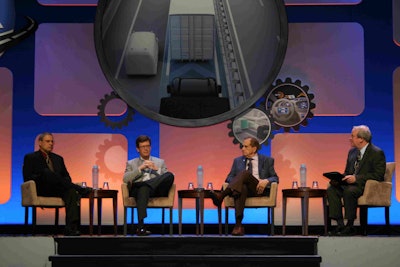

(L to R): Roy Cox, Joey Hogan and Don Daseke shared their strategies for acquiring other carriers during the 2018 TCA convention.

(L to R): Roy Cox, Joey Hogan and Don Daseke shared their strategies for acquiring other carriers during the 2018 TCA convention.In the truckload sector, motor carriers looking to grow via acquisitions are motivated by the healthy freight market and short supply of drivers. Meanwhile, smaller carriers — especially those whose owners are approaching retirement — see an opportunity to cash in.

At the annual Truckload Carriers Association member conference on Mar. 27 in Kissimmee, Fla., fleet executives shared their thoughts on what it takes to successfully close deals.

Roy Cox, president of Best Cartage, said his company is acquiring privately held carriers whose owners who are looking to retire.

“We had some excess capital that our ownership group asked me to put to work,” he said. “You can only grow so fast organically.”

Best Cartage is a division of Best Logistics Group, a full-service, integrated logistics and transportation provider. The company has made three acquisitions in the last 2.5 years. All three were successful companies whose owners were “looking to cash out” of their businesses yet have them continue to operate under new ownership that would take care of their associates.

Joey Hogan, president of publicly traded Covenant Transportation Group (CTG), based in Chattanooga, Tenn., said that when access to capital is cheap and when carriers have “more freight than you know what to do with” it is tempting to “go buy somebody.”

Having experienced both successful and non-successful acquisitions, Hogan recommended carriers stay focused on what they do well and carefully evaluate the core values and culture of any company they have interest in buying. Otherwise, “you are going to get distracted when an acquisition comes,” he said.

Last year, Hogan decided to back out of an acquisition because “at the last minute it didn’t feel right,” he said. “If you feel like they want to have their cake and eat it to, you better stop.”

Elaborating on this, Hogan said “at end of day it’s all about the people. You can buy trucks and trailers all day long,” but “if you quickly get a feeling that ‘it’s all about me’ from seller, that is dangerous.”

Don Daseke, chairman, president and chief executive officer of Daseke, Inc., said companies looking to acquire often do not consider the full effect that buying a company has on that company’s employees. The seller “often has a lot of loyal people on their team,” he said, and stressed the importance of having a plan to integrate the new employees quickly.

Daseke has acquired 16 flatbed carriers in the last eight years. He said his management team puts a lot of time and thought into evaluating and resolving “people issues” before closing deals.

“It’s like getting married,” he said. “You need to look at all aspects including the in-laws.”

Daseke has stopped some transactions late in the process due to concerns that surfaced over people issues.

“Do not be afraid to step back if it does not feel right. If you do not feel right before you close, it really won’t feel right after you close,” he said. “We often spend years talking to companies before they join us. We really get to know one another.”

All three agreed that one of the most difficult parts of buying carriers is getting through the due diligence process. Sometimes the process uncovers information the seller wants to protect such as past litigation from accidents or tax problems. The seller may be wanting a clean break from the business, but “that is a battle line that has to be worked through,” Hogan said.

Sellers typically want to conduct a stock sale to benefit from tax savings and to indemnify themselves, Hogan said. On the other hand, buyers typically prefer an asset sale versus a stock sale for the same reasons.

Hogan said if the seller wants to do a stock sale, he or she has to be willing to accept the added scrutiny of their business from due diligence.

“Sometimes sellers don’t quite understand the rigor that a buyer has to go through,” said Hogan about a stock sale. The buyer may want to talk to the seller’s attorneys, tax advisors and go through customer contracts and accident settlements, for example.

“A stock sale is much more onerous,” Hogan said. “It is good for the seller, but they have to understand everything that is involved from the buyer.”

Hogan, Cox and Daeske spoke at the TCA convention during a panel discussion that was moderated by David Freeman, director of Capital Resource Partners.